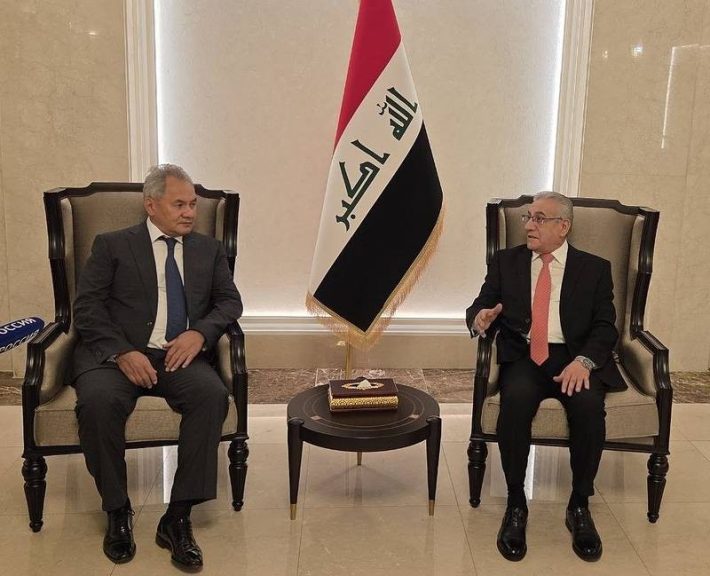

Russia’s Security Council Secretary, Sergey Shoigu, has been visiting Baghdad and has been holding meetings with Iraq’s top political and military leadership during his visit to the country. Visits of this type typically involve security issues; however, these can also interface with regional trade and investment projects.

Shoigu said that communications between Moscow and Baghdad are becoming more intense, with business, economic, transport, military, and military-technical cooperation issues all being discussed, stating that “Contacts are becoming more intense and multidirectional. This concerns business, the economy, and transport, military and military-technical cooperation.”

Part of Shoigu’s meeting is likely to have been concerning security for nuclear materials, as Iraq is sending an official delegation to Moscow later this month for talks on building nuclear power reactors. The Iraqi Ministries of Foreign Affairs, Electricity, Higher Education and Scientific Research, and the Iraqi Atomic Energy Commission are authorized to sign a preliminary deal if an agreement is reached, according to Iraq’s Shafaq news agency, which stated, “Russia will assist Iraq in building nuclear power plants to generate electricity, in addition to providing nuclear fuel cycle services and training local personnel to manage and operate nuclear facilities.”

Russia is additionally expanding its oil interests in Iraq, capitalizing on opportunities created by Baghdad’s need to modernize its hydrocarbon sector and boost crude exports. In February this year, Moscow and Baghdad signed four major energy cooperation agreements and memorandums of understanding, marking a significant escalation in bilateral energy ties.

Russian oil companies have already invested about US$19 billion into Iraq’s oil sector, according to Iraq’s Ministry of Oil. These include:

Lukoil, which operates the West Qurna-2 field, one of Iraq’s largest, with estimated reserves of over 14 billion barrels. Block 10, operated by Lukoil and Japan’s Inpex, has shown promising results with estimated reserves of over 2.5 billion barrels.

Gazprom Neft is involved in the Badra oil field, producing around 85,000 barrels per day (bpd).

Bashneft is involved with Block 12 exploration and contributing to upstream development.

Another breakthrough in Russia-Iraq bilateral energy agreements includes the resumption of crude exports from Iraq’s Kurdistan Region (KRI) to Türkiye’s Ceyhan port, which was halted in 2023 due to legal and political disputes. That suspension reportedly cost Iraq over US$23 billion in lost revenues. Russian firms, particularly those involved in pipeline infrastructure and field services, stand to benefit from the reactivation of the Kirkuk–Ceyhan pipeline and the return of KRI volumes to international markets. Security advice is also likely to have been involved in this segment of bilateral relations.

Moscow and Baghdad have agreed to review and expand existing oil and gas contracts from 2025 to 2030, signaling an improved commitment to energy diplomacy and bilateral cooperation. The objectives are:

- To secure stable Russian oil investments in Iraq’s southern and central regions

- Expand technical assistance and upstream services

- Facilitate technical knowledge transfer between Rosneft, Tatneft, and Iraqi national oil companies

- To position Russia as a long-term partner in Iraq’s oil development roadmap.

Iraq holds the world’s fifth-largest proven crude oil reserves, estimated at over 145 billion barrels as of 2025. These reserves are predominantly located in the southern region, including the supergiant Rumaila and West Qurna fields. This sector is vital to Iraq’s economy, accounting for a significant portion of government revenue. In 2024, Iraq produced approximately 4.5 million barrels of oil per day, making it the second-largest producer in OPEC.

However, Iraq faces challenges such as political instability, infrastructure issues, and security concerns. The government is actively seeking foreign investment to boost production and aims to increase its proven reserves to over 160 billion barrels.

The energy agreements are part of a larger geopolitical strategy to reinforce Russia-Iraq economic relations across multiple sectors. The latest cooperation packages also include:

- Maritime transport and logistics infrastructure, aimed at improving Iraqi export capabilities,

- Public health initiatives, including medical training and equipment supply,

- Trade and commerce facilitation, with a focus on dual-currency trade mechanisms using the Russian ruble and Iraqi dinar, partially insulating both economies from Western sanctions.

Iraq has already stated it wishes to become part of the International North-South Transport Corridor (INSTC) with a spur leading to Baghdad from the Iranian section.

In the non-oil sector, Russia increased its exports to Iraq by 27.8% in 2024, with the majority of shipments consisting of food products, steel, wood, and pulp/paper goods. Non-energy bilateral trade reached about US$1.4 billion. According to the IMF, the Iraqi economy is expected to grow by over 3% this year – three times more than the European economies.

Further Reading

Русский

Русский