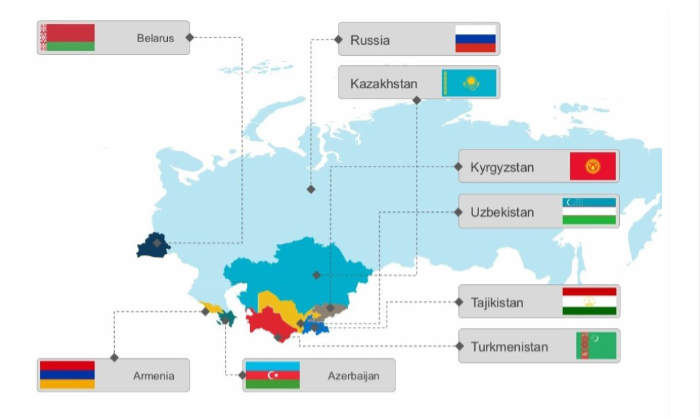

The annual Commonwealth of Independent States leaders’ summit has taken place in Dushanbe, Tajikistan, with Tajikistan being the current chairman of the bloc. Participants included President of Russia Vladimir Putin, President of Azerbaijan Ilham Aliyev, Prime Minister of Armenia Nikol Pashinyan, President of Belarus Alexander Lukashenko, President of Kazakhstan Kassym-Jomart Tokayev, President of Kyrgyzstan Sadyr Japarov, President of Tajikistan Emomali Rahmon, President of Turkmenistan Serdar Berdimuhamedov, President of Uzbekistan Shavkat Mirziyoyev, and CIS Secretary-General Sergey Lebedev.

The Heads of State meeting has occurred nearly 6 months after the previous CIS Foreign Ministerial meetings, with Presidents and Prime Ministers able to assess the work produced since then.

The member countries of the Commonwealth of Independent States are illustrating sound economic growth during 2025, according to forecasts taken from Eurasian Development Bank data. They are averaging GDP growth rates for the year at 4.7%. Details are as follows:

| Country | 2025 GDP growth forecast |

|---|---|

| 🇦🇲 Armenia | 4.5% |

| A return to normality following conflict with Azerbaijan. | |

| 🇦🇿 Azerbaijan | 3.5% |

| The non-oil sector is a key growth driver, oil and gas sector may see a more moderate expansion. | |

| 🇧🇾 Belarus | 3% |

| Strong mid-year results and expected expansion of credit support for investment. | |

| 🇰🇿 Kazakhstan | 5% |

| Growth driven by transport, logistics, manufacturing, mining and construction. | |

| 🇰🇬 Kyrgyzstan | 11.7% |

| Strong consumer demand supported by a sharp rise in remittances. | |

| 🇷🇺 Russia | 1.4% |

| Slowdown due to impositions of Western sanctions and an economic battle against inflation. | |

| 🇹🇯 Tajikistan | 7.4% |

| Strong economic growth, supported by investments in energy and industry, consumer demand, and private sector development. | |

| 🇹🇲 Turkmenistan * | 6% |

| The successful implementation of socio-economic development programs. | |

| 🇺🇿 Uzbekistan | 6.5% |

| Strong domestic demand, supported by high real wages, increased remittances, and investment. | |

| *note Turkmenistan is an associate, not full member of the CIS, but follows CIS trade guidelines and regulations. | |

Fundamental Indicators

Much of this growth appears to be economically driven by Russia’s pivot to Asia. According to the United Nations COMTRADE data, we note that Russia’s exports to the CIS countries rose from US$55.2 billion in 2021 to US$104.53 billion in 2024, according to data gleaned from their respective customs agencies. This indicates annual export growth of an average of 20% per annum in current Russian-CIS trade flows. This flow of trade from Russia to the CIS is having a positive effect on the local economies.

This has been additionally augmented by Russian outbound investment into the CIS countries, both as individual markets to access andin developing joint venture partnerships with other local CIS nations in order to jointly produce products to be resold into third markets, such as China, and into Asia. Uzbekistan also has a significant trade agreement with the European Union, meaning that Russian investors, while following rules of origin regulations, can also insert themselves into supply chains for finished products being sold to the EU. This can also take the form of agricultural exports, with Russian fertilizers being sold to Uzbekistan to grow crops that are then exported to Europe, although the Chinese and other Asian markets are the real prize.

Illustrating this is that intra-CIS container transport use grew by 15.5% in 2024, to 72.3 million tonnes.

Structural Distinctions, The Eurasian Economic Union, & BRICS

The CIS is a slightly different trade organization from examples such as the European Union, as it doesn’t have a rigid set of intra-trading regulations and tariffs on a uniform basis. It also does not have a common currency, with members free to use their own respective monies. This has had two effects, one being a more liberal trade policy, where CIS members agree to their own bilateral trade arrangements rather than a complex set of regulations that unify all. Secondly, the use of sovereign currencies rather than a singular regional one has also proven to be more flexible, as local dynamics can reflect real value at any one time. That has meant a reduction in the use of the US dollar as an intermediary currency, with some 97% of all intra-CIS trade now being conducted in the relevant regional currencies.

However, because the CIS is not a customs union per se, it cannot (and does not) enter into free trade agreements with other countries or blocs.

It should also be noted that several of the CIS members are also members of the Eurasian Economic Union (EAEU), which does have specific intra-bloc customs and tariff agreements. These are Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Russia. The EAEU has signed Free Trade Agreements (FTA) with China, Vietnam, Iran, and Serbia and is currently in negotiations with India, Indonesia, Egypt, and the UAE, amongst others. However, these FTAs can also be flexible. The EAEU-China FTA is non-preferential, meaning that decisions on products and tariffs can be made on an ‘as needed’ basis without the requirement to enter into lengthy, multi-year negotiations. The BRICS operates its bloc trade agreements under similar principles. This has already proven to be advantageous when dealing with sanctions and the unpredictable nature of US President Trump’s administration in changing tariffs from one week to the next.

It should also be pointed out that the CIS, EAEU, and BRICS also hold rotating presidencies (as does the Shanghai Cooperation Organisation), with each member taking on the role for twelve months at a time.

Infrastructure Developments

The CIS nations encompass much of the ‘Middle Route’ between China and Europe, including routes that transit Russia as well as routes that circumnavigate Russia due to geopolitical tensions. Accordingly, the Eurasian region is seeing a huge influx of development, and especially in roads, rail, and river connectivity along with related infrastructure build. The Eurasian Development Bank have assessed this expenditure as being as much as US$234 billion.

Russia is very much part of this and is looking to develop services such as high-speed rail, the digitization of cargo, and expand links between it and all CIS nations, either collectively or individually.

Summary

The developing trade and growth of the CIS bloc, as well as the BRICS group and EAEU, showcase several new issues in terms of multilateralism. This includes the basic illustration that regional trading with Russia is economically beneficial. Economies that cut themselves off from Russian resources, and especially energy, have been seen to decline.

The flexibility of the CIS and international trade structures built along similar lines appears to be a viable model for redesigning and reinvigorating regional and global institutions.

Further Reading

Commonwealth Of Independent States GDP To Equal European Union’s By 2050

Русский

Русский