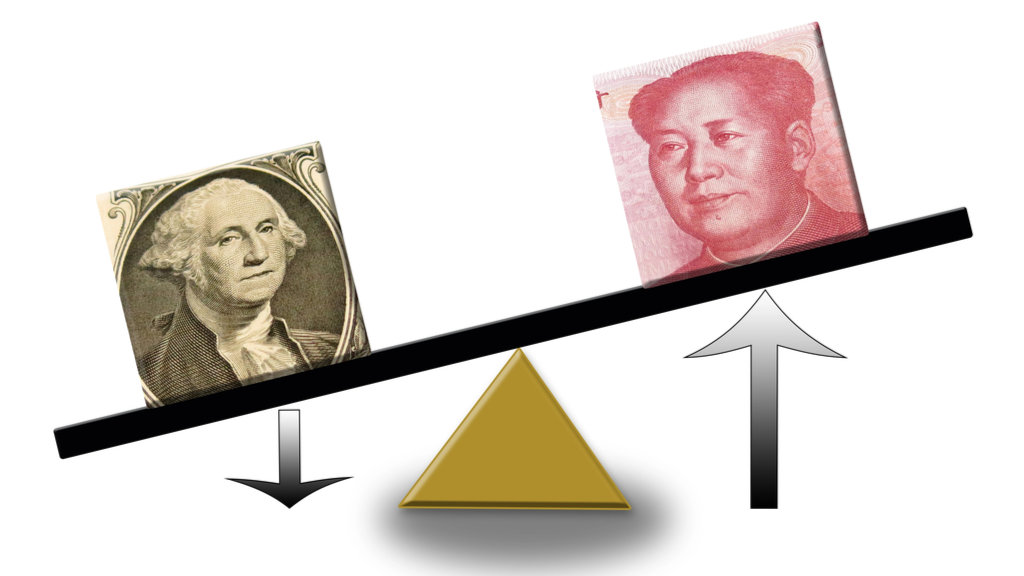

China’s RMB Yuan accounted for virtually the whole volume of exchange forex trading after the imposition of sanctions against the Moscow Exchange (MOEX), making up 99.6% of all transactions, the Central Bank of Russia has stated. Trading volume on the over-the-counter forex market reached ₽13 trillion (US$148 billion) in June.

When sanctions were first imposed in 2022, the average daily forex trading volume on MOEX fell 32.7%. However, the Moscow exchanges liquidity moved from “toxic” currencies to the RMB Yuan, increasing its trading volume on MOEX to record highs, including the ₽509 billion (US$5.8 billion) traded on June 19.

US dollar and euro trading on MOEX has been suspended since June, as a result of sanctions imposed by the United States and European Union. It is possible to conduct over-the-counter trade on MOEX, but volumes have plummeted. Euro over-the-counter trade is currently less than US$3 million a day, a miniscule amount considering the Russian economy is now the world’s 4th largest in PPP terms.

It means that the US dollar and the euro have been practically wiped out as currencies in Russian trade. The Bank of Russia will want to see diversity in currency trade however, with the potential introduction of a basket of currencies under the “BRICS Bridge” type of mechanism likely to be preferred balance.

If adopted, the BRICS Bridge concept would see an option for intraBRICS trade to be settled in a combination of currencies from Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE. Of these, Chinese RMB Yuan, the Saudi Rial and the UAE Dirhams would be the most valuable alternatives from the Russian perspective, although Russia’s trade with Central Asian countries is also on the rise and these may also start to show some increases in forex trading volumes.

Русский

Русский