The redistribution of foreign participation in the Russian market over the past two years has resulted in Chinese investors becoming the largest source of foreign investment into the country. In the first nine months of 2024, the number of Russian registered companies with Chinese equity increased by 32% over the same period in 2023, according to SPARK-Interfax.

Much of this has been motivated by the exit of European businesses from Russia. The Chinese have simply replaced the European corporates – the vast majority of which were highly profitable and therefore proven business models – with their own investments.

Chinese investors have made up a staggering 34% of all new foreign invested company registrations in Russia during 2024, up from 13% in 2021. The volume of Chinese new business registrations in Russia is running at about 200 a month, followed by investors from Belarus with about 130. Some of those Belarus investments may be of European origin.

The growth of Chinese investment in the Russian market has coincided with a tripling of Chinese revenues in Russia, far outpacing Russia’s GDP growth rates, which are the highest in Europe.

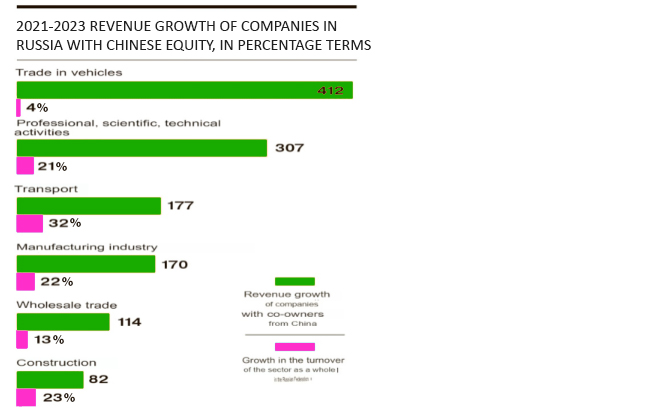

However, the sectoral distribution of Chinese investors is uneven. Key growth sectors include the Auto sector, with the revenues of Chinese auto dealers in Russia growing by over 5 times, and its market share increasing from 24% to 43%. Russian taxi companies now routinely use Chinese models while their take up in the vehicle rentals and consumer purchases have also significantly increased.

The Wholesale sector accounts for 26% of the total revenue of Chinese invested businesses in Russia, with 38% of all Chinese foreign invested enterprises (FIEs) in this sector. These investors are coming into the massive hyperstores that used to be operated by the likes of Leroy Merlin and Ikea, however the structure of Russia’s wholesale market is changing. Trade growth in mechanical products increased 2.2 times, with a market share of 69% of the total, driven by more Russian’s turning to DIY activities and especially in home improvements. Other industrial goods grew by 1.8 times, to take 16% of the market), light industry by 2.1 times; accounting for 11%), while trade in consumer goods also grew by 2.7 times.

In the processing sector, Chinese investors in Russia saw this area grow at 2.7 times over the year, although the overall share of processing revenues in Russia fell from 20% to 18%. The leaders are the automotive industry (its share in processing increased from 46% to 73%), metallurgy (the share decreased from 17% to 7%), and woodworking (a decrease from 9% to 3%).

Among the rapidly developing sectors, scientific / technical activities and transport cumulatively accounted for just 6% of China FIE revenues, but their growth was more rapid (4.1 times and 2.8 times) in 2023 compared to 2021.

It remains to be seen what the European long-term business communities ultimate reaction to the losses they have now endured, based on political constraints imposed upon them will now be. Many of these companies have significant institutional investors.

The encouragement to exit Russia, the closure of ports and of course sanctions have destroyed the bulk of European manufacturing, revenues and profits previously obtained from the Russian market. Not only have those revenues ceased, they are highly unlikely to ever to coming back as more competitive Chinese investors have now taken their place. With Russian Corporate Income Tax rates at 20%, this has meant that 80% of European profits previously generated from Russia are also not now returning to Europe. That was European fiscal tax income, with taxes further levied in Europe on the difference between CIT tax paid in Russia and CIT tax rates due in the EU, which are generally higher.

Boardrooms in China meanwhile will be celebrating at this somewhat unexpected and unique set of Russian business opportunities and profitability.

Further Reading

China’s Chery Auto Manufacturer Now The Largest Foreign Company In Russia By Revenue

Русский

Русский