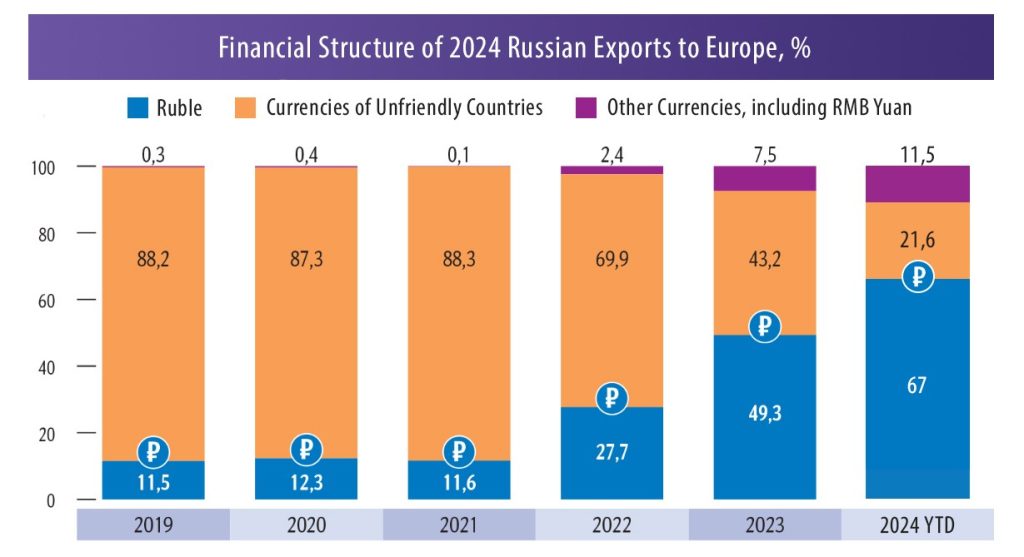

Russia is increasing the volume of payments in its national currency, with the Ruble’s share in its export trade with Europe rising to a historical high of 67% of the total, according to the Russian Central Bank. This indicates that the global structure of renumerations is changing against the backdrop of Western financial sanctions, and that the role and importance of the US dollar and euro is decreasing – not only in trade with Russia, but also among global settlements.

The share of currencies of unfriendly countries in payments between Russia and Europe for Russian exports – which would usually be paid for in euros – fell to 21.6% in July. At the same time, the percentage of payments now being made in Rubles is growing — in July it reached a record 66.7% of the total. The remaining 11.7% came from other monetary units.

European Union Trade

The problem Europe has is that in imposing financial sanctions on Russia and effectively banning the use of the euro and dollar (Russia was disconnected from the SWIFT payments system that facilitates this trade), if it wants Russian goods, it must pay for them in other currencies. This has put the EU in the ironic position of having to use Rubles – or other currencies, typically the Chinese RMB Yuan or UAE Dirham to settle their purchases. And again, despite sanctions and attempts to disrupt Russian gas supplies, with winter now approaching and alternative supplies from United States and Middle East up to three times more expensive – the EU has been once again increasing, not decreasing its purchases of Russian LNG. Natural gas imports from Russia to the European Union in the 7M 2024 from Russia increased by 23%, while the annual State of the EU Energy Union report shows Europe still relies on Russia for nearly a fifth of its gas imports.

In total, over the first five months of 2024, Russia exported products worth US$15.7 billion to the European Union according to Ksenia Bannikova, of the Agency for Transformation and Economic Development (ATRE). The bulk comes from oil, gas, metals and fertilizers. If indicative for the full year, this implies Russian exports to the EU, paid for in Rubles rather than euros, will amount to about USD37.68 billion.

Another reason for the high growth of European settlements in Rubles is that Russia adopted a law in April 2022 as a response to Western financial sanctions that unfriendly countries must pay for Russian gas in Rubles. And the EU is quietly having to do this.

Other Trade Partners

Payments for Russian exports in national currencies are also growing with other key partners, according to Central Bank data. In July, their share in settlements with Asia increased to 84% of the total, of which 33% were in Rubles, and 51% in other monetary units, most notably Chinese RMB Yuan, Indian Rupees and UAE Dirham. The situation is similar with Africa. In July, payments for domestic exports in toxic currencies accounted for just 19% of the total, in Rubles it was 80%, and in other African currencies, 1%.

Vladimir Ivin, of the Russian Federal Customs Service has said in an interview that during 2024, Europe and Asia have essentially changed places in terms of trade turnover with Russia. Europe’s total share of Russia’s global trade has now decreased to just 12% of the total, while Asia’s has reached 66%. That has radically diminished the European importance to Moscow in terms of supply chains and trade volumes. Brussels is no longer a key market, and Europe has now lost its significance to what had been its third largest trade partner. Brussels now has little to offer Moscow except problems.

In addition to energy imports from Russia, there has been significant increases in supplies to Asian markets in agricultural products — grain, meat, fish, as well as chemical products, especially mineral fertilizers.

The increase in the global share of the Ruble in settlements is associated not only with the growing demand for the Russian currency, but also with tightening currency control and a decrease in the volume of direct – indirect trade with countries, with which payments were usually made in dollars and euros. New technologies are also changing the dynamics, with China already moving ahead this year with its use of the Digital RMB Yuan. The total of Digital RMB transaction volumes to the end of June this year reached US$988 billion, and are currently running at user volumes equivalent to US$56 billion a month. The digital RMB is used for high value corporate transactions, including cross border trade. With the Digital Russian Ruble poised to follow, it could well be that 2025 spells the beginning of the end for US dollar hegemony, and a problematic future for the euro as well, as it has become too similar to the US dollar in what it can reliably offer as an alternative.

African Trade Growth

Other countries are also showing an increasing preference to settle in their national currencies in international transactions. These include other new Digital National Currencies issued by National banks, cryptocurrency (stablecoins), a potential BRICS currency – amongst others.

Mutual settlements in national currencies will make it possible to create a world with equal opportunities for the development of all countries, rather than have their development dictated too by the political use of the US dollar and to some extent the euro.

Russia’s largest trading partners in Africa are Egypt, Algeria, Morocco, Nigeria, and South Africa. According to Vladimir Ilyichev, Russia’s Deputy Minister of Economic Development, Russia’s trade turnover with these African countries will double from US$24.5 billion to over US$50 billion by 2030.

About a quarter of Russian supplies to Africa comes from wheat and meslin (mixture of wheat and rye), and about the same amount for oil and petroleum products.

A New Emerging Market Currency Basket

That means the development of Digital payments systems with Africa and elsewhere will also start to come online, meaning that the Ruble has real prospects for strengthening its global use. To do this, the Russian economy must be resistant to crises and quite flexible and comfortable for settlements with other countries, while the Ruble exchange rate must be stable. In doing so, the Ruble is likely to join an alternative global basket of currencies, including the Chinese RMB Yuan, Indian Rupee, UAE Dirham and possibly the Singapore Dollar and Indonesian Rupiah in determining the bulk of global trade flows by 2040.

Further Reading

Русский

Русский