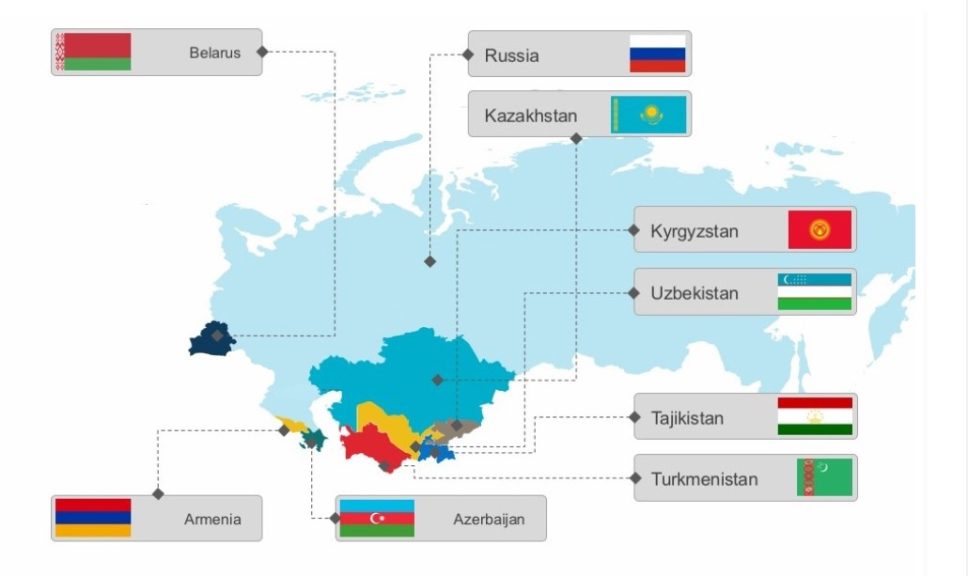

The member countries of the Commonwealth of Independent States are illustrating good economic growth during 2025, according to forecasts taken from Eurasian Development Bank data. They are averaging GDP growth rates for the year at 4.7%. Details are as follows:

| Country | 2025 GDP growth forecast |

| Armenia | 4.5% |

| A return to normality following conflict with Azerbaijan. | |

| Azerbaijan | 3.5% |

| The non-oil sector is a key growth driver, oil and gas sector may see a more moderate expansion. | |

| Belarus | 3% |

| Strong early-year results and expected expansion of credit support for investment. | |

| Kazakhstan | 5% |

| Growth driven by transport, logistics, manufacturing, mining and construction. | |

| Kyrgyzstan | 11.7% |

| Strong consumer demand supported by a sharp rise in remittances. | |

| Russia | 1.4% |

| Slowdown due to impositions of Western sanctions. | |

| Tajikistan | 7.4% |

| Strong economic growth, supported by investments in energy and industry, consumer demand, and private sector development. | |

| Turkmenistan * | 6% |

| The successful implementation of socio-economic development programs. | |

| Uzbekistan | 6.5% |

| Strong domestic demand, supported by high real wages, increased remittances, and investment. | |

| *note Turkmenistan is an associate, not full member of the CIS, but follows CIS trade guidelines and regulations. | |

Fundamental Indicators

Much of this growth appears to be economically driven by Russia’s pivot to Asia. According to the United Nations COMTRADE data, we note that Russia’s exports to the CIS countries rose from US$55.2 billion in 2021, to US$104.53 in 2024, according to data gleaned from their respective customs agencies. This indicates annual export growth of an average 20% per annum in current Russian-CIS trade flows. This flow of trade from Russia to the CIS is having a positive effect on the local economies.

Comparison With Europe

In contrast, the average GDP growth rate for the European Union, and the United Kingdom, according to the IMF’s World Economic Outlook, is set to be 1.2%, a rate lower than Russia’s – with all the disadvantages of the sanctions placed upon it.

Structural Distinctions, The Eurasian Economic Union, & BRICS

The CIS is a slightly different trade organisation to the European Union, as it doesn’t have a rigid set of intra-trading regulations and tariffs on a uniform basis. It also does not have a common currency, with members free to use their own respective monies. This has had two effects, one being a more liberal trade policy, where CIS members agree their own bilateral trade arrangements rather than a complex set of regulations that unify all. Secondly, the use of sovereign currencies rather than a singular regional one has also proven to be more flexible as local dynamics can reflect real value at any one time. In short, the CIS arrangements provide more flexibility.

However, because the CIS is not a customs union per se, it cannot (and does not) enter into Free Trade Agreements with other countries or blocs.

It should also be noted that several of the CIS members are also members of the Eurasian Economic Union (EAEU) which does have specific intra-bloc customs and tariffs agreements. These are Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Russia. The EAEU has signed Free Trade Agreements (FTA) with China, Vietnam, Iran, and Serbia and is currently in negotiations with India, Indonesia, Egypt and the UAE amongst others. However, these FTA can also be flexible. The EAEU-China FTA is non-preferential, meaning that decisions on products and tariffs can be made on an ‘as need’ basis without the requirement to enter into lengthy, multi-year negotiations. The BRICS operates its bloc trade agreements under similar principles. This has already proven to be advantageous when dealing with sanctions and the unpredictable nature of US President Trump’s administration in changing tariffs from one week to the next.

In contrast, the EU has a rigid set of intra-bloc trade agreements that are centrally imposed from Brussels and do not always reflect individual members wishes. The recent stand-off between Brussels and EU members Hungary and Slovakia is illustrative. The EU has also found itself to some extent in the same position as Russia – with the United States also imposing trade tariffs upon it.

It should also be pointed out that the CIS, EAEU and BRICS also hold rotating Presidencies (as does the Shanghai Cooperation Organisation), with each member taking on the role for twelve months at a time. While the EU has the same structure, due to its size it limits this to just 6 monthly periods, which compacts and reduces effectiveness. In addition, the EU appoints a select European Commission, based in Brussels to take decisions. This commission does not include all EU member states, which tends to limit decision taking to a select group.

Summary

The developing trade and growth of the CIS bloc, as well as the BRICS group and EAEU showcase several new issues in terms of multilateralism. Firstly, the fairly basic illustration that regional trading with Russia is economically beneficial. Economies that cut themselves off from Russian resources, and especially energy, have been seen to decline.

The second observation is more intangible however of great importance when designing a new world order, and it is that federalism, in the guise of bodies such as the European Union, may not be the most appropriate structures in today’s more unpredictable trade and commercial environment. A lack of flexibility and an over-reliance on strict regulatory systems, coupled with a tendency to restrict decision-making to a few executive bodies rather than the whole structure are now showing their inefficiencies. Deregulation is key. The flexibility of the CIS, and international trade structures built along similar lines, appears to be a viable model for redesigning both regional and global institutions.

Further Reading

International Container Transport In Commonwealth Of Independent States Grows 15.5%

Русский

Русский