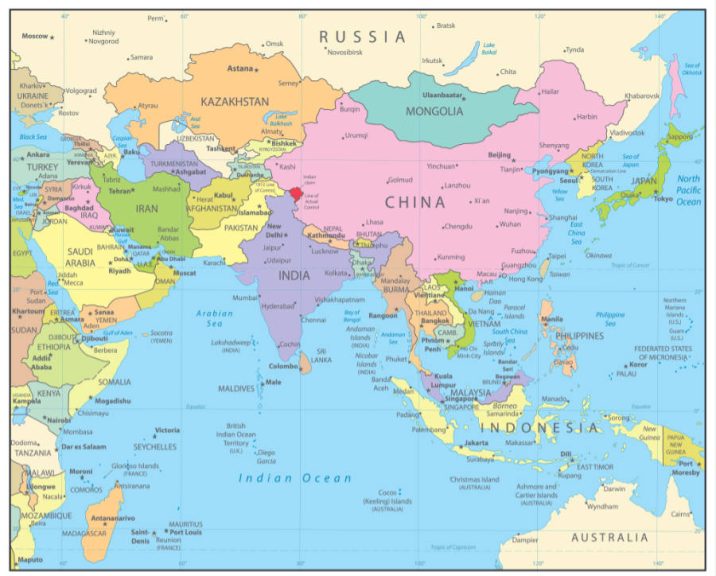

While Russia, under increasing sanctions, is looking for new logistical supply chains, strengthening cooperation with North Korea, and planning new international routes, the Central Asian countries continue to seize the moment to build as many transport corridors as possible through their territories, consolidating their place not only in the regional but also in the global market. Uzbekistan, for example, is pursuing seaport access, while Kazakhstan is strengthening its cross-border connectivity with China.

Uzbekistan and Turkiye meanwhile have agreed to switch to electronic permits for cargo transportation from next year as part of the joint efforts to develop the Uzbekistan-Turkmenistan-Iran-Turkiye transport corridor, which will link with the INSTC—of which Russia is a substantial user.

This additional route can be used to deliver European goods from Turkiye, which has become a consolidation hub for European goods given problems with the Suez route, to Central Asia. Uzbekistan, for example, has a significant trade agreement with the European Union. In addition, Uzbekistan and the European Union initialled an Enhanced Partnership and Cooperation Agreement in 2022, which could be signed this year during President Shavkat Mirziyoyev’s expected visit to Brussels.

The Uzbekistan-Turkmenistan-Iran-Turkiye transport corridor opens up access to European markets for China and overland access without repeated transshipment, as happens when using the Trans-Caspian route through Kazakhstan and the Caspian Sea.

Uzbekistan has also organized the first pilot automobile cargo transportation on the Uzbekistan-Kyrgyzstan-China-Mongolia route. This shows how Uzbekistan views its geographic position as an emerging logistics hub in order to deliver goods to countries that directly border Russia and typically use transport corridors passing through Russia.

This suggests that the Uzbekistan-Kyrgyzstan-China-Mongolia route may become a continuation of the Turkiye-Iran-Turkmenistan-Uzbekistan transport corridor, which also offers direct access to Europe.

Another cargo transport development involves the active use of the proposed Trans-Afghan railway corridor, as Afghanistan provides the shortest route between Kazakhstan and Pakistan and would connect both itself and similarly landlocked Uzbekistan to global seaport access.

Afghanistan has been considered by the countries of the region as a promising logistics destination over the past few years, opening access to the Persian Gulf and Indian Ocean through Pakistani ports. Work on this, however, has yet to start, although some slow diplomatic progress is being made. Kazakhstan, however, is also trying to get ahead of the roadmap here.

While Uzbekistan and Russia have jointly proposed the Trans-Afghan railway project, which runs Termez-Mazar-I-Sharif-Kabul-Peshawar, Kazakhstan is also working—separately—on a secondary railway line from the border with Turkmenistan. Last week, the Zhetysu joint Kazakh-China rail terminal was opened in Almaty, which is close to the border with Kyrgyzstan. China does not yet have railway connections with Kyrgyzstan. It can be assumed that the new terminal will be used, among other things, for transshipment of goods for Kyrgyzstan; plus, there is a transport corridor to Uzbekistan through Almaty.

This illustrates that Kazakhstan is also strengthening its intermediary logistical role for China—not just to connect with EU countries via the Trans-Caspian route, but also to more easily access Central Asian markets.

Russia’s movements into North Korea are also of interest. While generally regarded as backward and impoverished by the West, North Korea is extremely mineral-rich. The country possesses significant mineral resources, including deposits of magnesite, coal, iron ore, and various other metallic and non-metallic minerals and rare earths. These resources are estimated to be worth trillions of dollars.

While previously, there was only an intermittent railway connection between the two countries, and vehicle access was assessed as financially unviable, times have changed—the construction of a Russia-North Korea vehicle bridge has already begun, while railway access has been expanded.

The growing trans-border crossings with China are now booming freight routes—such as the Nizhneleninskoye-Tongjiang railway bridge and the Blagoveshchensk-Heihe vehicle bridge – are active reminders that North Korean connectivity may also prove significant. The North Korean vehicle crossing is scheduled to be completed by early 2027.

Further Reading

Русский

Русский