The global use of credit rating agencies has come under criticism in the past, often with allegations of political bias. The United States, for example, was always held up as a shining beacon of creditworthiness and a guaranteed AAA rating, as were the economies of the European Union and the United Kingdom. As recently as 2020, the US and EU were AAA-rated economies, with the UK at AA.

However, there has always been a somewhat self-serving aspect to these rankings, as the main players—Fitch, Standard & Poor’s, and Moody’s—are all American-owned. Over the years, that resulted in accusations of bias and even corruption. All were heavily fined as recently as September last year by the U.S. Securities and Exchange Commission for failing to keep adequate records. All had previously been found guilty of collusion with banks, circumstances that led directly to the 2010 subprime crisis.

That these agencies routinely also downgraded Asian economies was also often highlighted, with Russian bonds and companies in particular often regarded as junk. That was accelerated in 2022 when all three pulled out of the Russian market, effectively preventing Russia from attaining any credit score rankings at all on the global markets and making any attempts by Russia to raise overseas capital almost impossible. Banks will not provide financing to companies, and even to entire countries, that have no credit rating. This was despite Russia at the time being a US$2.3 trillion economy, with one of the world’s lowest debt-to-GDP ratios and a proven history of repaying its debts on time.

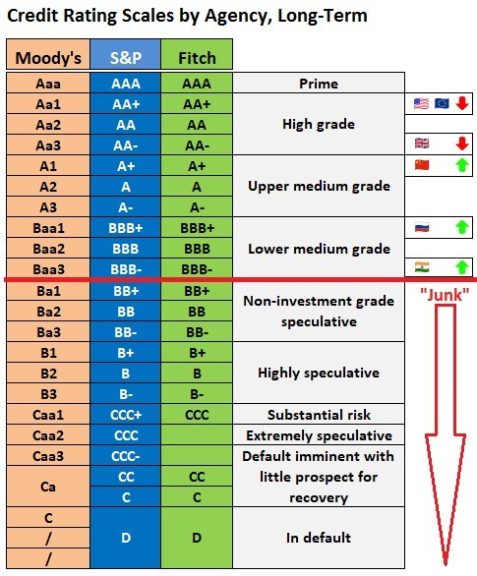

To fill the Russia expertise gap, in 2024, Chinese credit rating agencies stepped into the market, sensing opportunities and especially as Chinese investment into Russia is growing (examples are here, here, here and here). This is a growing trend, however Chinese banks require evidence that the investment projects are sound from the Russian side. To that end, China Chengxin International Credit Rating (CCXI) have established facilities in Russia and have been charged with providing credit rankings based upon the standard analytical data. They found that Russia should have a ranking of BBB+ and awarded the status. That determines the level of risk in the Russia market and elevates it to investment grade. Loans at the appropriate interest rate would then have been made available to the Chinese investors. Interestingly, CCXI is partially owned by Moody’s.

With the arrival of alternative credit agencies into the global market, attitudes and analysis began to change. Where the US-owned firms have illustrated both collusion with lenders and geopolitical bias in the past, this new breed of credit agency is both better positioned to understand local market dynamics and—hopefully—to resist the temptation to collude with banks (in China, such a crime would lead to serious prison time; in the United States, the Federal Reserve bailed out the banks and even awarded bonuses).

This has begun to reveal itself in a rebalancing from both ends of the spectrum—the US agencies and the Asian ones, which also include credit rating firms such as Lianhe and Dagong in China, CRISIL, ICRA and ONICRA in India, and others such as Credit Bureau in Singapore, and Etihad Bureau in Dubai, amongst many others. Russia, too, is developing its own credit ratings firms, with players such as ACRA and the National Ratings Agency among the new participants in this new, worldwide industry now spreading its regional and global analytical expertise beyond that of what had mainly been an American-only preserve.

The result has been a gradual rearrangement in global credit awareness. In the United States itself, the huge amount of national debt has become so large that even American credit ratings agencies can no longer ignore it. They downgraded the US from a AAA economy to AA+ in October last year. That makes it more expensive for the US Treasury to borrow money.

The same has also happened in the European Union, which was also downgraded to AA+ from a AAA ranking. There are suspicions that given the recent economic performances of several key EU economies, such as France and Germany, that the European Union itself will face further downgrades. For example, France was downgraded last month to AA.

The United Kingdom has also been downgraded to AA-. This is in contrast to China, whose credit rating is now at A+, one level behind the UK, an issue that appears rather odd when considering that China has a nominal GDP value of US$19 trillion, more than 5 times larger than Britain’s, and an economy roaring along at 5.3% when the UK’s GDP output has slumped due to what the UK Exchequer has called ‘excessive spending.’

India, too, is being shown in a more realistic light, with GDP value now higher than the UK’s at US$3.9 trillion and growth rates at an astonishing 7.8%. Its credit ranking is still below the UK’s at BBB-, but it is still investment grade.

We suspect that there is still a great deal that needs to be improved and reshuffled to show the real credit ratings of countries around the world, as much remains opaque and influenced by political mechanisms and media. Yet we can see quite clearly where the underlying trends are—Western credit rankings are in decline, and the RICS rankings are on the rise.

Further Reading

Russia’s IPO Market Booms With The Average 5 Times Over-Subscribed

Русский

Русский