Russia’s ambassador to Bolivia, Dmitry Verchenko, has been commenting on the status of the delayed Bolivia-Russia lithium mining project between Rosatom and the Bolivian state-owned enterprise YLB (Yacimientos de Litio Bolivianos).

The Joint Venture agreement was signed in September 2024; however, a change of government in Bolivia has held up any development. The JV is the largest lithium extraction project in the world, with the product a sought-after commodity in the new generation of electric batteries in everything from smartphones to electric vehicles. Control over lithium supplies comes with geopolitical and trade advantages.

Verchenko stated that in his opinion, Bolivia’s new government is not abandoning cooperation with Russia on lithium mining, but may revise the terms of the existing agreement. The project, while agreed upon, has not been launched under new Bolivian President Rodrigo Paz Pereira and could now be hampered by the center-right administration’s desire to strengthen ties with the United States and focus on projects with Washington.

Verchenko has said that “During our contacts with members of Rodrigo Paz’s government, including Mauricio Medinaceli, Minister of Hydrocarbons and Energy, who oversees the lithium industry, we highlighted the Russian-Bolivian contract currently under consideration in the local parliament. At the declarative level, official La Paz has not abandoned the prospect of bilateral cooperation in lithium extraction. At the same time, local Bolivian authorities do not hide their intention to amend existing legislation regulating the energy sector. According to our information, these legislative initiatives may, among other things, change the procedures and terms of cooperation with foreign companies interested in participating in the development of the country’s lithium sector. Therefore, we wouldn’t rule out the possibility that the aforementioned bilateral contract will be revised to align it with the new government’s requirements.”

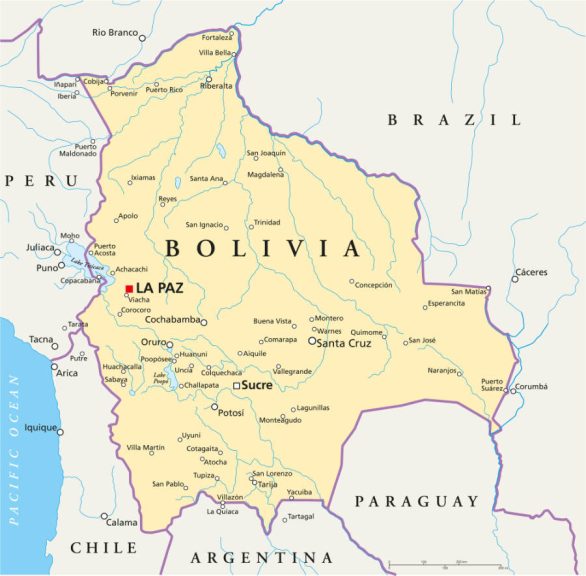

Bolivia, along with Chile and Argentina, is part of the so-called lithium triangle. The country’s lithium reserves are estimated at approximately 23 million tons. Russia also has significant lithium reserves; however, it finds it more profitable to purchase the metal abroad rather than mine it domestically.

The joint venture agreement to build a plant in Bolivia’s Uyuni Salt Flats was expected to yield approximately 14,000 tons of lithium carbonate per year. This lithium carbonate is essential for the production of electric vehicles, electronics, and renewable energy, among other products.

During the recent prime ministerial and presidential elections in Bolivia, the issue of lithium mine development agreements concluded with Chinese and Russian companies under the previous Luis Arce administration was a key point in Rodrigo Paz’s election campaign. However, the discussion wasn’t about an outright refusal to cooperate but rather about ensuring the transparency of these agreements and the possible revision of their terms. It became a significant domestic political issue.

Potosi, where lithium mining is planned, remains a hotbed for accountability in lithium mining. Among the demands of the protesters, led by the Citizens’ Committee of Potosi (COMPICO), are the adoption of a special law regulating the extraction of the rare metal, increased royalties for the region, consultations with local residents, and an environmental damage assessment before the ratification of the Russian and Chinese contracts that are still pending in the Bolivian parliament.

In Bolivia’s October presidential elections, over 60% of voters in Potosi and other mountainous departments of Bolivia supported the new president, Rodrigo Paz, based on his promises of transparency in mining agreements and consultations with indigenous peoples. That included the use of advanced technologies to minimize environmental damage. However, delays in the development of the mining industry and the industrialization of Bolivian lithium also delay the receipt of profits from this and the contribution to the Bolivian national budget, meaning the issue has not just political, environmental, and local compensatory aspects but also impacts Bolivia on a national economic development basis.

Russia, meanwhile, has been listening to these concerns, with Rosatom CEO Alexey Likhachev saying that it intends to deploy a “clean” lithium extraction procedure, emphasizing that this method allows for the extraction of over 90% of the metal from the salt marsh while preserving the natural balance. Its main advantage is its complete environmental friendliness: the process requires no harsh chemicals, and the used water is returned to the subsoil, allaying any concerns of local residents. How that will translate into Potosi and national-level politics with the Paz government intent on improving relations with the United States remains to be seen. An anti-Chinese and anti-Russian momentum has been developing in La Paz.

For nearly 20 years, left-wing representatives of the Movement Toward Socialism (MAS) party held power in Bolivia. Russia managed to build productive cooperation with them, and during the previous Luis Arce presidency, Bolivia joined BRICS as a partner country.

A change of power in Bolivia occurred in early November, with center-right candidate Rodrigo Paz emerging. A week before assuming his presidency, he visited the United States to seek funding to address the crisis in his country. A short time later, an American government delegation visited Bolivia. This marks a new stage in relations between La Paz and Washington, considering that for 17 years, the Latin American country has not had an American ambassador.

Russia’s Ambassador has commented on this change, saying, “The president-elect came to power with the promise, according to his campaign formula, of ‘opening Bolivia to the world and the world to Bolivia.’ The current administration emphasizes its intention to work with each interested state on a mutually beneficial basis, primarily with a view to attracting investment and implementing strategic bilateral projects. The Bolivian leadership emphasizes its commitment to strengthening multipolarity and increasing La Paz’s ‘international weight. Russia’s significant potential, including in scientific and technological fields, can provide local authorities with additional leverage and tools to stabilize the challenging socioeconomic situation in Bolivia. Our proposals and requests are being considered by the Bolivian side. We await signals of readiness to move from words to concrete actions.”

Further Reading

Russia, Bolivia Bilateral Relations: October 2025 Update

Русский

Русский