In many ways Russia and Iran find themselves in a similar geo-strategic position. Both are heavily sanctioned by the West and pursue a set of policies which aim at bolstering their respective influence on their regional, if not global stage. They also work to diminish the collective West’s ability to shape the world order and limit Eurasian powers’ projection of power. These wider incentives serve as a major driver behind the expanding cooperation between Russia and the Islamic Republic. Given the sanctions imposed on Russia and the latter’s wide-ranging attempts to re-orient trade from the EU to Asia, Iran stands to benefit significantly. This has already been evident throughout 2022 in terms of growing bilateral trade or mutual investments. The trends indicate the figures grew in 2023 and will continue to do so into 2024 and beyond. However, this could change given the current situation between Iran and Israel. In this article we outline where Russia-Iranian development stands today.

Trade

In 2022, the trade turnover between Russia and Iran increased by 20% and amounted to US$4.9 billion. Existing trends indicate that the bilateral trade will continue to grow. Russian officials even suggested that it would be possible for two countries to reach a staggering US$40 billion mark in bilateral trade. Since 2019, an interim Free Trade Agreement (FTA) has been in force between Iran and the Eurasian Economic Union (EAEU). It was extended until 2025 or until the entry into force of a new agreement on a permanent free trade regime. In January 2023, the EAEU and Iran signed an agreement to create a free trade deal which came into effect at the year end.

Russian exports to Iran mainly consist of metals, food and agricultural raw materials, equipment and vehicles, products of the chemical industry and others. Imports from Iran are made up of food and agricultural materials, pharmaceutical products, textiles and footwear, various machines and similar items. Following the visit of deputy prime minister of Russia, Alexander Novak, to Iran in May 2022, it was announced that the two countries agreed to switch to trade settlements in Rubles and Rials as much as possible, and also discussed the possibilities of operation of Shetab and Mir payment cards. A year later Russian officials claimed that around 80% of trade settlements between Russia and Iran are carried out in their respective national currencies. The remaining 20% is in US Dollars and Euros with even this expected to be supplanted by the Chinese Yuan in the future. In 2023, Russian and Iranian media reported that Russia and Iran were discussing the development of a common stablecoin – a cryptocurrency backed by gold – often regarded by Russian and Iranian officials as a potentially viable alternative to the US dollar’s dominance in global trade.

Investments

In 2022 Russia became the largest foreign investor in Iran, contributing US$2.76 billion (investment into two oil projects) to the country’s economy, which is nearly 2/3 of the US$4.2 billion that Iran attracted in total. FDI into Iran generally is also increasing – the US$4.2 billion is in itself significantly higher than what was recorded in 2021 when Iran received US$1.45 billion in foreign direct investment. Iran’s recent rapprochement with Saudi Arabia will also be an FDI spur into the country.

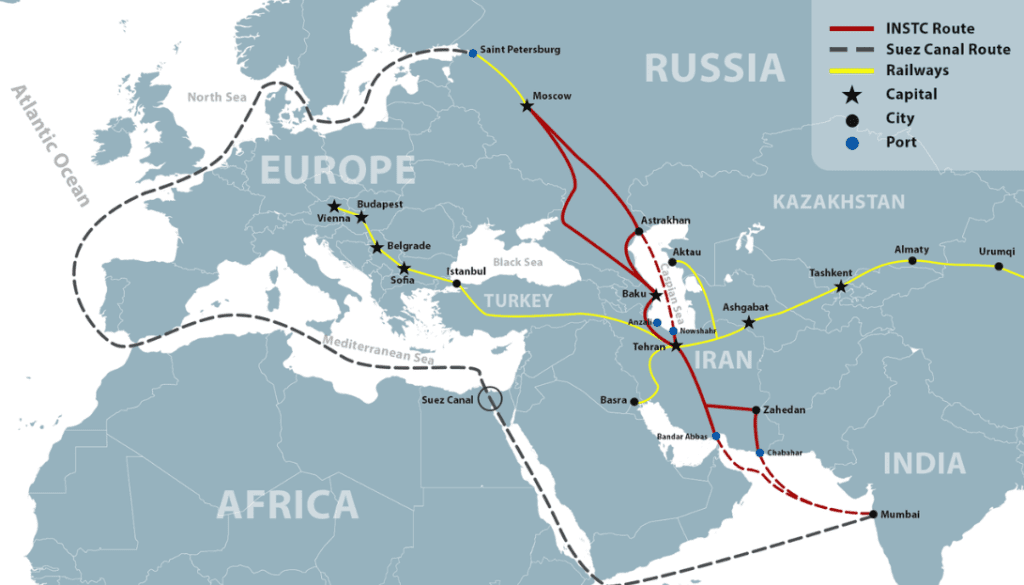

By early 2022 the largest joint investment project between Russia and Iran was the construction of the Bushehr nuclear power plant in Iran. In June 2021, the implementation of another project to create a thermal power plant (TPP) Sirik in the province of Hormozgan in southern Iran began with Russian investment in the form of a state loan. As Russia came under Western sanctions its push for closer investments ties with Iran became especially apparent by mid-2022. For instance, in July the National Iranian Oil Company and the Russian giant Gazprom signed a memorandum on energy cooperation which envisioned Russian investments of US$40 billion into Iran’s oil and gas industry. The Iranian side however has complained numerous times that only a small amount of the promised investment has arrived to date and that scheduled payments have been delayed. Large scale cooperation likewise takes place around the International North-South Transportation Corridor (INSTC), which aims at connecting Russia with the Global South and thus facilitating its re-orientation of trade from Europe to Asia.

In May 2023 Russia agreed to make another a significant investment into Iran by financing the still incomplete 162-km-long Rasht-Astara railway section in the north of Iran. This will shorten the travel time for products from Russia to Iran and vice versa. The project is scheduled to be completed by 2027 and is being financed by the Russian side. The total investment amounts to US$1.6 billion, with work underway. As this is a key connectivity issue for Russia’s pivot to Asia, funding has not as yet been an issue. The expansion of the much-touted corridor, however, has not yet come to full fruition. For instance, in 2022 about 14.5 million tons of cargo was transported along the western branch of the corridor (i.e via Azerbaijan), while 121 million tons were sent via the major Azov-Black Sea route. The difference is striking meaning that the INSTC, though it indeed has a significant potential, at the present is merely a route of regional significance rather than being a transcontinental corridor.

Modest expectations are that by 2030 total throughput through the western branch will reach 30 million tons per year, while total cargo transportation through all three routes will hit 45 million tons. Iranian and Russian authorities are exploring another investment possibility through establishing a joint shipping company as part of efforts to strengthen strategic cooperation. This fits into a growing cooperation between the Russian regions bordering the Caspian Sea, and Iran’s northern territories.

In July 2023, the head of Russia’s Astrakhan region, Igor Babushkin, proposed creating shipping lines between the two countries’ ports. Iran and Russia have several active ports in the northern and southern parts of the Caspian Sea: including Makhachkala, Astrakhan, and Solyanka on the Russian coast, and Astara, Enzali, Nowshahr and Amirabad on the Iranian side. This area is especially interesting to Iran which has actively invested in Russia’s Caspian ports. For instance, the controlling stake in Astrakhan Port PJSC (53.1%) is owned by Iranian Nasim Bahr Kish CJSC. Russia owns 25%, while the rest is privately held.

Tehran and Moscow are also working the creation of an energy hub in a bid to establish a system which will provide stable gas prices, minimize competition between Russian and Iranian gas and prevent foreign interference. The two countries also agreed on development of a partnership for the production and maintenance of civil aircraft. It requires the development of the necessary infrastructure, with China and India also interested in participating. This is linked to the ongoing bilateral work in signing a services and investment agreement, given that the countries aim at intensifying cooperation across as diverse areas as energy, transport and logistics, finance, digital economy and technology, engineering, and tourism. Russia and Iran may be largely shunned in the West, but elsewhere they have proved adept at working around sanctions issues and creating new opportunities.

Tehran’s BRICS Membership

Tehran’s full-scale involvement in BRICS’ activities was the focus of discussions between Presidents Vladimir Putin of Russia and Ebrahim Raisi of Iran, in late September 2023. The sides discussed steps to ensure Iran’s smooth integration into the association’s full-format activities taking into account Russia’s presidency in 2024.

In the framework of his foreign policy doctrine, Iranian President Ebrahim Raisi has paid close attention to promoting economic diplomacy, the importance of multilateralism, Iran’s active presence in regional economic organizations, and new South-South cooperation. With Iran becoming a permanent member of the Shanghai Cooperation Organization, a permanent presence in BRICS became a logical next step, with Tehran participating in BRICS meetings and summits. From Tehran’s point of view, participation in BRICS with about 26% of the area, about 42% of the world’s population, strengthening economic and financial cooperation, an increasing role in the future of the world’s economy and geopolitics, would be a ‘new season’, that will increase political and economic power, and will be a “strategic victory” for Iran’s foreign policy.

Due to the efforts of the New Development Bank in granting US$8 -10 billion in loans (30% of this in Iranian Rial) and focusing on the implementation of projects and supporting infrastructure, Iran has also requested to become a member of the NDB. By becoming a BRICS member and the upcoming trip of the NDB President to Tehran, the process of Iran’s joining the New Development Bank will be easier. Iran’s participation in the bank and obtaining voting power will lead to financial and technical privileges of the bank and the granting of soft loans to support development and investment in Iran. Despite the small size of the bank compared to Western institutions, the bank’s foreign currency reserves and liquidity facilities are in favor of Iran. This can make difficult financial conditions easier for Tehran.

Tehran can still use the BRICS international position for geopolitical geoeconomic maneuvers. Also, Iran can be a stable partner for the group due to its unique geographical location and transit networks. Iran is the key part of the International North South Transportation Corridor (INSTC) connecting ECO, ASEAN, EAEU, India, Central Asia, the Middle East, GCC, and Europe. With the help of BRICS and with the operationalization of INSTC, Iran can earn about US$20 billion annually from transit via the INSTC route.

In turn, that means Tehran can place itself at the crossroads of trade with BRICS and play a bigger role through China’s Belt and Road Initiative. That goes hand in hand with the development of Iranian free trade zones and the creation of new zones as one of the important economic approaches of the Iranian government.

Tehran hopes that with BRICS, it will be able to strengthen existing ports and increase exports from Iran’s free trade and special economic zones. Iran’s entry into BRICS can also be an important factor in helping Tehran in free trade negotiations with the Eurasian Economic Union (EAEU), India, cooperation with economic institutions, and Latin American and African countries. This approach is a step to develop trade with emerging economies, rapid economic growth, opening new markets, and huge foreign investment (FDI) deals in Tehran.

Although raising the issue of removing the dollar from global financial and banking exchanges is not practical in the short term, by joining BRICS, Iran expects to reduce its dependence on the dollar and diversify its portfolio of foreign currencies. The de-dollarization of the economy completely aligns with Iran’s economic policies in foreign trade. Forming alternative payment systems and non-dollar financial systems, moving away from reliance on the US dollar, increasing trade with domestic currencies, and creating a common currency can benefit Iran. Also, in case of overcoming the challenges and the members’ agreement and creating a new currency (similar to the Euro) and structures similar to SWIFT in BRICS, Iran will be one of the biggest winners.

In this approach, membership in BRICS can bypass US sanctions to some extent and support efforts to use national currencies and strengthen BRICS mechanisms. On the other hand, with the BRICS card, Iran can develop alternative routes, promote economic growth, diversify the economy, minimize costs, open new markets for Iran’s exports, develop e-commerce, market integration, and savings. Expanding Iran’s strategic relations with the main BRICS members and benefiting from the assistance of the member countries will open up geo-economic opportunities and contribute to the idea of a multipolar world in line with Iran’s foreign policy. In the past few years, Iran has been caught in the economic challenges of devaluing the country’s currency, annual inflation, hosting more than 8 million immigrants.

From the point of view of many in Tehran, with BRICS, it will be easier to attract large investments and economic reforms, increase the volume of production, stimulate Iran’s exports, increase trade exchanges, achieve the development goals and vision of Iran, and increase its overall GDP. Membership in BRICS can improve and increase tourists from the main and new BRICS countries. Iran imports part of its basic food needs, and providing food security and strategic goods, easy supply of raw materials and grains, and reducing supply chain costs will be easier through BRICS. In addition, Iran’s official joining of the BRICS group increases Iran’s position of economic power in Asia, the Middle East, and the world, the ability to influence important decisions and activities at the global level and to play a role in global trade and the international economy. Also, BRICS can use Iran’s internal economic capacities, such as cheap labor, rich natural resources of oil and gas, and the consumer market of 88 million people and its geopolitical position to strengthen itself.

Iran is a full member of the BRICS + group, will shortly be admitted as a full member of the Shanghai Cooperation Organisation and has a Free Trade Agreement with the Eurasian Economic Union. It has also signed a 20 year cooperation agreement with Russia, and a 25 year similar agreement with China.

This article was taken from the 2024 Russia’s Pivot to Asia guide, which details Russia’s trade and development with over 80 countries. It is a complimentary PDF download and can be accessed in English here and Russian here.

Русский

Русский