As 2025 draws to a close, the strategic trade and economic exchanges between Russia and the Gulf Cooperation Council (GCC) have reached unprecedented depth and vibrancy. What began as periodic high-level consultations has matured into a multifaceted, mutually beneficial partnership rooted in macroeconomic complementarity, robust commercial cooperation, infrastructure connectivity, and shared interests in shaping a stable, multipolar economic order. From Sochi to Riyadh, from Dubai to Muscat, business leaders, policymakers, and investors increasingly speak of Russia-GCC relations not just in geopolitical terms but as a platform for sustainable economic transformation and shared prosperity, one that integrates trade, investment, transportation networks, innovation ecosystems, and people-to-people links across Eurasia, the Middle East, and Africa.

The evolving partnership between the Russian Federation and the GCC (Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain) has emerged as one of the most geopolitically consequential developments in the architecture of Eurasian, Middle Eastern, and global economic relations. In less than a decade, the two sides have transformed what was once a relationship centered primarily around oil coordination under the OPEC+ umbrella into a multi-dimensional framework for trade, investment, logistics, technology, and industrial cooperation.

As Russia and the GCC move towards 2026, the momentum built through the dense calendar of 2025 business forums, investment missions, and strategic economic dialogues is shaping a new phase of pragmatic partnership. The steady rise in trade turnover, deepening capital flows, and expanding connectivity corridors demonstrates a shared vision rooted in mutual benefit and long-term stability. With both sides aligning industrial strengths, financial capabilities, and diversification agendas, the coming year promises even stronger economic cooperation. In this evolving multipolar landscape, Russia and the Gulf states are well-positioned to unlock new markets, modernize key sectors, and elevate bilateral prosperity. The trajectory is clear: 2026 and beyond will mark a decisive expansion of Russia-GCC economic relations built on trust, complementarity, and strategic opportunity.

The maturation of Russia-GCC relations is neither accidental nor symbolic. It reflects shared geoeconomic logic, diversification imperatives, and long-term development visions aligned with Russia’s pivot toward Asia and the Middle East, as well as the GCC’s national transformation agendas—Saudi Arabia’s Vision 2030, UAE Centennial 2071, Qatar Vision 2030, Kuwait Vision 2035, Oman Vision 2040, and Bahrain’s Economic Vision 2030. Together, these states represent a combined economic weight of nearly US$4 trillion, massive sovereign wealth capabilities, high-growth non-oil sectors, world-leading logistics infrastructure, and increasingly diversified energy systems. Russia, for its part, remains a top-10 global economy with substantial industrial capacity, a vast agriculture base, formidable scientific and technological potential, and a long-standing tradition of strategic engineering and defense expertise.

In assessing the economic prospects of Russia-GCC cooperation as we enter 2026, it is clear that the Gulf region remains one of the world’s most stable and dynamic growth poles. The IMF forecasts real GDP expansion of 4.50% annually across the GCC in the coming years, barring major hydrocarbon disruptions—a trajectory that provides a dependable foundation for long-term Russian engagement. The region’s economic strength is underscored by exceptionally high PPP per capita incomes, reaching $122,000 in Qatar, $84,000 in the UAE, $69,000 in Bahrain, $74,000 in Saudi Arabia, $52,000 in Kuwait, and $42,000 in Oman, compared with $49,000 in Russia, confirming the Gulf’s enduring purchasing power and investment capacity. In terms of economic scale, Saudi Arabia leads with a GDP (PPP) of US$2.781 trillion, followed by the UAE at almost US$1 trillion, Qatar at US$400 billion, Kuwait at US$300 billion, Oman at US$245 billion, and Bahrain at US$125 billion, while Russia itself stands at an impressive US$7.7 trillion, making the complementarity between markets self-evident.

Financial stability further elevates the Gulf’s attractiveness: with Saudi Arabia rated A+ (strong fundamentals, high stability), Qatar and the UAE rated AA (very strong creditworthiness) by global agencies, investors face minimal sovereign risk, while even Oman retains a borderline investment-grade rating and Bahrain has significantly lower ratings (B/B+). While Kuwait’s ratings are in the high ‘A’ to low ‘AA-‘ range with strong outlooks on reform momentum from agencies like Fitch and S&P, Oman’s ratings are typically in the ‘A’ to ‘A-‘ bracket, reflecting differing fiscal strengths and economic diversification levels.The UAE, Saudi Arabia, and Qatar consistently rank among the world’s top ten emerging markets, underpinned by strong macroeconomic fundamentals, robust investment flows, and ambitious diversification agendas. For Russian companies, investors, and state institutions, such conditions signal a region not only capable of sustained growth but one ready for deeper strategic partnerships, a natural direction as Moscow and the Gulf expand cooperation across energy, technology, industrial development, logistics corridors, and broader Eurasian connectivity in 2026 and beyond.

Economic Fundamentals: Complementary Structures, Shared Ambitions

The GCC’s collective GDP (PPP)—approaching US$4 trillion—positions it among the most economically dynamic regions. Russia’s economy, valued at over US$7 trillion in PPP terms, complements Gulf economies through scale, resource endowment, industrial expertise, and agricultural capacity. Russia and the GCC together represent a high-value, rapidly expanding consumer space that combines scale with purchasing power. Russia’s domestic market of over 144/145 million consumers is supported by its middle class and rising demand for affordable industrial goods, food products, digital services, and domestic tourism. In contrast, the GCC’s population of around 61.2 million is characterized by one of the world’s highest per capita income levels, strong consumption of premium goods, advanced services, and technology-driven products. The region’s youthful demographics and accelerating urbanization are further expanding consumer demand. Growing retail, e-commerce, healthcare, education, and mobility markets in the Gulf align closely with Russia’s manufacturing, agri-food, pharmaceuticals, and digital solutions. Together, these markets form a complementary consumer ecosystem capable of sustaining long-term trade growth and cross-investment in consumer-oriented industries.

Consumer Market Size in Numbers

| SL | Country | Market Size | Projection (2050) |

| I. | Russia | 144 million | 136 million |

| II. | Saudi Arabia | 34-35 million | 47.6 million |

| III. | UAE | 11.5 million | 15.3 million |

| IV. | Qatar | 3.1million | 4.1 million |

| V. | Kuwait | 5.0 million | 6.3 million |

| vI. | Oman | 5.5 million | 7.8 million |

| VII. | Bahrain | 1.6 million | 2.1 million |

By 2050, the GCC’s consumer market is projected to expand to nearly 84 million people, driven by population growth, urbanization, and rising disposable incomes, with a strategic emphasis on sustainable food security and resilient supply chains. At the same time, Russia is accelerating the diversification of its non-oil economy, spanning agri-food processing, high-tech manufacturing, IT services, pharmaceuticals, and quality tourism, opening broad opportunities for Russian companies in fast-growing Gulf markets.

Demographic trends, however, are reshaping Russia’s internal dynamics: by 2050, the country’s population is projected to decline to around 136 million from 146 million, intensifying existing labour shortages. In this context, competent, skilled migration from GCC countries particularly in engineering, healthcare, IT, logistics, and services can make a tangible contribution to Russia’s economic resilience. Simultaneously, Russia has emerged as an increasingly attractive destination for GCC citizens, reinforcing people-to-people mobility. This convergence underscores the need for both sides to prioritize tourism cooperation, human capital development, education exchange, and workforce mobility frameworks, transforming demographic challenges into a shared strategic opportunity.

Russia’s Economic Strengths Relevant to the GCC

- World’s leading grain exporter: Over 60 million tonnes annually (World’s largest wheat exporter in 2025)

- Top global energy power and advanced technology in energy sector across oil, natural gas, petrochemicals, and nuclear energy.

- Advanced industrial sectors: aviation, space, machinery, metals, fertilizers, pharmaceuticals.

- Massive domestic market of 145 million consumers, integrated with the broader EAEU (185 million market size).

- Strong engineering and defense capabilities.

- GCC Economic Strengths Relevant to Russia

GCC Economic Strengths Relevant to Russia

- High-income markets with per-capita GDPs ranging from US$42,000 to over US$100,000.

- Sovereign wealth funds exceeding US$5 trillion: GCC sovereign wealth funds collectively manage approximately US$5 trillion in assets (with projections estimating growth to US$7 trillion by 2030) led by Saudi Arabia’s Public Investment Fund (PIF)-nearing US$1.15 trillion– the Abu Dhabi Investment Authority (ADIA) with about US$1.13 trillion, Kuwait’s KIA with over US$1 trillion, the Qatar Investment Authority (QIA) with approximately US$526 billion and the Oman Investment Authority (OIA) with $53 billion.

- These funds control about 40% of global sovereign wealth assets, highlighting their dominant influence in global finance. GCC sovereign wealth funds’ dominance creates an opportunity for Russia to attract alternative, long-term capital outside Western markets. Shared interests in energy, infrastructure, and food security enable strategic co-investment and market coordination. Such partnerships also support Russia’s shift toward a multipolar financial system and Global South engagement.

- Regional and global logistics hubs: Dubai, Abu Dhabi, Doha, Jeddah, Dammam.

- Leading centers of Islamic finance, FinTech, green energy, AI, and tourism.

- Strategic location bridging Europe–Asia–Africa.

- Given these fundamentals, the potential for mutually beneficial exchange, co-investment, and connectivity is immense.

For instance, the accelerated transformation of Oman, Bahrain, and Kuwait through 2026 opens a wide spectrum of concrete economic opportunities for Russia. Oman’s expanding ports and free zones align naturally with Russian logistics, mining, agro-processing, and maritime engineering expertise, while Bahrain’s role as a regional financial and fintech hub creates entry points for Russian digital platforms, cybersecurity firms, and financial services providers.

Kuwait’s large-scale infrastructure drive and the global reach of its sovereign wealth fund offer strong prospects for co-investment in construction, energy services, pharmaceuticals, and industrial manufacturing. Tourism growth across the three states also creates demand for Russian hospitality management, cultural projects, and aviation cooperation.

At a strategic level, deeper engagement allows Russian companies to integrate into GCC supply chains and regional value networks, strengthening Russia’s economic presence in the Gulf. Together, these trends position Oman, Bahrain, and Kuwait as practical gateways for Russia’s long-term trade, investment, and connectivity expansion in the Middle East.

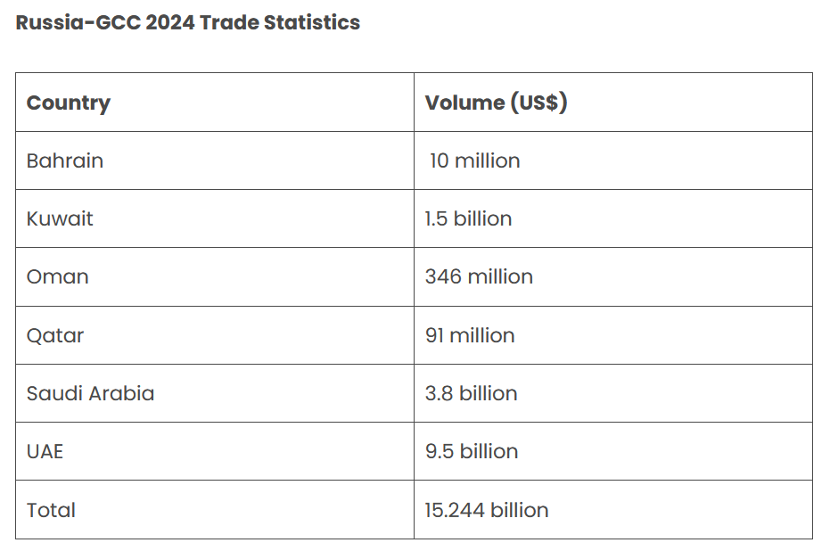

Russia-GCC Trade: A Story of Rapid Expansion

Trade between Russia and GCC members has grown over sevenfold in roughly three years from 2021 to 2024, reflecting structural, not accidental, momentum. Total bilateral trade surpassed US$15-16 billion in 2024-2025, with strong upward prospects for the decade ahead. Beyond commercial transactions, Russia and the GCC have significantly deepened structural, policy-level economic engagement, marking a transition toward institutionalized cooperation. High-level exchanges, most notably the state visit of Sultan Haitham bin Tariq Al Said of Oman to Russia in April, the August visit of UAE president Sheikh Mohamed bin Zayed Al Nahyan and the continued convening of the Qatar–Russia Business Forum in April and 8th joint annual ministerial meeting of the Russia-Gulf Cooperation Council (GCC) Strategic Dialogue in September, have elevated economic dialogue to a strategic level. Equally significant is the launch of the first UAE–Russia Business Forum and the inaugural Saudi Arabia–Russia Investment Forum in December, which signal a new phase of structured business-to-business and investor-to-investor engagement. These high-level exchanges and business policy solution platforms are designed to translate political alignment into bankable projects, joint ventures, and long-term investment pipelines and are expected to substantially accelerate trade, deepen corporate partnerships, and expand economic interdependence between Russia and GCC states.

Below is a country-wise analysis, reflecting the differentiated yet complementary dynamics:

Russia-UAE: The Flagship Economic Partnership

The United Arab Emirates is Russia’s largest economic partner in the Arab world.

Key features:

- Bilateral trade: Nearly US$10 billion annually.

- Over 13,000 Russian companies registered in the UAE. This year alone, around 2,000 new licenses were issued.

- Strong cooperation in logistics and re-export, finance and investment, real estate, IT and tech startups logistics, industry, technology, retail, transportation, energy, real estate, the food industry and tourism (nearly 2 million Russian tourists visited the UAE in 2024)

- Both governments and private sectors continue to identify new opportunities for cooperation in trade, investment, industry, IT, AI and innovation. If they cement new trade ties, bilateral trade could reach $15 billion by 2030.

- Emirati sovereign wealth funds (ADQ, Mubadala) have invested billions into Russian tech, infrastructure, and manufacturing. Russian companies use the UAE as a launch pad for expansion into Africa, South Asia, and Southeast Asia, creating a multi-regional economic corridor.

Russia–Saudi Arabia: Strategic Energy and Food Security Axis

Saudi Arabia is Russia’s second-largest partner in the GCC.

Key features:

- Trade growth momentum: Trade volume stands at US$3.5-4 billion, growing at around 60% annually. Russia’s main exports include grain and other food products, metals, machinery, and chemical and industrial materials, while Saudi Arabia exports petrochemicals, aluminum products, and plastics to Russia.

- Beyond trade, the two countries are deeply interconnected through OPEC+ coordination, one of the most influential energy alliances shaping global oil markets.

- Saudi Arabia’s Public Investment Fund (PIF) and Russia’s RDIF have collaborated on several joint projects in energy, innovation, and industrial manufacturing. Over the past decade more than 40 joint Saudi-Russian investment projects have been launched in sectors including information technology, transport, infrastructure and petrochemicals.

- Companies from both countries are seeking more trade frameworks and vitality to explore emerging IT and technology sectors. Cooperation is expanding across sustainable energy supply chains, food security strategies, and agricultural development. Opportunities in urban development and sustainable cities reflect a shift toward broader economic and industrial cooperation beyond hydrocarbons.

Russia-Qatar: Investment Powerhouse and Strategic Financial Partner

Qatar’s role in Russia-GCC relations revolves around high-value investment diplomacy.

Key features:

- Trade remains relatively modest (US$100-120 million) but The QIA–RDIF investment platform exceeds US$2 billion. The Russian Direct Investment Fund (RDIF) and Qatar Investment Authority (QIA) have strengthened their strategic partnership with the launch of a new $2 billion investment platform, underscoring a shared commitment to advancing technology, healthcare, and mineral extraction sectors. This collaboration not only enhances Russian companies’ access to Middle Eastern markets but also facilitates Qatari business expansion into Russia, building a robust foundation for sustained economic cooperation.

- Target sectors: cybersecurity, fintech, logistics, infrastructure, mining and advanced materials, space and geospatial technology.

- Qatar is also strengthening LNG consultation with Russia, two of the world’s top gas producers seeking cooperative approaches rather than competition. Qatar and Russia could expand trade to US$1 billion by 2035 by deepening cooperation in energy, LNG, and petrochemicals. Diversifying into food security, agriculture, logistics, and technology partnerships would broaden the trade base. Improved investment frameworks, joint ventures, and alternative payment mechanisms would further support trade growth.

Russia-Kuwait: Finance, Petrochemicals, and Industrial Potential

Russia-Kuwait trade stands at US$1.5 billion, with room for growth. Kuwaiti funds (KIA) are evaluating co-investments in Russian petrochemicals, participation in Russian infrastructure funds, logistics, and maritime reinsurance partnerships. Industrial cooperation (fertilizers, metals, and machinery) is expanding as Kuwait diversifies its industrial base under Vision 2035. Kuwait and Russia could reach US$3 billion in trade by 2035 through energy, petrochemicals, and joint downstream projects. Collaboration in food security, agriculture, and logistics would diversify trade beyond hydrocarbons. Investments in industrial goods, technology, and phased market growth support sustained trade expansion.

Russia-Oman: Logistics, Mining, and Fisheries

Oman and Russia maintain growing economic dialogue, with bilateral trade around US $300-500 million. Potential lies in mining technology, fisheries modernization, maritime logistics via Duqm port, tourism, and cultural exchange. Oman’s strategic location along the Arabian Sea allows it to integrate more deeply into Russia-India-Gulf-Africa shipping corridors linked to the INSTC. Russia and Oman’s bilateral relations have already entered a new era of strategic economic partnership, marked by rapid trade growth, deepening sectoral integration, and expanded institutional cooperation. Anchored by Oman’s Vision 2040 and Russia’s industrial and technological strengths, collaboration spans energy, logistics, agriculture, digitalization, and tourism. Growing security and defense cooperation further solidify the relationship, boosting investor confidence. Together, Russia and Oman are building a resilient, forward-looking partnership aligned with global economic shifts and regional stability. Oman and Russia can achieve US$1 billion in bilateral trade by 2030 through expanded cooperation in energy, agri-food exports, and logistics via Oman’s strategic ports on the INSTC corridor. Enhanced industrial equipment trade, digital economy collaboration, and growing tourism flows will further boost trade volumes. Strong institutional frameworks and joint investment initiatives will ensure sustained growth and market integration.

Russia-Bahrain: LNG, Financial Services, and Tourism

Trade volumes remain largely underutilised at US$10–15 million, but strategic initiatives include Russian LNG supply negotiations with Bahrain, banking and financial integration, tourism exchanges, and potential joint ventures in medical services and pharmaceuticals. Bahrain’s advanced financial regulatory ecosystem also provides opportunities for Russian fintech firms seeking entry into the Gulf market. Bahrain and Russia reaching US$1 billion in bilateral trade by 2040 is achievable through a strategic blend of sectoral diversification, institutional cooperation, and enhanced connectivity. Here’s how:

- Energy and Petrochemicals Expansion

Joint upstream and downstream projects in oil, gas, and emerging green hydrogen sectors will create substantial trade volumes, including technology transfer and equipment supply. - Agricultural and Food Security Collaboration

Russia’s strong agri-food exports (grain, poultry, and processed foods) will meet Oman’s growing demand for sustainable food supplies, supported by joint ventures in agro-processing and cold-chain logistics. - Logistics and Transport Integration

Leveraging Oman’s strategic ports as part of the INSTC corridor, Russia can expand its access to Middle Eastern, African, and South Asian markets, facilitating increased cargo flows and maritime services. - Industrial Equipment and Technology Trade

Omani infrastructure projects will require Russian machinery, automation systems, and engineering services, expanding trade in high-tech industrial goods. - Digital Economy and Services

Collaboration on AI, cybersecurity, and e-government solutions will generate new service exports and investment opportunities. - Tourism and People-to-People Exchange

Growth in tourism flows, supported by visa facilitation and direct flights, will boost services trade and stimulate related sectors. - Institutional Mechanisms

Regular business forums, joint commissions, and streamlined trade agreements will reduce barriers, enhance investor confidence, and ensure steady growth. By systematically developing these sectors and maintaining political will, Bahrain and Russia can realistically push bilateral trade to the US$1 billion mark by 2040.

The EAEU–GCC Free Trade Agreement: A Game-Changing Opportunity

One of the most significant future milestones is the potential Free Trade Agreement (FTA) between the Eurasian Economic Union (EAEU) and the GCC. If GCC countries sign an FTA with the EAEU in the near future, the integration of Eurasia and the Middle East will be significantly accelerated. The EAEU integrated market of 185 million consumers offers unified customs rules, simplified cross-border logistics, industrial specialization zones, and harmonized standards in pharmaceuticals, food safety, and technical regulations.

- What would an EAEU–GCC FTA achieve?

Tariff reductions for industrial and agricultural goods.

Mutual recognition for pharmaceutical, medical, and industrial certifications.

Simplified visa and service mobility for engineers, IT specialists, and consultants.

Expanded energy cooperation regulations.

Harmonization of digital trade and fintech rules.

- Who is leading negotiations?

The UAE has been the most proactive GCC member pushing for deeper economic cooperation with the EAEU. The EAEU and UAE signed an economic partnership agreement on June 27 to strengthen trade, investment, and economic cooperation. Saudi Arabia, Qatar, and Oman are also studying institutional frameworks. An EAEU-GCC FTA could raise bilateral trade from US$15 billion to as high as US$40-50 billion within a decade

Connectivity Architecture: INSTC, Middle East, East Africa

No analysis of Russia–GCC relations is complete without examining the transport and geopolitical connectivity frameworks shaping the region’s future.

- The INSTC is Russia’s most ambitious trade corridor:

Linking Russia-Caspian Sea-Iran-India-Arabian Sea.

Shipment times reduced from 40 days to 20 days.

Costs are reduced by 20–30% compared to the Suez Canal route.

- Relevance for GCC

GCC goods can connect to Russia through Iran and the Arabian Sea.

Saudi and UAE exporters gain alternate overland–sea routes to Central Asia, Russia, Caspian markets, and the Caucasus.

Instability or congestion in the Red Sea becomes less risky.

GCC ports (Jebel Ali, Fujairah, Jeddah, and Duqm) can integrate their logistics systems with INSTC’s southern and western branches.

Russia–GCC–East Africa Triangular Connectivity

The UAE and Saudi Arabia already maintain significant commercial and strategic footprints across the Horn of Africa, East Africa, and the Red Sea region. Meanwhile, Russia is steadily expanding its trade presence in Ethiopia, Eritrea, Egypt, Tanzania, Mozambique, and South Africa. The development of joint Russia-GCC-sponsored logistics platforms in key hubs such as Djibouti, Mombasa, Dar es Salaam, and Port Sudan could establish a robust Russia-Gulf-Africa economic triangle, unlocking new avenues for cooperation. This emerging corridor would advance strategic priorities, including food security collaboration, energy technology transfers, mining investments, maritime digitalization, and pharmaceutical supply chain networks, creating a framework for sustainable, multidimensional economic growth across the continents.

Multilateral Opportunities: Trade and Investment Growth

- Energy and Petrochemicals

Both Russia and the GCC are global energy leaders. Opportunities include joint oil field services, LNG supply agreements (e.g., Russia-Bahrain, Russia-Oman), green hydrogen production, nuclear energy collaboration via Rosatom, and co-investments in petrochemicals such as plastics, polymers, and advanced materials. - Agriculture and Food Security

Russia plays a critical role in Gulf food security. Potential areas of cooperation include grain storage terminals at GCC ports, agro-logistics hubs in Jebel Ali or Dammam, livestock and dairy supply chains, and harmonized halal certification. - Technology, AI, and Digitalization

GCC digital transformation ambitions align with Russian expertise in AI, machine vision, FinTech, cybersecurity, e-government, smart city management, and space technology with GLONASS integration. Joint tech parks in the UAE, Saudi Arabia, and Bahrain can integrate Russian engineering talent into Gulf innovation ecosystems. - Transport and Logistics

Collaborations can focus on maritime logistics, rail engineering, port modernization, multimodal freight, and aviation MRO, leveraging Russian heavy engineering capabilities to expand Gulf logistics networks. - Defense and Security

Opportunities exist in secure digital infrastructure, maritime security, drone technologies, training and simulation systems, cybersecurity platforms, peacekeeping, counter-terrorism, humanitarian coordination, and strengthening regional resilience. - Tourism, Culture, and Human Capital

With nearly 2 million Russian tourists visiting the GCC annually, cooperation can expand through cultural exchange seasons, joint universities, medical tourism, sports diplomacy, and technology talent exchange, building long-term societal and professional linkages. - Multilateralism

GCC engagement with BRICS, SCO, and other multilateral platforms supports energy market coordination, alternative financial systems, trade currency diversification, development funds, shared digital payment systems, and energy research mechanisms, positioning the Gulf as a key actor in a multipolar economic order. - Humanistic Prudence

Beyond trade and strategy, Russia–GCC relations must emphasize mutual cultural respect, academic cooperation, tolerance, tourism, sports, and societal development. This “soft infrastructure” of trust reduces political risk, enhances confidence, and strengthens long-term bilateral relations.

Summary

The Russia-GCC relationship stands at a historic inflection point. With rapidly growing trade, deepening investment links, expanding connectivity routes, and emerging multilateral platforms, both sides have the opportunity to elevate cooperation to unprecedented heights. In an era where global systems are being reconfigured, Russia and the GCC are constructing an alternative paradigm of pragmatic, mutually beneficial economics, built not on ideological rivalry but on shared growth, connectivity, and stability.

The coming decade could see Russia–GCC trade reaching US$50 billion, driven by a fully realized EAEU-GCC Free Trade Agreement and a strengthened INSTC corridor connecting the Arctic with the Indian Ocean. This strategic partnership will facilitate joint expansion into African, South Asian, and Eurasian markets, while intensifying cooperation across energy, technology, food security, and financial sectors. By integrating industrial strengths, capital resources, and logistical networks, Russia and the Gulf are poised to create a durable, high-value economic axis spanning two continents. Both regions, guided by strategic foresight and economic logic, are poised to become pillars of a new multipolar economic order, contributing to global stability and shared prosperity.

This article was written by I.K. Hasan, a geopolitical analyst with extensive MENA expertise. He can be reached at info@russiaspivottoasia.com

Further Reading

The Russia–Saudi Arabia Business Forum: Constructing a Eurasian/Middle East Axis

Русский

Русский