Analysts at the Moscow-based Gaidar Institute’s Foreign Trade Laboratory (IEP) have stated that China-Russia trade dynamics show that the pressure of secondary sanctions on China began from March 2024, when they were first applied on a large scale. However, within four months, Russian exports to China had recovered, and by July the initial decline was reversed with the share of the Russian market in Chinese trade returning to 3.3% of China’s total imports.

The Institute stated that “Export data from the main “unfriendly” countries allow us to estimate a decrease in their share in Russian imports to 18% of Russia’s total in the first three quarters of 2024.” The pre-Ukraine conflict figure had been as high as 55%.

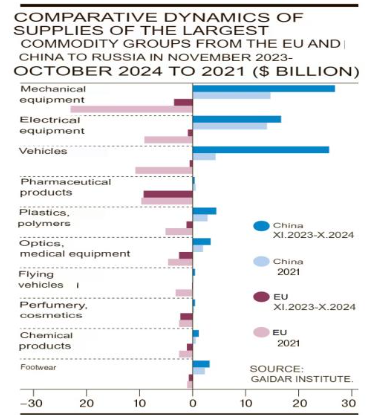

China has become the main source of substitution for goods from unfriendly countries, however the amount varies by industry, according to the Gaidar Institute, who researched export data based on Chinese Customs and Eurostat figures.

An example is the increase in the export to Russia of vehicles from China, which were double the pre-sanctioned import of cars from the EU. From November 2023 to October 2024, this was valued at US$25.5 billion, US$21.3 billion higher than in 2021.

However, for several other large groups of goods, the drop in imports from the EU was only partially offset. These include mechanical equipment, optics and medical equipment (about 60% of the decrease in imports from the EU was offset), plastics and polymers (40%).

There was also no significant increase in imports from China in a other product groups. For example, the growth in the aviation parts sector amounted to US$201 million, while supplies from the EU decreased by just US$3.1 billion. Pharmaceutical supplies from the EU to Russia remained at 2021 levels at US$9.3 billion, compared to Chinese imports worth just US$108 million, meaning the Russian market remains dependent on European medicines and substances.

However, the makeup of Russia’s import substitution away from the EU isn’t purely reliant on China. In the pharmaceuticals sector, Europe accounts for nearly 80% of the world’s pharmaceutical exports, meaning moves to break that dominance. Countries such as India, with a 4.1% share of global exports, will be looking to ramp up R&D and production facilities in what it can see is a new market opportunity. These strategic production moves take time and investment though – we predict that there may be future Russia-India joint investments coming to fill this gap. Russian investors should be keen not just because of the opportunity, but to insert themselves into a supply chain that both governments are encouraging. The Russia-India balance of trade is heavily weighted in Russia’s favour to an unhealthy degree – it accumulates to many rupees from the sale of energy products and needs India to sell more to Russia to counterbalance this.

While the Gaidar data is useful for examining the Russia-China import substitution dynamics, more work is needed to identify other sectoral opportunities involving supply chains that can also be restructured from Western production to boost production and supply from other countries, with the BRICS a major potential source. Russian corporates and other BRICS investors should be looking at where these likely sectors are now emerging – not just for the Russia market but also the EAEU and Commonwealth of Independent States trade blocs – with the latter possessing a population of 247 million and achieving growth rates of nearly 5% last year.

Further Reading

Russia-China Bilateral Trade Expected To Reach US$243 Billion For 2024

Русский

Русский