The Russian President, Vladimir Putin, visited Beijing and Harbin, China last week to meet Chinese President Xi Jinping and discuss multiple issues concerning trade and mutual development. In Harbin, Putin attended the China-Russia Expo.

In this article, we summarise the meetings, and discuss the numerous announced deals and developments.

Overall Impact

The overall impact of the meetings of the two sides has been highly positive, at least in China and Russia. Both sides attended with substantial teams, including the Foreign Ministers, Central Bank Governors, Ministers of Commerce, Defence Ministers, and many other Ministerial level heads. These high-level and broad sectoral meetings have paved the way for an unprecedented level of cooperation between the two countries.

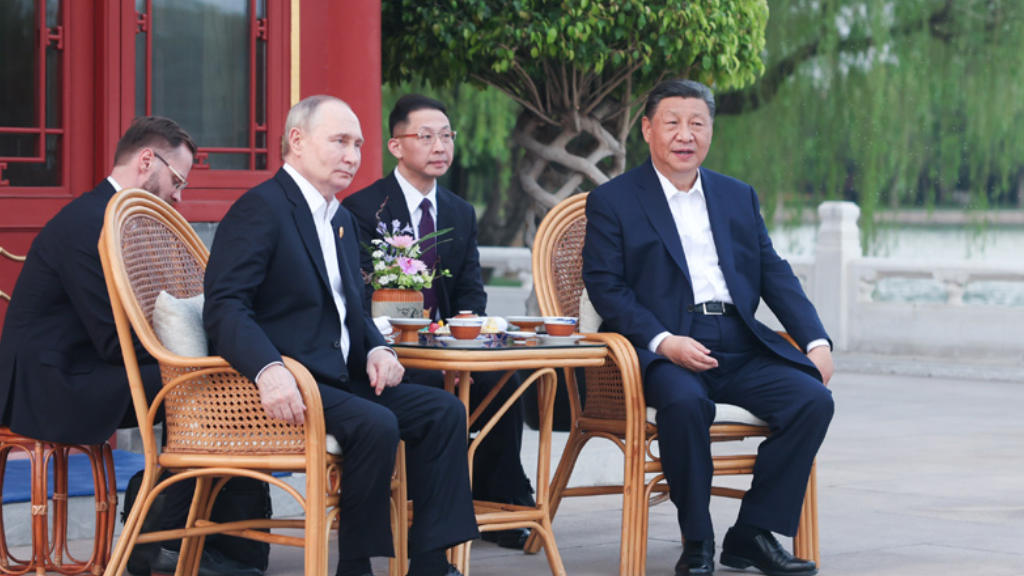

In Beijing, Xi hosted Putin at the Great Hall of the People on Tiananmen Square and at Zhongnanhai, the private, central seat of power and part of the original Forbidden City, allowing an informal, multi-level setting for discussions about security and the situation in Ukraine, in discussions that lasted about four hours. Very few foreign leaders are ever permitted entrance to Zhongnanhai as the area is reserved for high-ranking Chinese officials and their families only.

Following the Beijing meetings, the two Presidents signed a joint statement on deepening the China-Russia relationship of comprehensive partnership and strategic interaction, and gave a joint media statement concerning this afterwards. Putin also met with met with Li Qiang, the Premier of China’s State Council. We examine both these events later in this article below.

First, we provide a deep dive into announced developments and deals as follows:

Energy

Continuing to acquire Russian energy is a key strategy for China’s development, as it seeks to maintain GDP growth rates of 5% per annum plus. The country is the world’s second largest economy, with over 17% of total global trade. However, it has stresses as well, such as limited energy reserves of its own and a population five times larger than that of the United States. Securing – and diversifying – energy supplies is a vital cog in both Chinese and global development.

Putin stated that “I have no doubt that our strategic energy alliance, which has become a cornerstone of the entire global energy market, will continue to strengthen. Russia is ready and able to supply the Chinese economy, enterprises, towns and cities with eco-friendly, affordable energy, power and heating in a continuous and reliable manner.”

A joint statement was issued by both Presidents concerning energy, in which they agreed “to continue strengthening the Russian-Chinese strategic partnership in the energy sector and develop it at the high level in the interests of ensuring the two countries’ economic and energy security, seek stability and sustainability on the global energy market, bolster production and supply chains in the fuel and energy sector, develop cooperation in oil, natural gas, liquefied natural gas, coal and electricity based on market principles, ensure the stable functioning of the relevant cross-border infrastructure, and create conditions for the unhindered transportation of energy resources.”

That deals with both energy supplies, the transportation and supply chain logistics, and implies they are close to agreeing prices in line with market norms. They also touched on future joint development, agreeing to “provide assistance to large joint energy projects implemented by Russian and Chinese enterprises and to deepen interaction in promising areas such as renewable energy sources, hydrogen energy and carbon unit markets.”

Strategic Energy Alliance

China and Russia have termed their multiple energy arrangements as a ‘Strategic Energy Alliance” with Putin saying in Harbin that “Our strategic alliance in the energy sector, which has become a robust pillar of the entire global energy market, will continue to grow stronger. Russia is ready and able to reliably and without interruptions supply the Chinese economy, enterprises, cities, and towns with environmentally friendly, affordable energy, electricity, and heat.”

Moscow has ramped up energy deliveries to Asia, particularly China. According to Bloomberg, Russia became China’s biggest source of oil, exporting a record 107 million tons of crude in 2023, a quarter more than in 2022.

Power of Siberia 2

There have been some wild assumptions in US media that the Power of Siberia 2 pipeline would not see the light of day. In fact, Russian Deputy Prime Minister Alexander Novak stated on Thursday (May 16) that the two sides expect to complete preliminary work on the Power of Siberia 2 gas pipeline soon, and sign construction contracts. He stated “We are also planning to complete the review soon and sign a contract for the construction of a gas pipeline with a capacity of 50 billion cubic meters (bcm) of gas through Power of Siberia 2.”

Gazprom started assessing the possibility of supplying large volumes of gas per year to China through Mongolia in 2020. Design and survey work began as part of the Soyuz Vostok gas pipeline construction project in February 2022.

Putin also confirmed this while speaking at the Harbin Institute of Technology on Friday (May 17), saying the Russian and Chinese leaderships have confirmed their interest in projects aimed at increasing energy deliveries, including the implementation of the Power of Siberia 2 gas pipeline. Putin said “I am not in a position to tell you the technical details, but both parties reaffirmed their interest in implementing these projects. On the one hand, there’s an interest in getting additional amounts of energy, and on the other, an interest in selling it on the Chinese market. The Chinese economy is growing and requires more energy for sustaining this growth. There’s nothing more reliable than supplies from Russia. We have a huge common border, and nobody can put any obstacles here. Neither by imposing sanctions on the tanker fleet, nor even sanctions on financial institutions. We’ll buy and sell everything in national currencies. I think the economic operators, such as Gazprom and our oil companies, will reach a consensus. This is always a complex process, and it’s about prices and who makes how much. But strategically, both parties are definitely interested in implementing these projects, and we’ll be doing that.”

Russia currently supplies gas to China via Power of Siberia, a section of the Eastern Route, under a bilateral 30-year agreement. Deliveries started in 2019, and the pipeline is expected to reach its full operational capacity of 38 bcm of natural gas annually next year. The pipeline’s operator, Gazprom, has exceeded its contractual obligations on a regular basis throughout 2023-24, with new volume records frequently recorded. The company is projecting that gas supplies to China will continue to grow due to soaring demand. Once all pipelines are fully operational, the volume of Russian gas supplies to China could reach nearly 100 bcm annually.

Power of Siberia – Crude

Putin also said that the planned Power of Siberia 2 gas project could also see an extra conduit laid for crude oil. Speaking at a press conference in Harbin, he said it may be possible to lay an oil pipeline next to the new gas route. ”Various routes for Russia’s oil to reach China are available, one of them is the route through Mongolia. It is possible to lay both gas and oil pipes in the same corridor. Experts will decide how best to proceed.”

Russia has traditionally supplied oil to China via sea and the East Siberia-Pacific Ocean pipeline, via transit through Kazakhstan, and by tankers. Moscow also plans to develop railways as another means of transporting crude to the Chinese market.

The Kazakh Connection

In addition to the potential Power of Siberia Crude pipeline, Kazakhstan’s KazTransOil shipped 3.342 million tonnes of Russian oil in transit to China in January-April 2024, the company has stated. KazTransOil has been transiting Russian oil via Kazakhstan to China since 2014 under an agreement between the governments of Kazakhstan and Russia dated December 24, 2013. The transit of Russian oil to China reached 3.218 million tonnes from January through April 2023, a 3.8% increase. Last year, Kazakhstan supplied 9.989 million tonnes of oil from Russia via transit to China. Almasadam Satkaliyev, Kazakhstan’s Energy Minister said that Kazakhstan would earn US$1.7 billion from the transit of Russian oil to China from 2024 to 2033. The agreement to extend transit services includes a section of the route along the Tuymazy-Omsk-Novosibirsk 2 (TON-2) main oil pipeline, while the Atasu-Alashankou main oil pipeline is part of the Kazakhstan-China main oil pipeline system and belongs to Kazakhstan-China Pipeline LLP, a joint venture between KazTransOil JSC (50%) and China’s National Oil and Gas Exploration and Development Company Ltd. (50%). The design capacity of the Atasu-Alashankou main oil pipeline is 20 million tonnes of oil per year.

Russia became China’s largest oil supplier last year. Beijing imported a record amount of discounted Russian oil in 2023, taking advantage of Moscow’s push to find new buyers following the implementation of Western sanctions.

Carbon Footprint

Scientists from Russia and China are currently working on solutions that will allow radically reducing carbon footprint, Russian President Vladimir Putin said at a meeting with students and professors of Harbin University of Science and Technology. “Russia and China are doing much in the area of environmental protection, biodiversity protection and countering climate change. Our two countries’ communities are currently working on technical solutions that allow radically reducing our carbon footprint.” A programme for the creation of carbon polygons already exists in Russia, and is being implemented together with Chinese partners.

Northern Sea Route

Russia and China will set up a joint commission for the development of the Arctic Northern Sea Route (NSR), Rosatom nuclear corporation head Alexei Likhachev has stated. Rosatom will lead the project on the Russian side, while China’s Ministry of Transport will oversee its share of the work.

Likhachev said after meetings in Beijing with China’s Ministry of Transport that “Our task is to create in the shortest possible time a joint program for expanding Chinese transit along the Northern Sea Route, as well as for a number of other projects in the interests of using this global artery, which, of course, has enormous development potential. The Arctic region is increasingly becoming a new frontier for geostrategic competition between the powers.”

During President Vladimir Putin’s state visit to China Moscow and Beijing released a joint statement, expressing interest in preserving the Arctic as a territory of peace, low military-political tension and stability. A recent report by Strider Technologies, citing open-source data, noted that:

- From January to July 2023, 123 new companies with Chinese owners registered to operate in the Arctic;

- New Russia-China Arctic and Far East cooperation projects have emerged, especially in the areas of liquefied natural gas, mineral extraction and infrastructure;

- Russia-China trade via the Arctic Ocean’s Northern Sea Route is increasing.

Russia-China interaction in the Arctic includes joint interactions such as:

- Development of Arctic resources, including oil and gas;

- Transport and logistics;

- Science and education;

- Environmental protection;

- Tourism;

- Joint development of the Northern Sea Route and related coastal infrastructure, as well as energy and scientific cooperation.

From the outset, Beijing recognized that the Northern Sea Route could complement its ambitious Belt and Road Initiative, serving as an extension of the strategic project.

Cargo traffic via the Northern Sea Route has reached a record 35 million tons since the start of 2023. Chinese shipping company COSCO has been the main international operator on the NSR, making over 100 voyages over the past decade.

The Northern Sea Route is over 3,000 nautical miles (3,452 miles) long and connects the Barents Sea and the Bering Strait. It is the shortest route between Europe and Asia, as well as the shortest sea route between the Far East and the European part of Russia. The cargo shipping route from the Far East to Europe via the NSR is 14,000 kilometers (8,699 miles). In 1991, the route was opened to international shipping, with Rosatom granted the authority to develop it in 2018.

Russia is in the process of implementing a federal project to develop the NSR with new port facilities, oil, LNG and coal terminals, and ice-class vessels to boost cargo traffic to 110 million tons by 2030. Russia’s Northern Fleet includes the world’s only nuclear-capable icebreakers and is based in Murmansk.

Over the past decade China is estimated to have invested in excess of US$90 billion in Russian Arctic energy and mineral projects. Chinese companies have long been involved in Yamal LNG, an integrated project encompassing natural gas production, liquefaction and shipping. Investors from China controlled about 30% of NOVATEK’s Yamal LNG project, and become the largest foreign co-owners of its second liquefied natural gas plant, Arctic LNG-2. China National Offshore Oil Corporation (CNOOC) and China National Petroleum (CNP) each have a 10% stake.

Russian Prime Minister Mikhail Mishustin highlighted the close ties between the two countries in the region last year, singling out Yamal LNG, located on the Yamal Peninsula above the Arctic Circle, as a flagship of Russian-Chinese cooperation in the Arctic.

An estimated 80% of Russia’s natural gas and 17% of its oil production lies in the Russian Arctic. The Russian Arctic continental shelf is believed to contain 17 billion tons of oil and 85 trillion cubic meters of gas reserves.

Russia accounts for about a third of the total Arctic region and nearly 70% of its economic activity.

Shipbuilding

Chinese shipyards in Dalian have also been involved in the development of Russia’s shipping fleet, with the hope of expanding their sales to Russia. This is linked with both the development of the NSR but also with fishing.

Dalian’s Liao Yu Group shipyard in Dalian has been building the mid-sized factory trawler Kuloi, built for Russia’s Sever fishing at a cost of about ₽600 million (US$6.6 million) and is being prepared for delivery, according to the Arkhangelsk regional government. A Russian regional delegation led by Governor Alexander Tsybulsky visited the Dalian fishing port in China, where the trawler is located, on Wednesday (May 15).

The project SRTM-4470 vessel is intended for harvesting various species of fish in the Northern fishing basin. The trawler is outfitted with high-tech equipment that will support harvesting, processing and production of goods directly onboard. The trawler, which was built according to an individual design, is 46.6 meters long and 10.6 meters wide and has a cargo hold with capacity of 452 cubic meters. The 2,000-hp (1,470 kWt) vessel can travel at up to 11 knots and is expected to have a crew of 24 people. The Kuloi was ordered by Sever and is being built under the control of the Russian Maritime Register.

The vessel has now been put in the water and its propulsion units and main engine have been installed. The signing of the acceptance and transfer certificate for the trawler is being planned.

Tsybulsky said Arkhangelsk Region fishing organizations cooperate with China in various areas. “The fishing industry of Arkhangelsk Region is now a developing sector of the economy. The ocean fishing catch totaled 85,000 tonnes last year. Commercial fishing in marine waters is done using 20 of our own fishing vessels, three of which are new large-capacity trawlers built by the Arkhangelsk Trawler Fleet under investment quotas.” the governor was quoted as saying in the press release.

He said the industry is successfully managing sanctions and an increasing amount of exports go to China. He also said that the Russian government has adopted a comprehensive plan to develop the Arkhangelsk transport hub to 2035 that involves developing existing infrastructure and building a deep-water port. Because of this, the region wants to invite Chinese companies that ship cargo to use Arkhangelsk port terminals for transshipment.

A direct voyage from Arkhangelsk to Shanghai through the Northern Sea Route was carried out in 2023 for the first time in ten years. The regional government said the vessel, which carried more than 300 containers of lumber, took 23 days to make the journey, compared to 30-32 days for shipments from St. Petersburg. There are plans to increase the number of voyages to 10-12 ship calls in the 2024 summer and fall navigation season.

Shipping Logistics

Russia’s Delo Group and China’s Xiamen C&D Group have agreed to build joint logistics chains to support foreign trade, develop sea shipping routes and modernize terminal and warehouse infrastructure in Russia and China. C&D sees Russia as a priority market for investment and business development and is interested in having a reliable logistics partner in the country.

Delo Group, in turn, is prepared to provide a complete range of logistics services for joint projects, including railway, marine and overland shipping, port infrastructure and customs processing, the company said.

“The strategic goal of our work is to create a joint venture that will provide the whole range of services within the context of trade between Russia and China.” Delo Group founder and chairman Sergei Shishkarev was quoted as saying. During a recent visit to Russia, the Xiamen C&D Group delegation visited Delo Group’s marine terminals in St. Petersburg and Leningrad Region. The group said the Chinese side expressed an interest in exploring joint projects to develop the Ust-Luga Container Terminal, a division of Global Ports, which is controlled by Delo Group.

Delo Group operates marine container terminals in the Azov-Black Sea, Baltic and Far East basins, a network of railway container terminals and a fleet of containers and well cars. Shishkarev owns 51% of the company and state corporation Rosatom owns the other 49%.

The group’s transport and logistics business includes intermodal container operator TransContainer and multimodal transport operator Ruscon, and its stevedoring business includes DeloPorts and leading Russian container terminal operator Global Ports.

Rail Connectivity

Russian Railways (RZD) and China Railways signed an agreement on comprehensive strategic cooperation on Thursday (May 16), RZD reported.

The companies have agreed to accelerate the implementation of the project to build a second main rail line with a standard 1435mm gauge at the Zabaikalsk-Manchuria border crossing. That is the gauge used in China. They have also agreed to develop existing railway border crossings between Russia and China, and infrastructure on approaches to them; promote the development of shipments of mail and e-commerce freight on regular container trains; increase shipments of frozen meat and poultry products in refrigerated containers; and increase shipments of grain freight to China through the Zabaikalsk-Manchuria crossing, including with loading at the Zabaikalsk grain terminal.

The companies are also discussing increasing freight shipments between the two countries.

“We are seeing high rates of growth of freight shipments on services with China. In the first quarter, overall shipments through our railway border crossings and ports increased by 8.2% compared to the same period of 2023, to 42.5 million tonnes.” Oleg Belozerov, Chairman of RZD was quoted as saying.

RZD and China Railways are also looking to expand the practice of forming container trains from cars headed from one departure station in China to one destination station in Russia towards a specific terminal; develop parity container transfer technology at neighboring border stations using flatcars made available after unloading on the delivering side; as well as to develop Chinese infrastructure to increase the length of trains, including container trains.

Bolshoi Ussuriysky Island Development

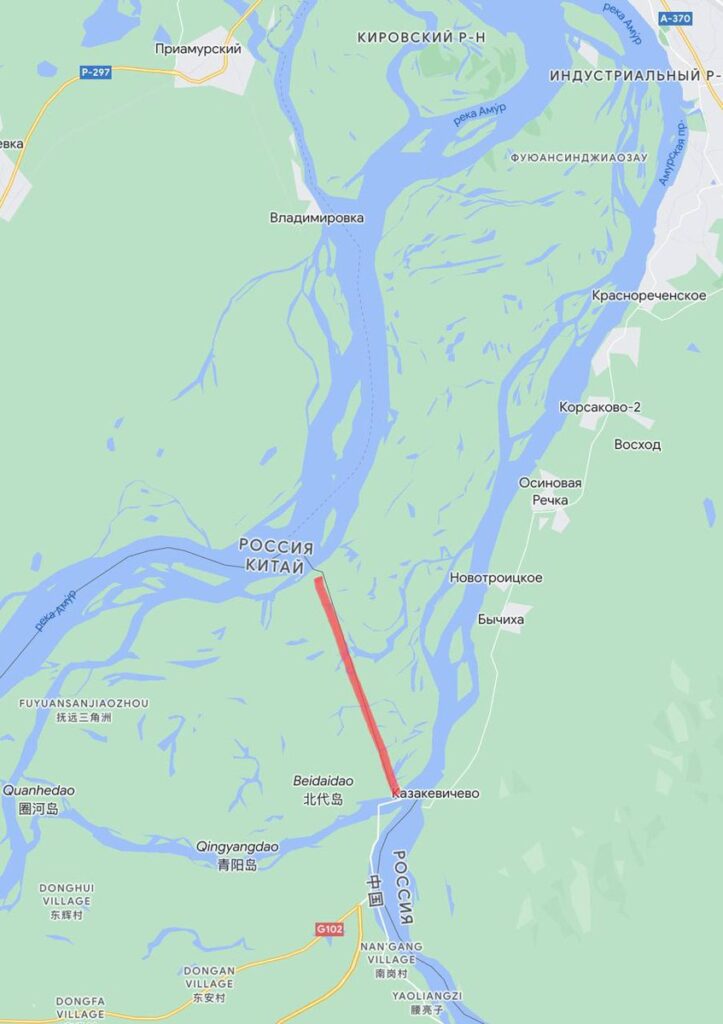

Alexei Chekunov, the Russian Far East and Arctic Development Minister and Zheng Shanjie, China’s National Development and Reform Commission head have signed a general roadmap for a project to develop Bolshoi Ussuriysky Island on the Amur River, which serves as the main border between Russia and China. The island is strategically placed in the middle of the river and has long been a source of debate about its use. The document was signed in the presence of Russian President Vladimir Putin and Chinese President Xi Jinping.

The main areas of cooperation on the island will be joint projects on environmental protection and the cultivation of unique crops and curative plants, as well as the creation of an international transport corridor that includes an automobile border checkpoint, motorways leading to it, and transport and logistic infrastructure.

In addition, an international cooperation centre including congress and exhibition spaces, hotels, a creative cluster, energy utilities, telecommunications, and hydro-protection infrastructure, tourism and recreation facilities will be built on the island. Joint work on science, medicine, healthcare, the bioeconomy, the digital economy, and IT will also be carried out on the island.

Chekunov said “The agreement on developing Bolshoi Ussuriysky Island has been anticipated for 20 years. In 2004, Russia and China agreed on the principle of One Island, Two Countries. The western part of the island, China’s, is called Heixiazi (Black Bear Island). The Eastern part is Russia’s Bolshoi Ussuriysky Island. The approaches could not be synchronized for a long time. The island is important to China; Xi Jinping even visited it in 2017. It is noteworthy that the easternmost point of China is located on the Chinese side. That’s a significant fact for the most oriental power in the world and a potentially strong magnet for tourists. Today we agreed on creating a new border checkpoint, developing transport and logistics infrastructure, tourism and recreation. Khabarovsk will soon also become close to China, like Blagoveshchensk. We will present a detailed plan for implementing the Island’s roadmap at the World Economic Forum in September.”

Automotive

Russia has welcomed China’s automakers, whose Russian domestic market share has shot up to 50% from 5% in two years since the withdrawal of Western brands. Russian First Deputy Prime Minister Denis Manturov said that Russia is offering equal conditions for the work of all automakers, Russian and foreign, who are ready for take the next step toward localization, and this includes Chinese automakers, he said. The key requirement is the gradual (Russian) localization of both assembly production and the production of components, he said, noting that an agreement of this type has been reached Chinese auto manufacturers.

Manturov said that the level of localization in the automotive industry is assessed using a point system and the development strategy of the Russian automotive industry provides for a gradual increase in the requirements for the number of points scored. “This is spelled out in the strategy of the auto industry: a point system and increasing points, first of all, in relation to automakers. Moreover, an automaker can be both foreign and Russian. Therefore, if a Russian automaker that has acquired a production site expects that it will maintain production, but not will increase localization annually, then it will not receive any state support.”

He commented on statements made by Russian President Vladimir Putin the day before that Russia welcomes the success of the Chinese automobile industry in its market. “We are glad to cooperate with the Chinese auto industry, because at a certain moment, when the Western majors, which had been creating their own localized production for years, and highly localized production, for some models up to 80%, disappeared overnight, our Chinese partners supported us,” the First Deputy Prime Minister said.

At a press conference following Chinese-Russian negotiations on Thursday (May 16), Putin said that Russia is interested in the presence of Chinese automakers in the Russian market and intends to expand cooperation. “We welcome cooperation with our Chinese friends in the field of automobile production, where they are achieving clear, completely obvious successes and advantages in competition, in fair competition. We welcome the cooperation and will develop it further.” he said.

According to data published by Russian analytical agency Autostat, the share of Chinese automobile brands on the Russian car market surpassed 50% in 2023, while Russian brands, mainly Lada, accounted for only a third of the market. The new cars market in Russia stood at slightly over one million units (+69%) last year. As reported, the Russian market’s Big Three of China’s automakers alone – Chery, Great Wall (Haval as the main brand) and Geely – saw a 3.7-fold increase in their overall revenue on the Russian market to over ₽1 trillion (US$11 billion) in 2023.

Auto Battery Charging

An agreement was signed between Russia’s Rusnano and Shanghai’s Caroad Energy Technology, which aims to boost transport capacity with a gradual localization of hybrid energy solutions on transport. The investment in the project is estimated at US$1.2 billion. In particular, it is planned to launch and localize the production of innovative traction batteries and the necessary infrastructure in Russia, including a chain of charging stations on Russia’s federal and regional motorways for international and intercity transportation.

“The project aims to boost the effectiveness and competitiveness of cargo transportation, increase transit capacity, broaden ‘narrow places’ and balance the burden on the country’s transport infrastructure,” Rusnano said in its statement.

China, Central Asia Auto Supply Chains

Russia’s RM Rail Company has manufactured a prototype for a car-carrying railcar as per an order from Chinese automobile company Sino-Worlink International Supply Chain Management, and will present it to the customer in May, RM Rail said.

The companies began working together at the international PRO//Dvizhenie.Expo Railway Expo in August last year. The parties discussed the next stage of cooperation as the creation of a new railcar model during the Russian-Chinese Expo currently taking place in Harbin. RM Rail is planning serial production of this 8-axle vehicle carrier.

The new type of rolling stock will allow the transportation of the increased volume of Sino-Worlink vehicles between China and Russia, as well as to Central Asia. Deputy Director of the Sino-Worlink group, Ms. Zhao Hao, said that “The new type of railcar, which is planned to be created in cooperation with RM Rail, will increase the efficiency of the proposed logistics solutions for auto manufacturers from China and increase the capacities of railway lines.”

Aviation

Russia is ready to help resume the creation of a Chinese wide-body long-range plane, the CR929, based on an executors’ contract, Russia’s First Deputy Prime Minister Denis Manturov has said.

“We have revised the format of involvement in the project, corresponding changes in interstate documents should be made in terms of changing approaches. In other words, by analogy with a helicopter, there is a customer and an executor. Those competencies that are required from the Russian side, we are willing to join with these competencies in this project based on a contract of executors.”

The creation of a joint Russian-Chinese passenger plane was discussed in the 2000s, and in 2014 Russia and China signed a cooperation agreement. PJSC United Aircraft Corporation (UAC, part of Rostec) and Chinese aircraft holding COMAC were involved in the development of the aircraft. In 2017, the China-Russia Commercial Aircraft International Corporation (CRAIC) was established in Shanghai and became an operator of the project.

Before the Covid-19 pandemic, the CR929’s first test flight was expected to be organized in 2023, and commercial deliveries were scheduled to begin beyond 2025. In July 2020, the UAC management announced a move of deliveries to 2028-2029. At that time, the project was going through the Gate-3 stage, which involves collecting and scrutinizing proposals from suppliers of systems and units to determine the final configuration of the aircraft.

In August 2022, UAC CEO Yury Slyusar said that work on the CR929 was continuing, but the project would be updated to take into account the effects of the pandemic and the imposition of sanctions on Russia. Manturov, who headed the Industry and Trade Ministry at the time, noted that Russia might change the status of its participation in the project, becoming a supplier of units and components instead of a partner. That now appears to have been resolved.

“There are different components there, including a power plant is also being considered.” Manturov said when asked as to whether the Russian side would supply an engine for this aircraft.

The joint venture set up for the project with China will remain, but it will not be involved directly in the development of the plane. “We are leaving the joint venture to work as a kind of office inside China, which would help our enterprises, which will work with the Chinese ‘finalists’ as suppliers. Starting from organization to overcoming cultural and language barriers,” Slyusar also said. A Russian-Chinese heavy civilian helicopter is also under development, Manturov said.

“The stage is advanced in terms of all schedules and stages. Everything is being observed, everything is proceeding according to schedule. The contract was signed only a year and a half ago. Before that there were approaches, planning, and sketches. Currently, the stage of contract execution is already underway,” Manturov said.

The intergovernmental agreement on the development of a heavy helicopter was concluded in 2016, and the contract was signed in 2021. As reported, its maximum takeoff weight should be 38.2 tonnes, its flight range is 630 km, its speed is 300 kmph. Serial production of the helicopter, according to the agreements, will be set up in China, with Avicopter named as the Chinese partner.

Russia will supply some of the required units under the project, former CEO of Russian Helicopters Andrei Boginsky, who is currently heading PJSC Yakovlev , said at a meeting with Russian President Vladimir Putin in 2021. “It will be a transmission, a steering propeller and an anti-icing system, plus pumping up the resource for this helicopter.”

Meanwhile, the supply of Chinese-made planes to Russia has not been discussed, Manturov said. The sanctions imposed by Western countries following the start of the military operation in Ukraine include a ban on the supply of civilian aircraft and spare parts to Russia, as well as their maintenance and insurance. Rostec announced the market entry of Russian-made aircraft, namely, the MS-21, import-substituted Superjet 100, and the TU-214, with a delivery timeframe now expected in 2025-2026.

Agriculture

Eurasian Grain Supplies

The Russia-China State-Owned New Land Grain Corridor Group (NLGC) and the government of Tatarstan have entered into an agreement to build an inland grain hub with capacity to handle 8 million tonnes per year. A terminal for high-speed transhipment of grain will be built next to the Deng Xiaoping logistics complex as part of the development of the Grain+ logistics model and the rollout of inland railway transhipment technology for bulk cargo.

The freight base for the hub will be grain from Tatarstan and other regions in the Volga Federal District, while the target markets for exports will be China, Uzbekistan, Turkmenistan, Iran and other countries. Return freight, consisting of consumer goods and components for Russian companies in the amount of up to 200,000 TEU per year, will go to regional transport and logistics centers with which the grain hub will coordinate operations.

NLGC is an export-oriented holding company that is carrying out projects in the Urals, Siberia and the Far East to build and develop infrastructure for exports of grains, grain legumes and oilseeds to China, Central Asia and the Middle East. The key element of the Russia-China New Land Grain Corridor project, the Transbaikal Grain Terminal has capacity to handle 8 million tonnes of grain per year, with it designed to provide alternative grain security away from Western political influences.

Oilseed Exports

The first export train carrying agricultural products from the Ulyanovsk region has departed for China, the press service of the regional government has said, with regional governor Alexei Russkikh quoted as saying “We are expanding cooperation in agriculture. The first export train departed from our region for China last week. (May 12). There are almost 2,000 tonnes of oilseed flax [seeds] from the Novospassky region on their way to Qingdao. This will give our foreign trade turnover with China a good boost. In the future, we are ready for interregional cooperation with the Volga regions.”

The first exports of agricultural products from Ulyanovsk farmers to China took place thanks to the Ulyanovsk Special Economic Zone logistics centre. The Ulyanovsk region is also developing cooperation with China in the automotive, nuclear and aircraft industries, Russkikh said. China ranked first in the share of the export trade of Ulyanovsk region in 2023.

Beef, Artichoke Exports

China has granted permission for imports of artichoke from Russia and expanded the list of imported beef by-products, Russian plant and animal health watchdog Rosselkhoznadzor has reported. The relevant documents were signed in Beijing by Rosselkhoznadzor head Sergei Dankvert and the director of China’s General Administration of Customs Yu Jianhua. “Since 2022, the service, together with our Russian colleagues, has done a great deal of work to ensure access for artichoke to the Chinese market. Specifically, Rosselkhoznadzor conducted negotiations and prepared extensive materials confirming the serious level of control over compliance with China’s import requirements.” China customs said.

Recalling that the protocol on veterinary standards for beef exported from Russia to China was signed in 2021, Rosselkhoznadzor said its new version expands the list of by-products that can be exported to China to include beef cartilage, aortas and stomachs. Requirements for these by-products have also been included in it and some technical editing corrections have been made, while conditions regarding Covid-19 have been removed. Russian exports of beef by-products to China have doubled year-on-year since the beginning of 2024.

Dagestan Brandy

Russia’s JSC Kizlyar Brandy Factory has shipped its first consignment of brandy, amounting to 6,210 bottles to China, CEO Yevgeny Druzhinin has said. The shipment has been carried out as per the agreement signed between Kizlyar Brandy Factory and China’s Guangzhou Ark Import & Export Ltd. Three brands of brandy from Dagestan will appear on the shelves of Chinese stores at the end of May 2024. “We continue to work actively to expand sales markets, particularly abroad. The company plans to export over 11,000 deciliters of products in 2024,” Druzhinin said. As previously reported, Kizlyar Brandy Factory boosted exports of products 35% year-on-year to 3,000 deciliters in January-March 2024. Dagestan Brandy is amongst the top brandy products in Russia and is regarded as a premium product.

Chinese Whiskey

Russia’s Tatspirtprom has received the exclusive rights to distribute Chinese Furing Whiskey in Russia, and will begin these deliveries in 1,700 Magnit stores in Moscow and St. Petersburg.

Tatspirtprom has said that sales of Chinese alcohol in Russia correspond to their strategy to expand the assortment of their portfolio, and their new imported category of whiskey is now developing in the Russian market. They stated that the growth in sales of imported whiskey from Asia is associated with continuing difficulties with sanctions, logistics and payments with Scotland as part of the United Kingdom being largest European exporter yet problematic to deal with. From January to October 2023, the import of strong alcohol from China to Russia grew tenfold, to more than 464,000 litres, of which 421,000 litres were whiskey.

But there is some debate about who is drinking Chinese products in Russia, with consumer analysts noting that Russian consumers still prefer established European brands, including Scotch whisky.

According to CIFRRA, Russia’s alcohol consumer agency, the growth of Furing sales in Russia is linked to the Chinese tourist flow to the country. Chinese tourists are more likely to drink alcohol from their own country. Russian consumers are still careful about Chinese brands. CIFFRA suggest that Chinese whiskey for the Russian consumer in the coming years will remain an exotic. Whisky is a vulnerable in the Russian market, because of sanctions, only a few British manufacturers are prepared to work with Russian importers.

Space

Lunar Exploration

A Russian-Chinese expansion on the Moon will begin after 2036, Roscosmos head Yury Borisov said in a statement on Thursday (May 16). ” We are planning an expansion on the Moon sometime after 2036, but we will first develop and test it on Earth.” Borisov said in response to a question about when a nuclear power plant that is being developed together with China for lunar projects might be tested.

Russia and China presented a roadmap for building a joint lunar base in June 2021. They signed an intergovernmental memorandum of mutual understanding in the joint construction of an international lunar research station in March 2021. Borisov said in April 2023 that the Zeus nuclear-powered space tug might be used in the Russian-Chinese lunar program, and in October that year reported Russia’s plans to explore the Moon together with China after launching the Luna 26 and Luna 27 spacecraft.

In early March 2024, Borisov said that Russia and China planned to deploy a nuclear power plant on the Moon in approximately 2023-2035. Western media has dressed that up as Russian attempts to place nuclear weapons in space, an accusation Moscow has denied.

On March 14, Russian President Vladimir Putin said that the development of a nuclear power plant in space required funding and should become a priority.

BRICS in Space

The heads of BRICS space agencies will convene under Russia’s chairmanship in Moscow on May 23, Roscosmos said on Thursday (May 16), stating that. “The event program includes an exchange of views on a broad range of aspects of international space cooperation, the discussion of current and future space projects in the multilateral format, and the adoption of joint documents.”

De-Dollarisation

National Payment Systems

Russia and China have agreed to actively use national payment systems in bilateral trade, Russian President Vladimir Putin said following Russian-Chinese negotiations. “The timely coordinated steps towards conducting interstate settlements in national currencies have made a significant contribution to deepening trade and investment relations. The share of the ruble and the yuan in Russian-Chinese commercial operations exceeds 90% and continues to grow. So, we can say that bilateral trade and investment are well protected from the impact of third countries and negative trends on global currency markets. We have agreed in this context that Russia and China will continue to enhance contacts between lending and banking institutions and will energetically use national payment systems to serve our economic operators.” he said.

Offloading Dollars

Russian President Vladimir Putin has pledged privileges to Chinese investors in Russia. China sold off a record US$53.3 billion of US Treasury and agency bonds in the first quarter of 2024, a move seen as part of Beijing’s drive to diversify from US dollar assets. This comes as gold’s share in China’s official reserves rose to 4.9% in April, the highest on record. Russian incentives for Chinese investors will come in the form of stock market access and currency swap deals, including futures.

VTB To Expand In Shanghai

Russia’s VTB plans to increase the staff at its branch in Shanghai by 150% in response to its growing number of customers, the Russian state bank’s head, Andrei Kostin said on Thursday (May 16). “We will increase personnel by 150%, from 60 to at least 150 for Shanghai alone. We plan to open in other Chinese cities as well” Kostin said.

VTB’s Chinese branch said in March that it was seeing a significant increase in the number of requests to open new accounts and that there would possibly be delays in processing. The bank said it was working on expanding possibilities for opening new accounts.

VTB is currently the only Russian bank with a financial license to conduct banking operations in China. Its branch in the country opened in 2008. Sberbank, Russia’s biggest lender, planned to open branches in China at the end of 2023, but has still not done so. Alfa Bank also has plans to open two branches in China. Those are pending as partner Chinese banks with no exposure to Western sanctions need to be prepared. These are likely to be smaller, regional banks with no other global exposure that can integrate with China’s CIPS financial transfer system and connect with Russia’s SPFS.

Financial Services

Audit

One of Russia’s largest audit and consulting companies, Capt, has entered into a strategic partnership agreement with the Chinese audit and consulting company ShineWing CPA. The partnership involves joint marketing, the provision of services to existing customers and the search for new ones, rather than selecting subcontractors or providing recommendations on the choice of an audit and consulting firm in another country. In terms of audit, this includes harmonization of approaches to quality control and methodology, the guarantee of the availability of temporary resources for a partner to work with clients and gives priority access to local data and experts.

ShineWing CPA is part of the international group ShineWing and ranks seventh among Chinese audit and consulting companies. More than 9,000 employees work in 30 branches of the company in China.

This is the first agreement among large audit and consulting companies from Russia and China, with cooperation beneficial to Russian auditors primarily by mutual exchange of clients. More than 5,000 Chinese companies are registered in Russia, including major institutions such as the Bank of China and ICBC Bank, as well as industrial companies including Sinopec, China Mobile, Honor Technologies, Haval Motor, with many audited by Capt. The move will also help ShineWing consolidate Russian subsidiary accounts into their clients China based holding companies.

About 100,000 Russian companies have branches, representative offices or subsidiaries and associates in China.

IT

The Chinese company OSChina, together with the Russian 3Logic Group, have localized the platform for the development of open source Gitee in Russia, including access for developers to the Chinese software. Partners expect IT professionals to integrate with Chinese colleagues, with Asian development an in-demand business.

The project will allow developers from Russia to use the open software of the Chinese original platform, including the library for working with artificial intelligence, Hugging Face.

The most popular developments with gitee.com are selected as the first set of projects for localization: operating systems, databases, containerization solutions. By the end of 2024, it is planned to place 100,000 localized projects with open source on the gitee.ru platform, with the platform providing both free and paid hosting and repositories.

Created in 2016, Gitee became the second open source platform in the world after GitHub from Microsoft, now more than 12 million developers use it. In 2020, the platform began to develop, in conjunction with the Chinese Ministry of Industry and IT to create a single platform for working with open source software independent of Western projects. The American GitHub in China has been blocking access 2013.

Russian open code developers began to disconnect from GitHub in 2022. This prompted domestic companies to create their own solutions. Now the market is already operating several units. There will be no single player in this field in Russia, and the market will segment around various platforms. The OSChina partnership will find a niche as it allows for commercial products or the development of AI, however there are issues with it, as part of the code is written using Chinese characters, which complicates communication with the technical team.

Tourism

The Russian Economic Development Ministry expects that mutual travel between Russia and China should grow to 2 million people in 2024, Economic Development Minister Maxim Reshetnikov said.

“Mutual travel between Russia and China exceeded 1.2 million trips last year. China is leading among the countries outside of the CIS in terms of inbound tourism to Russia. The target for this year is 2 million mutual trips. To attain it, we’re providing comfortable conditions, including as regards payments for services and goods in Russia.” the ministry’s press service quoted Reshetnikov as saying during a visit to China as part of the Russian delegation. Nearly 100,000 Chinese citizens entered Russia as tourists in the first quarter of 2024, accounting for about a half of all inbound trips to Russia in this period. The two sides will be working on mutually improvement of their respective tourism sectors.

Meetings With Li Qiang

A Kremlin statement concerning President Putin’s meeting with Chinese State Council Premier can be read here.

Joint Statement

A joint media statement issued by both Russian and Chinese Presidents can be read here.

Conclusion

There will have been much that will have remained behind closed doors as concerns these meetings, and especially as concerns Ukraine and Sino-Russia military ties and cooperation. Additional methodologies concerning anti-sanctions measures in terms of financial cooperation will also have been discussed in depth.

Our view is that the impact of Western sanctions upon Russia and China, coupled with the perceived threats these contain as regards third-party compliance are ushering in an alternative payments mechanism to the global SWIFT network. The technology already exists. This is likely to lead to a two-tier global payments system, where normal transactions that do not fall under any US objections are carried out by SWIFT, and for transactions that do fall under sanctions, secondary sanctions and trade embargos will fall upon bilateral (or in the case of BRICS, potentially multilateral) structures that exclude the United States, European Union and allies.

A similar path appears under preparation for the US dollar.

Such as transition away from Western-centric financial systems may be some years away. However, the content of last week’s China-Russia summit appears to indicate that the process is underway and will be phased in over time. We predict that the manner of global trade transactions by 2030 will be rather different than in 2024.

Further Reading

Russia – China 2024 Trade & Development

Russia’s trade and development dynamics with China, including comprehensive and details of trade and development analysis concerning mainland China, Hong Kong, Macau and Taiwan are all featured in our 2024 Russia’s Pivot to Asia guide, which is a complimentary download and can be accessed in English here and in Russian here.

Русский

Русский