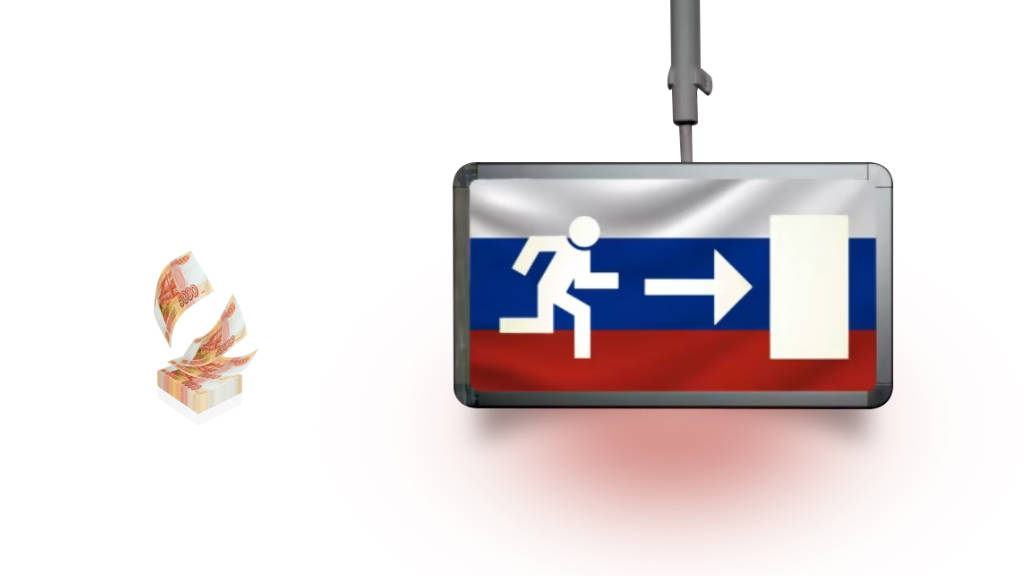

The Russian Ministry of Finance has introduced significant changes to the market exit conditions of Russian based assets owned by individuals or entities from so-called “unfriendly” states or companies controlled by them. These are as follows:

- The valuation discount is increased to 60%, meaning that assets can be sold at a price not exceeding 40% of the market value determined by an authorized appraiser;

- The ‘exit tax’ payment to the Russian federal budget is increased to 35% of the market value (not the discounted value) of the assets being sold. 25% shall be paid within one month of completion of the transaction and the remaining 10% shall be paid in two installments within the following two years. Should the market value exceed ₽50 billion (US$516 million) this transaction must be additionally approved by the President of Russia.

The above requirements are applicable both to new petitions for obtaining the permission of Government Commission for Control over Foreign Investments in the Russian Federation and the ones being already considered by the relevant ministries. In the latter case applicants will have to adjust the conditions of planned transaction and change their applications accordingly.

The ‘Unfriendly countries’ list includes:

Albania, Andorra, Austria, Australia, Bahamas, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Latvia, Liechtenstein, Lithuania, Malta, Micronesia, Monaco, Montenegro, Netherlands, New Zealand, North Macedonia, Norway, Poland, Portugal, Romania, San Marino, Singapore, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, Taiwan, Ukraine, United Kingdom, (and all UK dependencies) and the United States.

Further Reading

Russia’s Tax Revenues From ‘Unfriendly Countries’ Business Exceeds Forecasts

Русский

Русский