The average economic growth rate of the Eurasian Economic Union (EAEU) countries between 2025 – 2030 is projected to average out at about 6% per annum, according to various analytical sources including the Eurasian Development Bank, World Bank and data analysts Statista.

That could even be higher should sanctions during the coming five years be relaxed on the Belarus and Russian economies, however is still considerably higher than the projected European Union GDP growth rate of 1.4%, as evidenced by the European Commission’s predictions.

At present, the EAEU has a total GDP (PPP) of about US$5 trillion. GDP growth for 2024 was 4.4% and is expected to be about 3% for this year. That decrease is mainly due to high inflation rates in Russia, which has interfered with investment, however is on the way to being reduced as these pressures slowly recede. A shift is also occurring in EAEU economic growth models, with a transition from a demand-driven approach to one that emphasizes innovation and investment.

We can examine each of the EAEU economies as follows:

Armenia

Armenia is at something of a crossroads, and needs to decide whether to continue its membership of the EAEU or to commit longer-term to joining the European Union. This uncertainty means that the economy is expected to moderate from the high growth rates of recent years as the trade and services sector is finding it difficult to motivate investment from Russia and other EAEU nations should Armenia join the EU.

This uncertainty over regional trade tensions and potential slowdowns in trading partners could impact Armenia’s growth, while potential shifts could lead to volatility in capital inflows and foreign exchange. A moderation of domestic demand will play a role in the overall growth trajectory.

However, the Amulsar gold mine, expected to start operations in late 2025, will be a medium-term growth driver, while increased government spending on defence, infrastructure, and social security could impact the fiscal deficit and debt levels. Armenia suffered during its conflict with Azerbaijan and has been somewhat knocked off track in recent years as regards maintaining a clear forward vision. While growth is predicted to moderate from the high rates of the recent past, Armenia’s economy is expected to remain stable, with growth driven by a mix of domestic demand and potential growth in sectors like mining.

Much depends on the Armenian political situation and its decision-making as concerns its relations with Europe. It cannot be both a member of the EAEU and the EU.

Belarus

Belarus’s GDP growth is projected to increase by about US$16.70 billion USD between 2025 and 2030, showing an upward trend, with Belarus growth being influenced by factors such as its trade with Russia, and domestic factors such as investment and household consumption.

It does face some external pressures, mainly related to Western sanctions and its closeness to the Russian economy, however it is also diversifying its trade towards Asia and this is also influencing Belarus’s economic trajectory. Belarus’s Foreign and Trade Ministers for example have been far more active over the past few years of establishing trade ties with China, India and the ASEAN countries as it too repositions itself to the East.

This includes specific leased port developments in Russia and China, which expressly handle Belarussian products.

Belarus is actively developing its infrastructure, with a focus on engineering, social, manufacturing, and defence sectors. Key areas include tourism infrastructure, IT infrastructure, and public transportation. The country also prioritizes the development of gas and electricity infrastructure, as well as road networks, aiming for efficient resource allocation and economic benefits.

Key infrastructure development areas include tourism infrastructure, with 116 major projects completed in the past four years, increasing accommodation capacity, while the country ranks 18th globally in IT infrastructure, with a focus on expanding internet access and digital services.

The country is prioritizing road construction and maintenance, recognizing their importance for trade, transportation, and economic development, and is also actively developing its gas and electricity infrastructure, including extending gas supply networks and modernizing electricity infrastructure in regions. Belarus benefits by having access to inexpensive Russian energy supplies.

The Belarus State Investment Program has a focus on engineering, social, manufacturing, and defence infrastructure, and a National Infrastructure Plan that prioritizes projects based on economic, social, and environmental benefits. It utilizes public-private partnerships to develop infrastructure, particularly for projects requiring significant investment or expertise.

The Belarus President, Aleksandr Lukashenko, is especially bullish about the prospects for the EAEU, stating that it will double its share of global GDP by 2035.

Kazakhstan

Kazakhstan aims to double its GDP by 2030, with growth driven by a diversification of its economy beyond oil, focusing on processing, production, and technology. Kazakhstan’s GDP is expected to grow steadily, with a predicted increase of around US$141 billion between 2025 and 2030.

Kazakhstan is actively working to reduce its reliance on the oil sector and develop non-oil sectors like manufacturing, agriculture, and technology, and is also focusing on streamlining tax legislation and creating a more attractive investment climate to encourage both domestic and foreign investment.

The industrial sector, particularly alloys and minerals processing, and the petrochemical and polymer industries in the oil sector, are expected to be key drivers of growth. Kazakhstan is also working on strengthening regional cooperation with other Central Asian countries to remove trade barriers and foster economic growth. Astana is aiming for a 30% increase in GDP per capita by 2030, which would additionally represent a significant improvement in living standards.

Kazakhstan is actively developing its infrastructure through a National Infrastructure Plan until 2029, focusing on energy, transport, water supply, and digital infrastructure. This plan, valued at US$80 billion, includes over 200 projects aimed at enhancing service reliability and promoting economic growth. A key aspect of this development is attracting private sector investment and leveraging strategic location for trade routes between China and Europe.

It includes key areas of focus such as the energy sector, prioritizing and increasing the share of renewable energy sources and strengthening the electricity network, particularly in the Southern Zone, while developing its road and railway networks to facilitate transit trade, leveraging its strategic location between Europe and China.

The development of digital infrastructure is also a key component of the plan, aiming to improve connectivity and access to digital services. The National Infrastructure Plan is projected to create approximately 150,000 jobs.

Kyrgyzstan

Kyrgyzstan aims to reach a GDP of US$30 billion by 2030, with a target of 11-12% annual GDP growth. This ambitious goal is part of a broader national development program through 2030, aiming for significant economic and social improvements.

This programme has also sets targets for GDP per capita to increase to US$3,900, external public debt to increase to @50% of GDP, an unemployment rate below 5%, and entry into the top 100 countries in the Human Development Index (HDI).

The National Bank of Kyrgyzstan forecasts a real GDP growth of approximately 8.5-9% for 2025, while the Eurasian Fund for Stabilization and Development has upgraded its forecast for Kyrgyzstan’s 2025 economic growth to 8.1%.

There are several other infrastructure factors in Kyrgyzstan’s favour, not least its developing ties with China with road and rail links including the China-Kyrgyzstan-Uzbekistan railway, which is scheduled for completion by 2031. Other extensive state and private investment is driving growth in transport infrastructure, while China’s Belt and Road Initiative is contributing to transport projects and potential reductions in trade costs. Kyrgyzstan is positioning itself as an added value hub for goods and services between China and Central Asia.

Russia

The status of the Russian economy in the coming five years is hard to predict, however should the Ukraine conflict come to an end, a period of rapid growth could ensue, especially if trade ties with the West are allowed to resume. However, at present it remains something of an enigma. At present, the Bank of Russia suggests an average GDP growth rate of about 1.8% should current conditions persist.

This means that a tightening of monetary policy is expected to slow down private consumption and investment, while labour shortages are also expected to constrain growth, with declining global energy prices also predicted to limit export revenues and budget revenues. Meanwhile, inflation is expected to decelerate, but remains a concern, and the Central Bank is expected to maintain high interest rates to combat it. Reduced government support for businesses is also anticipated to contribute to slower growth should current economic conditions be maintained.

All that said, Russia is actively pursuing infrastructure development across various sectors, including transportation, utilities, and social infrastructure. This development is driven by strategic planning, government programs, and a focus on attracting private investment alongside public funding. These will spur economic development in the medium-longer term.

Key areas of focus include transportation, where Russia is heavily investing in the modernization and expansion of its transportation network, including highways, airports, and port infrastructure. The International North-South Transport Corridor is due for completion by 2027, which should significantly boost trade with the Middle East and Asia, while Russia’s Comprehensive Plan for modernization and expansion of its core infrastructure outlines multiple projects for high-speed highways, airport reconstruction, transport hub development, and strategic exports such as energy, agriculture and fertilizers as well as other products.

Russia is actively seeking private sector investment and expertise to complement public funding for infrastructure projects, while long-term planning and strategic goals are being set to guide regional development and address regional disparities through infrastructure investments.

Other Growth Considerations

Existing Free Trade Agreements

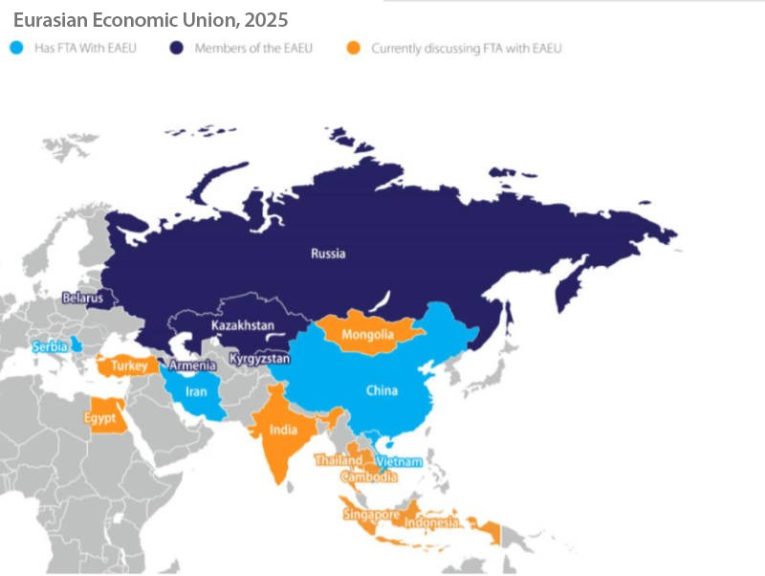

The Eurasian Economic Union has free trade agreements with China, as well as Iran, Mongolia, Serbia and Vietnam. The China agreement is non-preferential, meaning it is flexible in nature and is adjusted on an as need product by product basis as opposed to being driven by a strict set of applied tariffs. As a result, this agreement tends to fly under the radar, nonetheless it is operational. China’s trade with the EAEU nations has seen significant growth in recent years, with a focus on expanding trade and economic cooperation, particularly in areas such as transportation, infrastructure, and technology. China’s GDP growth rate for the 2025-2030 period is expected to be between 3.8 to 4.2%. This will have a positive impact on its trade with the EAEU.

The EAEU FTA with Iran and Mongolia are relatively new, however the EAEU-Iran FTA has specific value and is likely to double mutual trade to about US$12 billion per annum from 2025, again an economic positive. The FTA between the EAEU and Vietnam has significantly impacted trade between the two regions, leading to increased trade volumes and investment. Specifically, the FTA has resulted in a notable rise in trade, with some sources reporting a doubling of trade between Vietnam and the EAEU since its implementation. Russia, a key member of the EAEU, has also announced significant investment deals with Vietnam.

Pending Free Trade Agreements

The Eurasian Economic Union is also holding Free Trade negotiations with several major economies, including Egypt, India, Indonesia, Thailand and the UAE. These are significant economies, and if agreed (the Indonesia FTA is set to be signed in December this year) will have a substantial impact on the Eurasian Economic Union itself.

Summary

While the current political focus is on Armenia’s political ambitions, and its future within the EAEU, it is not a major economy and is only above Kyrgyzstan in its GDP wealth. The broader picture for the EAEU is more positive, with major economies wishing to structure trade deals with the bloc, meaning that any future Armenian departure would be rapidly absorbed.

Armenia also needs to decide whether the future lies east and trade and infrastructure with Asia, or West, where it remains somewhat of an outlier – Armenia has no border with any of the EU nations.

2025 and 2026 meanwhile look set to be decisive ones for the development of the EAEU as pending trade negotiations look set to materialise. That 6% GDP growth rate, especially if the Ukraine conflict can be resolved, may begin to look conservative should current plans, infrastructure developments and new supply chains begin to kick in over the coming five years.

In contrast, the European Union meanwhile spent an estimated €326 billion on defence in 2024, and plans to spend more, directing its capital away from infrastructure and into projects that do not provide a return on investment.

Further Reading

Commonwealth Of Independent States GDP To Equal European Union’s By 2050

Русский

Русский