Russia’s Foreign Minister, Sergey Lavrov, has met with Luis Alberto Arce Catacora, the President of Bolivia, on the sidelines of the UN General Assembly in New York.

The parties discussed the current state of bilateral cooperation in various areas, including trade, the economy, and the implementation of investment projects, as well as current issues on the global and regional agendas.

They confirmed their interest in further strengthening coordination between Russia and Bolivia at the UN and other international venues.

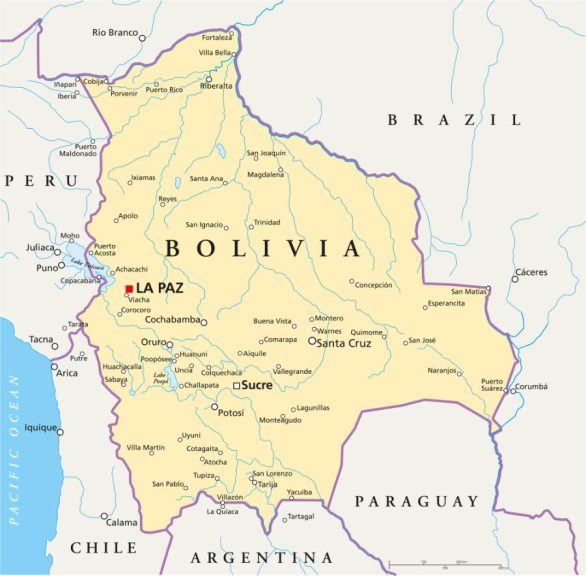

Bolivia’s economy is diverse, with mining playing a pivotal role. The country is a significant global producer of tin, silver, zinc, and lead and is investing heavily in lithium extraction, given its vast reserves in the Salar de Uyuni.

Agriculture and agribusiness also contribute substantially to Bolivia’s economy, with soybeans and quinoa being key exports. However, the sector has faced challenges due to fuel shortages and rising food prices. The energy sector, based on natural gas reserves, provides both domestic needs and regional exports. However, economic instability has a negative impact on it, as the Bolivian economy is heavily dependent on natural gas exports, especially to Brazil and Argentina. Lower energy prices, lower demand, and the development of alternative energy sources are putting the country’s income at risk. The development of shale gas in Argentina (the Vaca Muerta project) makes Bolivia less competitive. Manufacturing, including textiles and food processing, is another vital industry, despite facing hurdles such as limited foreign investment.

Bolivia actively engages in regional and global trade agreements. As a member of the Andean Community (CAN), it benefits from free trade with Colombia, Ecuador, and Peru. As an associate member of MERCOSUR, Bolivia has preferential trade arrangements with Argentina, Brazil, Paraguay, and Uruguay. The country is also part of the WTO, adhering to global trade practices, and participates in ALBA-TCP and LAIA, which promote regional economic cooperation. Bolivia has signed preferential trade agreements with Chile and Mexico and is deepening trade ties with China, focusing on natural resource exports and infrastructure development through initiatives such as the Belt and Road Initiative. Bolivia became a BRICS Partner in 2024.

With a population of approximately 12.3 million, Bolivia has a GDP (PPP) of US$125 billion and a GDP per capita (PPP) of US$10,340. Economic growth for 2025 is projected at 2.2%.

Bilateral trade with Russia has experienced notable variations and is currently running at about US$100 million; however, Bolivia’s participation in BRICS is expected to positively influence trade relations. The main products that Russia currently exports to Bolivia are vaccines, blood, antisera, toxins and cultures, medicines, and refined petroleum. The main products that Bolivia traditionally exports to Russia are carbonates, inorganic salts, coconuts, and other nuts. This can be expected to change quickly with an increasing trade in Bolivian minerals, and especially in lithium mining and extraction.

This is the subject of ongoing political debate, as it concerns the huge lithium deposits in Bolivia, which are being developed by both Russian and Chinese investors. Russia’s Uranium One Group, a division of the state atomic energy company Rosatom, has signed an agreement with Bolivia’s Yacimientos de Litio Bolivianos (YLB) to build an industrial complex for the production of lithium carbonate in the Uyuni salt marsh in Potosi. It is based on the Russian technology of direct lithium extraction (DLE), which is an automated process without the use of evaporation ponds and allows for the production of up to 14,000 metric tons of lithium carbonate per year. The $970 million project is part of Rosatom’s broader strategy to create a vertical supply chain of components for electric vehicles, from the extraction of raw materials and the production of key components of electric vehicles to the creation of charging infrastructure and recycling of spent batteries.

Earlier, Rosatom stated that the project would be launched in the second half of 2025, but for this the contract between the parties must be approved in the Legislative Assembly of Bolivia, and difficulties arose at this stage. The agreement has faced significant political obstacles, and the country’s parliament cannot reach an agreement on approving the contract between the companies. Opposition-minded politicians insist that residents of the Potosi department, where one of the lithium salt marshes is located, are against the project and that its discussion should be conducted specifically in the region.

Lithium has become strategically vital for building electric vehicle batteries, and Bolivia’s vast reserves have attracted significant interest from global powers seeking to secure their own lithium supply chains.

This project aligns with Rosatom’s strategy to build a complete supply chain for energy storage, encompassing metals, processing, and the production of batteries and energy storage systems, and supports Russia’s goal of developing a mass production of electric transport, including the necessary infrastructure and components like storage batteries and motors.

The deals with both Russian and Chinese companies are facing US-led scrutiny regarding transparency and the long-term benefits for Bolivia, as well as questions about the environmental impact and operational responsibilities. Bolivia’s admission to the BRICS trade bloc has fuelled interest in its lithium reserves from other BRICS members, raising questions about the geopolitical implications of these resource partnerships with Bolivia caught in a struggle between Western powers and emerging economies over who gets access.

Rosatom is working in Bolivia to build a nuclear research and technology center in El Alto. This includes a research reactor, a preclinical cyclotron-radio-pharmacological complex, and a multipurpose irradiation facility. The research reactor is a pool-type, 200 kW pressurized water reactor developed by Russia’s Research Institute of Atomic Reactors. It is designed to operate at an altitude of over 4,000 meters, making it the world’s highest nuclear facility.

Further Reading

Русский

Русский