Update: June 23

Niger, in West Africa, has just withdrawn the operating licence for France’s Oranco uranium mine in the country. France is heavily reliant on the mine to support its own nuclear energy programme. Niger is likely to redirect this facility to Russia, and if as expected it does so, will signal another trend of Russian leadership in the global SMR industry.

Clients include countries throughout the Global South

Rosatom is currently leading the way in developing global Small Modular Reactors (SMR), with investments being made globally amidst multiple calls for the technology to be used throughout Russia and the Global South. One of the key points that President Putin has been discussing in Vietnam for example is the establishment of a joint nuclear technology centre, according to Aiyana Investment Research.

Russia’s Domestic Switch To SMR’s

Examples of Russian domestic development came after President Putin visited Yakutia in the Russian Far East, the day before he visited North Korea. Yakutia is strategically important as a potential energy distribution hub for the Russian Arctic and Russian Far East, both of which need rapid development in order to cater for Russia’s move East and away from Europe.

The head of the Yakutia Government, Aisen Nikolaev, proposed at a meeting with Russian President Vladimir Putin that Russia establish the industrial production of small nuclear power plants, as it would allow for savings on the delivery of fuel to small settlements.

Nikolaev said that “I highlighted low-power nuclear power plants. Soviet developments already brought them to fruition, and they meet all modern safety requirements. They are unique in that their thermal and energy power is small, at 10 MW each. And if it were possible for a time to produce them not one-by-one, but by means of specific industrial production, then I think it would radically change the situation in hard-to-reach territories.”

Small nuclear power plants are ideal for northern towns such as Tiksi, which is expected to develop as a service port for the Northern Sea Route yet needs vastly improved energy efficiency.

“We spend a huge amount of money on importing fuel. We deliver it to small settlements 2-3 years in advance. They are insane expenses; it’s even scary to even say. And these small nuclear power plants could just solve everything,” Nikolaev said.

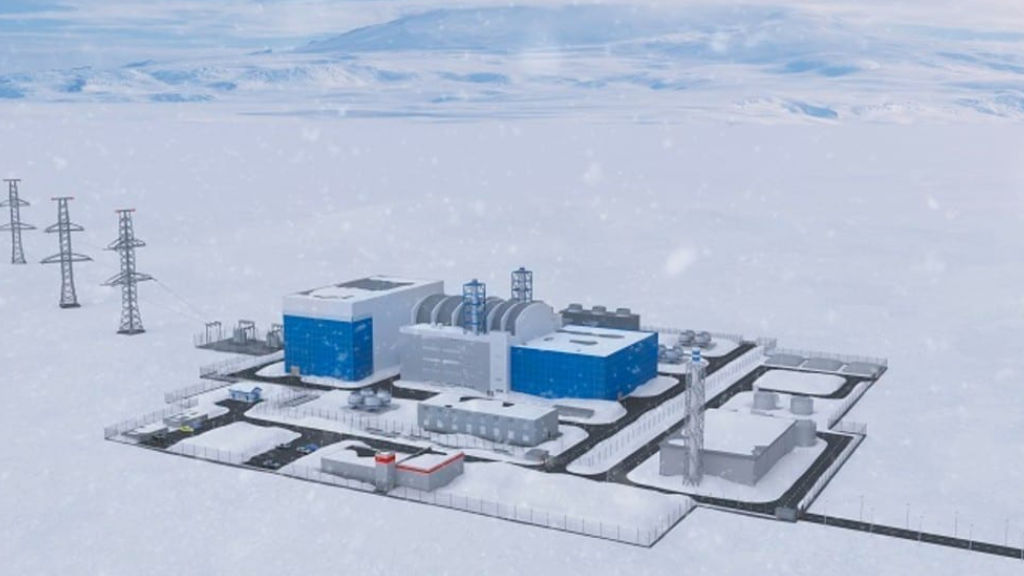

A new low-power land-based nuclear power plant is planned for construction this year at Ust-Kuyga, in the Sakha Republic (also part of Yakutia) on the River Yana, about 300km east of Tiksi. It will provide heat and electricity to the Kyuchus, Deputatskoye and Tirekhtyakh fields, industrial enterprises, social facilities and housing in the Ust-Yansky and Verkhoyansk regions. Ust-Kuyga is expected to become an inland service centre for ports such as Tiksi.

Russia’s SMR Exports

There is increasing market acceptance of Russian SMRs, despite Western geopolitical pressures. Numerous countries in Central Asia, including Uzbekistan, which agreed an SMR investment with Rosatom, using a RITM200 reactor commissioned to build it by 2026. Part of the Russia tech is to use existing nuclear waste to power up the basic plants, an effective way of re-cycling what was once thought of as toxic.

Rosatom is already building a SMR in Rooppur, Bangladesh, an investment to Dhaka of US$12 billion. Russia is currently involved in more than a third of the new reactors being constructed around the world at present, including in Belarus, Brazil, China, India, Iran and Egypt.

In Turkiye, Russia is building the country’s first nuclear power plant, a 4,800MW facility in Akkuyu which is expected to begin producing electricity this year. Russia often uses a build-own-operate model, which involves an even higher degree of co-operation as Rosatom provides everything, including the plant’s staff, during the lifetime of the project.

Other countries are taking notice. African, Asian and Latin American nation are also looking hard at Russia’s SMR’s, with numerous nations, including countries as diverse as Burkina Faso, Cuba, Iran, Guinea and Mali – among others – all interested in Russia’s SMR technologies. Wherever Russia’s busy Foreign Minister, Sergey Lavrov goes, the subject of energy – and increasingly nuclear – is at the top of the agenda.

Most recently in June, The Republic of Guinea in West Africa and Rosatom signed a MoU to cooperate on the development of floating power units using RITM-200 reactors to supply electricity to both to industrial and domestic consumers in Guinea. The first floating power plant, the Akademik Lomonosov, in the Chukotka region of Russia, was launched in 2020 and provides 70 MWe power and heat to the nearby coastal areas. Several North, West and East coast African countries appear poised to follow suit.

In 2023, Rosatom also began discussions with Nicaragua, Uzbekistan and Tajikistan about establishing nuclear technology centres. In Bolivia, the company completed a nuclear research centre in 2023 and, a few months later, secured a lucrative contract for lithium extraction.

However, the switch to SMRs doesn’t stop there. Global shipping is poised for a radical overhaul with all major cargo ships intended to be nuclear powered by 2035. Russia is already committed to delivering 160 Arctic class ships by 2030, while Russia’s general freight shipping, as used by companies such as FESCO, with a fleet of 30 large container ships, will also need upgrading.

While Russia currently leads the way in SMR technology, competition is on the horizon. Other style reactors are also being developed in the West, with the ‘holy grail’ of decarbonisation thought to be Thorium (Uranium 233) powered Molten Salt Reactors (MSR). To illustrate the depth of these coming changes, and the amount of money to be invested in them, it is worth looking at Bill Gates most recent comments on MSR technologies.

Russia has so far remained quiet about its own Thorium and MSR reactor developments – but for now, the West remains in catch up phase as concerns competing with Russia exporting its SMR technologies and currently dominating global uranium enrichment – 27% of the global total.

With the overseas SMR plants being managed by Russia technology experts during their lifespan – about 70 years – geopolitical risk is minimised, while that long project maintenance term allows Rosatom to offer attractive rates of investment – up to 90% financing for nuclear projects, with repayments spread over decades at minimal interest rates.

This intelligence gives very strong clues as to why Russia is so popular in the emerging world – it is sharing technologies, know-how and the financial risk to enable their own development.

Русский

Русский