Central Asia’s e-commerce market reached approximately US$14.7 billion in 2024, up from US$11.1 billion in 2023, driven by increasing internet penetration (now over 80% in urban areas) and smartphone adoption, according to data released by the IMARC Group.

When considering this, it is pertinent to note the size of the two main bordering e-commerce markets – Russia’s, worth US$86.6 billion in 2024 and growing at 17% over 2023, and China’s, worth an astonishing US$2 trillion in 2024, with growth rates of close to 9%.

These disparities are partially driven by the differences in population – Central Asia at 75 million, Russia at 145 million, and China with 1.4 billion. Yet Central Asia remains an emerging market as its e-commerce user share per capita is rather lower. However, this is now starting to change as neighbouring dynamics and technical investment are intent on bringing Central Asia closer to per capita parity with Russia and China. Opportunities therefore exist.

E-commerce in Central Asia can be traced back to early 2000s pilots in Kazakhstan, accelerating post-2015 with mobile internet booms. According to IMARC, the market hit US$8 billion (IMARC), ballooning to US$14.7 billion in 2024 amid COVID-19’s lasting digital shift.

Central Asia’s e-commerce ecosystem is a compelling case study in digital transformation amid geographic and socioeconomic constraints. Encompassing Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, the region, which is home to 75 million people and a youthful demographic (over 50% under 30) is leveraging its traditional Silk Road legacy to bridge East-West trade digitally.

The market’s US$14.7 billion 2024 valuation reflects a 32% year-over-year surge from 2023’s US$ 11.1 billion, outpacing global averages (9.4%). This growth stems from a confluence of factors: smartphone penetration exceeding 100% in urban Kazakhstan and Uzbekistan, government-backed strategies such as Digital Uzbekistan 2030, and the influx of Russian platforms such as Ozon, Wildberries and Yandex following Western sanctions dynamics.

However, this development is not uniform. Kazakhstan’s mature ecosystem contrasts with Tajikistan’s embryonic stage, underscoring a digital divide that could exacerbate inequalities if unmitigated. The World Bank’s E-GATE initiative, launched in 2023, has already resulted in US$23 million of B2B deals—over half intra-regional—demonstrating e-commerce’s role in developing functional trade dynamics.

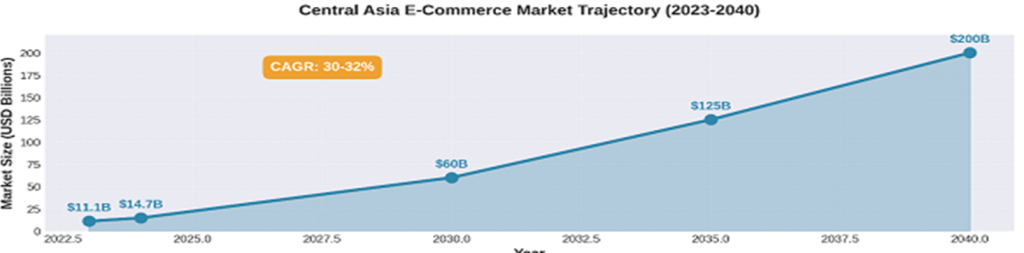

It seems likely that the Central Asian e-commerce sector will expand at a compound annual growth rate (CAGR) of around 30+% through to 2033, potentially reaching US$182 billion, although projections vary slightly across sources due to differing methodologies.

Kazakhstan leads with the largest market, followed by Uzbekistan (US$543 million in 2023, and growing rapidly). Kyrgyzstan and Uzbekistan show strong momentum, while Tajikistan and Turkmenistan are on the hard and soft infrastructure in catching up with the e-commerce boom. The progress made so far is positive and there are opportunities for targeted investment.

Central Asian E-Commerce Growth Projections

Cross-border trade, especially with Russia and China, is booming; digital wallets now dominate payments (over 70% of transactions); and marketplaces like Wildberries are enabling local Central Asian sellers to export.

Challenges include logistics in landlocked areas and low digital literacy in rural zones (affecting 60% of the Central Asia population), which could slow adoption if unaddressed. Over the next 5 years (to 2030), the Central Asian regional market may reach US$50-70 billion; in ten years (2035), US$100-150 billion; and in 15 years (2040), exceed US$200 billion, assuming sustained infrastructure improvements. These estimates lean toward optimistic scenarios from market reports but acknowledge risks like geopolitical tensions and regulatory hurdles.

E-commerce could create 500,000+ jobs by 2030, particularly for women and youth in rural areas, by bypassing traditional trade barriers. This figure is based on the projection of the current growth trend and is an approximation. However, equitable growth requires harmonized regional policies to avoid widening urban-rural divides.

Central Asia’s e-commerce sector is at an inflection point, transforming from a nascent market into a dynamic hub. With its population of 75 million and rising GDP growth (projected at 4-5% annually), the region benefits from its strategic position between Europe, Russia, and China. Internet penetration has surged to 77-87% in leading countries like Kazakhstan and Uzbekistan, encouraging a shift from bazaar-based retail to digital platforms.

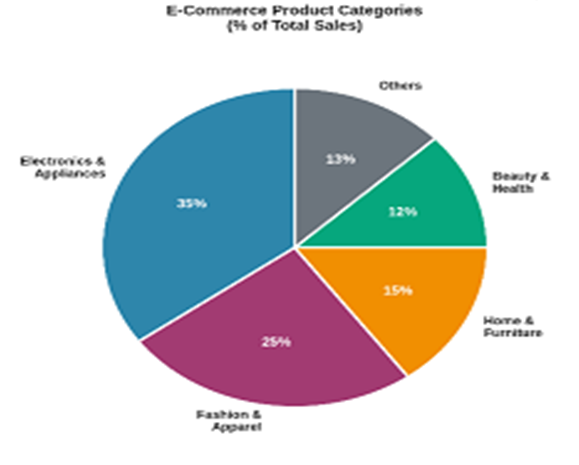

In 2024, business-to-consumer (B2C) transactions dominate (over 70%), with home appliances/electronics (35% share) and fashion (25%) as top categories. Cross-border sales, particularly via Russian platforms, grew 50-80% year-over-year, highlighting export potential for local goods like textiles and agriculture.

Despite this, the Central Asian e-commerce sector accounts for just 10% of its total retail (vs. 20-30% globally), indicating untapped potential. Government initiatives, such as Uzbekistan’s E-Commerce Strategy 2023-2027 and Kazakhstan’s Digital Kazakhstan program, are accelerating adoption through tax incentives and digital literacy campaigns.

Central Asian E-Commerce By Country

However, landlocked geography adds 20-30% to logistics costs, while only 40% of Central Asia’s rural households have reliable broadband, limiting reach. Kazakhstan remains the market leader, with 91 million transactions in 2024. Platforms like Kaspi.kz with 30 million monthly users, integrate banking and shopping, boosting average order values to US$50. Exports via Russia’s Wildberries platform tripled to US$614 million.

Kyrgyzstan has noted steady e-commerce growth to US$360 million, with 15,000 sellers on Wildberries generating US$115 million. Rural challenges persist, but the Kyrgyz E-Commerce Development Programme 2023-2026 aims for 15% annual increases.

Turkmenistan has stated its e-commerce market reached US$325 million in 2023, with 12% annual growth. Local platforms are also growing, with regional hubs such as Ashgabat and Turkmenbashi spurring 20% growth by 2030.

Uzbekistan has experienced huge development surge in its e-commerce, growing from US$201 million in 2021 to US$543 million in 2023. Over 50 marketplaces now contribute US$300 million of trade annually; with Uzum’s buy-now-pay-later (BNPL) model suiting low-income users.

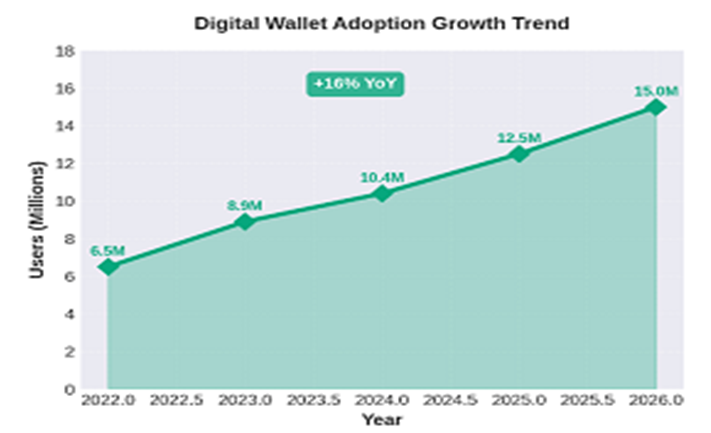

Tajikistan takes the final position with an e-commerce market of US$22 million, but the 2022 E-Commerce Law and World Bank support now signal 13% CAGR. Digital wallets hit 10.4 million users in 2024, up 16% and averaging one wallet per head of the Tajik population.

Turnover growth per country shows the following results:

- Kazakhstan: From 2.4 trillion KZT (US$ 5.3 billion) in 2023 to 3.4 trillion KZT (US$ 7.3 billion) in 2024, according to PwC’s Q1-Q4 analysis – a 42% rise, with marketplaces at 91% share. H1 2024 saw 61% growth, per PwC, with 16.6% of total retail online.

- Kyrgyzstan: US$359 million in 2023 to US$360 million in 2024 (data from the ECDB), stable but poised for 13.5% CAGR to US$596 million by 2028 via UNDP-supported hubs.

- Tajikistan: US$17-20 million in 2023 to US$22.4 million in 2024 (ECDB/Statista), with 5% growth; digital wallets surged 16% YoY to 10.4 million.

- Turkmenistan: Data estimates US$325 million in 2023 (Statista), projecting 12.5% CAGR; regional spillovers offer upside.

- Uzbekistan: US$543 million (or US$1 billion according to Forbes) in 2023 to US$700 million in 2024 (KPMG/Daryo), with 30-47% CAGR; 50+ platforms to drive a US$300 million turnover.

Aggregately, B2B holds 50%, B2C 40%, with electronics (35%) and apparel (25%) the leading categories. News Central Asia has reported Uzbekistan’s 2023 volume at US$1 billion (4% retail), with Kyrgyzstan at US$360 million. The Caspian Post estimates Central Asian regional 2023 at under US$6.5 billion, aligning with IMARC’s trajectory. Wildberries dominates cross-border (US$418 million Uzbek sales), per Forbes Kazakhstan, while Alibaba’s “Made in Uzbekistan” section on Alibaba.com aids 300+ firms. Uzum’s 23x growth (2022-2023) exemplifies local scalability; BirBir’s US$10 million funding signals classifieds’ rise. Globally, eBay/NOVICA support crafts exports, according to World Bank consultations.

Central Asia Local & International Market Platforms

The Central Asian landscape mixes local innovators with Russian/Chinese giants, enabling cross-border reach. These marketplaces hold an 80-90% share. Large-scale operators include the following:

- Kazakhstan: Kaspi.kz (USD 2.1 billion revenue; NASDAQ-listed, USD 20 billion cap); Wildberries (USD 614 million sales); Mechta.kz, Halyk Market.

- Kyrgyzstan: Wildberries (15,000 local sellers); Arena.Xspace; local apps like Madly.

- Tajikistan: Emerging players like Somon.tj; Wildberries entering 2025; NOVICA, eBay for exports.

- Turkmenistan: Growing; state-linked platforms; potential Wildberries expansion.

- Uzbekistan: Uzum (unicorn, USD 1 billion valuation; 800,000+ items); Wildberries (USD 418 million Uzbek sales); Asaxiy.uz, OLX, BirBir (classifieds, USD 10 million investment).

- International: Alibaba/Taobao (free shipping pilots); AliExpress (cross-border leader). These platforms onboarded 50,000+ regional sellers in 2024.

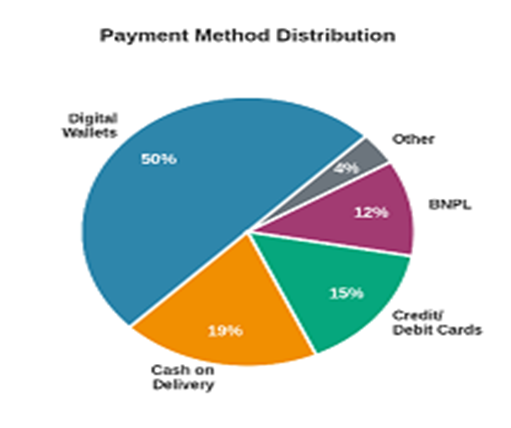

Central Asian Payment Preferences

Central Asian consumers favor cash-on-delivery (COD, 40-50% in rural areas) and digital wallets (60-70%), reflecting trust issues and cash habits.

Cards (Visa/Mastercard) now hold a 20% usage share, which is growing with BNPL and likely to take off once Russian digital payment platforms such as MIR overcome sanctions issues.

Gateways: Local systems like Click/Payme (Uzbekistan, acquired by TBC Bank); Kaspi Pay (Kazakhstan); Eskhata Online (Tajikistan). International: PayPal (limited); Qiwi, and WebMoney for Russia ties. There are blockchain pilots in Kyrgyzstan for remittances.

Currencies: Local (KZT, UZS, KGS, TJS, TMT) for domestic use; the US dollar and Russian ruble dominate in cross-border transactions (80% of exports). Multi-currency support on platforms like Uzum (14+ options) reduces conversion fees (2-5%).

Trends: 16% YoY rise in cashless transactions; wallets like Payme process 70% in Uzbekistan. Challenges: Rural banking gaps; opportunities in CBDC pilots (e.g., Tajikistan’s e-som).

Below, we dissect trends, players, mechanics, forecasts, and broader implications, drawing on PwC, KPMG, and Statista data for a holistic view.

Transaction Ecosystems: Gateways, Currencies, and Behaviors

Payments blend legacy cash reliance with digital leaps, with 70% via wallets according to Statista. COD persists (40%) for trust-building, but cashless rose 16% in Tajikistan alone. The most popular Gateways are: Payme/Click (Uzbekistan, 70% share post-TBC acquisition); Kaspi Pay (Kazakhstan, integrated); Eskhata/Qiwi (Tajikistan/Russia links). Emerging: Blockchain for remittances (Kyrgyzstan UNDP pilots).

Currencies: Domestic primacy (e.g., Uzbekistan Som accounts for 80% of Uzbek transactions); US dollar / Russian ruble for 80% exports. Platforms like Uzum support 14 currencies, minimizing 2-5% FX fees.

Conduct: Mobile-first (90% transactions); social media orders (50% via Telegram/Facebook, according to World Bank surveys). BNPL (Uzum’s shariah-compliant platform) aids low-income access; fraud controls via 3D Secure.

Challenges: Rural unbanked (40%); opportunities: CBDC integration could halve cross-border costs by 2030. IMARC forecasts US$182.2 billion by 2033 (30.6% CAGR from 2025), with Kazakhstan holding a 40% regional share.

The Central Asian economies are all part of the Commonwealth of Independent States (CIS). For our recent analysis of their current and longer term economic development prospects, please see here.

Further Reading

Русский

Русский