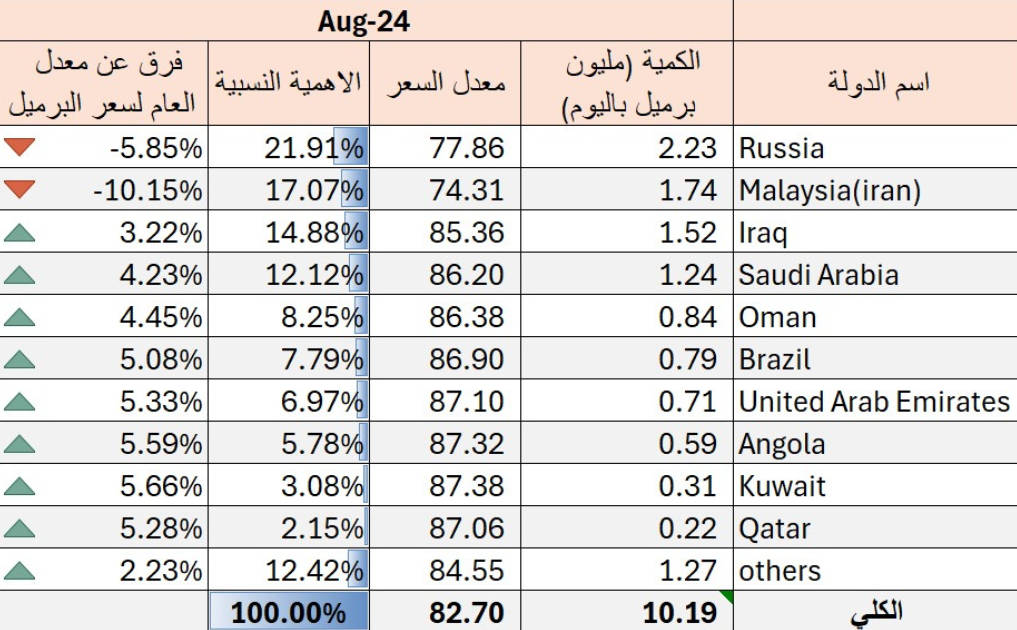

The Future Iraq Institute for Economic Research and Consulting has reported that Iraq and Saudi Arabia have lost their positions as the largest oil exporters to China due to purchasing incentives offered by Russia and Iran. According to the report, Russia captured 22% of China’s oil imports in August 2024, offering prices that were 6% below the average purchasing rate. Meanwhile, Iranian oil, funnelled through Malaysia, accounted for 17% of Chinese imports, with discounts of up to 10% compared to market rates.

These aggressive pricing strategies have pushed Iraq and Saudi Arabia, traditionally major suppliers to China, down the ranks in the world’s largest oil market.

The report noted that in July 2024, Russian oil was priced 4% below the average, while Iranian crude was sold at 7.5% below the standard, further solidifying both countries’ positions as top suppliers to China despite their lower prices.

Russia oil exports have found new markets in Asia, partially due to Western sanctions and partially due to aggressive pricing intended to combat competitive pricing by Western friendly suppliers. Brent crude oil prices in the EU have increased from a low of US$18.38 per barrel in Apil 2020 to reach US$80.36 in August 2024.

The pricing strategy adopted by Russia and Iran towards China means that globally productive manufacturing in China is now far more competitive than their European rivals, who are currently being priced out of international markets. EU oil supply prices from the United States are up to three times more than the pre-sanctions supplies from Russia.

Further Reading

Русский

Русский