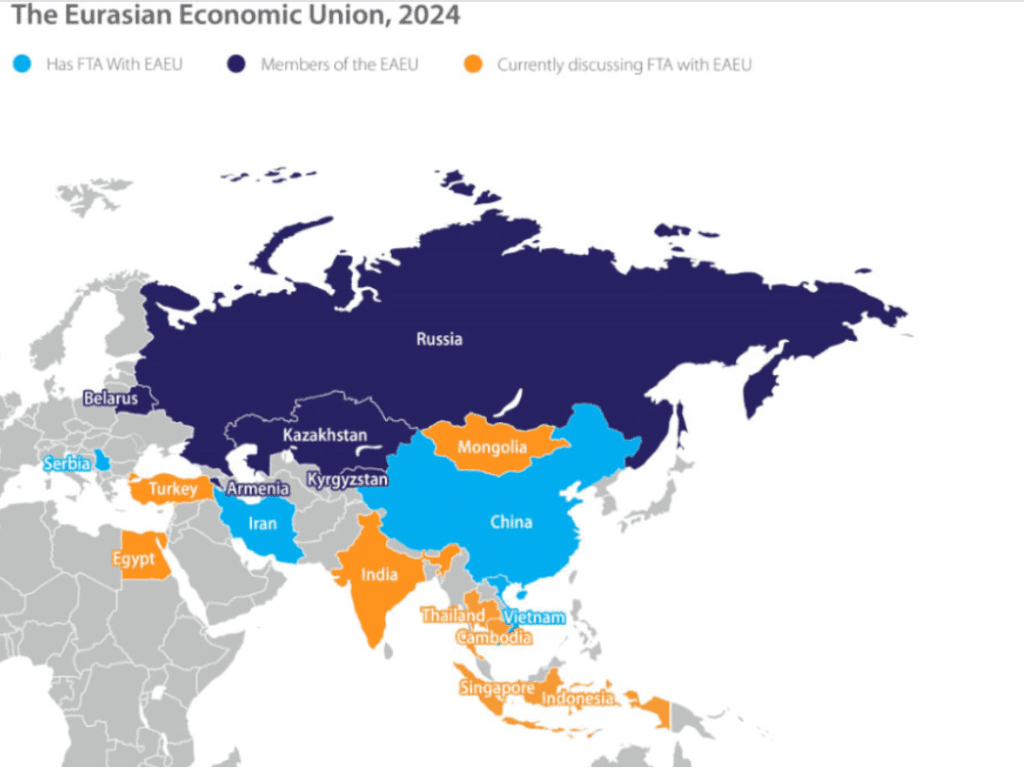

The mutual trade volume within the Eurasian Economic Union (EAEU) in the first quarter of 2024 increased by ₽2 trillion (US$22.5 billion), according to Dmitry Volvach, a Deputy Minister of the Russian Ministry of Economic Development of Russia. He was speaking at the ‘Export to the EAEU countries’ conference of interregional cooperation in Novosibirsk last week.

Volvach said that “Compared to the same period in 2023, in January-March 2024, mutual trade of the EAEU member states grew by another 7%. Let’s see how we end the year, but the trend is very, very good, in value terms it’s almost 2 trillion Russian roubles. We are taking all possible steps to maintain these trends.”

In 2023, the volume of mutual trade between the EAEU countries increased by 5.4% to ₽7.4 trillion, reaching a record level during the EAEU’s ten 10 year existence.

One of the support tools is the creation in 2023 of a supranational mechanism for financing industrial cooperation within the EAEU.

Volvach commented “Today, the commission is selecting applications received for appropriate support measures; we have now allocated ₽1.8 billion (US$20.2 million) from the EAEU budget in order to be able to index the interest rate on loans for cooperation projects in which three or more countries participate. The EAEU, of course, would prefer to have more, but the entry threshold of three enterprises from three different countries is a conscious decision to support projects with a high degree of connectivity, a high degree of cooperation.”

Volvach also noted that in 2023 it was decided to establish the Eurasian Reinsurance Company.

“The company’s activities will support the volume of mutual foreign trade of the Eurasian Economic Union in the amount of more than ₽360 billion” (US$4 billion) he said.

Liliya Shchur-Trukhanovich, at the Department for Development and Regulation of Foreign Economic Activity of the Ministry of Economic Development of Russia has also clarified that the formation of the working bodies of this reinsurance company is currently being completed. The move is needed as Western reinsurance companies have withdraw from the Russian market, hindering shipping access to Western ports and creating additional content insurance risks.

Русский

Русский