Over the past three years, Russia’s share in BRICS trade has more than doubled and has further potential for expansion and containerisation – but there are bottlenecks that need dealing with. During that timeframe, BRICS imports from Russia have surpassed exports to Russia by almost 4.5 times, creating a huge container imbalance. As a result, Russian companies are looking at developing sea terminals in transit countries, as well as entering into BRICS joint ventures to increase the conversion of Russian export cargoes.

Existing and potential BRICS participants export industrial and consumer goods to Russia in containers, and use these same containers to import generally low-value products. (Oil and gas are transported by pipelines, rail or ship). About 43% of Russia’s exports to these countries are pulp and paper, and timber industry products. Another 24% is food products (cereals, oilseeds, oils, meat, fish), 14% base metals, and 19% of other products of low and medium processing: rubber, polymers, acids, and so on.

This imbalance of export-import container flows in Russia can be resolved. The return of containers to China in some directions has increased in price by 2.5 times. The predominant volume of imports from the BRICS countries or 55% is formed by industrial goods. These are machines, equipment, mechanisms, products made of plastics and base metals, ceramic products, paper. Another 15% are consumer goods, which include cars, clothes, shoes, and fabrics. At the same time, the imbalance between the export and import flows of containers is increasing. For example, in 2020-2021, imports exceeded exports by only 10-14%, however by 2023 the gap had reached 59%.

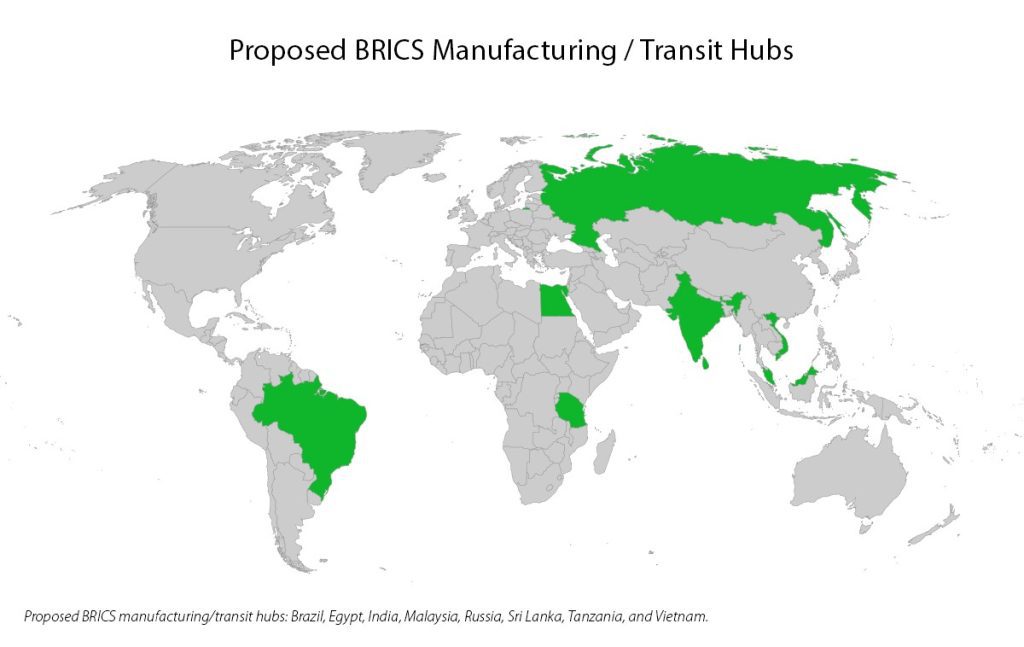

Proposals are currently being made to develop terminal infrastructure in the BRICS countries, as a presence in offshore, overseas terminals will allow Russian companies to supply goods to BRICS and other friendly markets without sanctions problems. In the BRICS transit countries or directly in the consumer countries, it is proposed to create joint production facilities for the further processing of Russian raw materials.

Alexander Iodchin, First Deputy General Director for Strategy and Development of Russia’s Delo Group, a leader in sea transshipment and rail transportation of containers, said that “From the point of view of container logistics development potential, we consider Brazil, Egypt, Tanzania, Malaysia, Vietnam, India and Sri Lanka priority countries for the implementation of terminal capacity and hub construction projects.” The opportunities for investment in these countries to facilitate BRICS trade is apparent. These countries all possess a competitive labour force, significant port facilities, free trade zones and related tax incentives.

Russia’s Pivot to Asia can provide cost analysis of the countries mentioned. For further information, please contact us at info@russiaspivottoasia.com

Further Reading

BRICS Invites 13 Partner States To Join: Full Details

Русский

Русский