Russian President Vladimir Putin met with the President of the Syrian Arab Republic, Ahmed al-Sharaa, at the Kremlin on January 28. The talks focused on political, economic, and military base security cooperation and coordination, as well as expanded collaboration in trade, investment, and post-war reconstruction. Notably, this visit marks President al-Sharaa’s second trip to Russia in two consecutive years, following his first official visit in 2025.

Russia and Syria’s renewed diplomatic engagement, marked by the recent visit of Syria’s foreign minister, Asaad al-Shaibani and defense minister,Murhaf Abu Qasra to Moscow, signals more than routine alliance management and reflects a strategic recalibration toward long-term economic stabilization and post-war reconstruction.

Reading signals from the Putin-al-Sharaa talks

The most important point is that the Kremlin referred to Ahmed al-Sharaa as Syria’s president without using the term “interim,” signaling Russia’s interest in working with the current Syrian leadership. During the meeting, the leaders discussed the current state and prospects of Russian-Syrian cooperation, as well as key issues on the regional agenda, including the situation in the Middle East. Putin emphasized that, following the previous meeting, significant progress had been achieved in restoring interstate cooperation. In particular, economic interaction has moved forward, demonstrating growth of over 4%. Putin stressed the importance of maintaining this positive trend and further expanding cooperation across a wide range of areas. The Russian leader highlighted the historically strong nature of Russian-Syrian relations, recalling that diplomatic ties were established in 1944 and have remained free of serious disagreements throughout the decades.

Special attention was paid to economic and humanitarian cooperation. Putin noted the active work of Russian and Syrian ministries and agencies, including the visit of a large interdepartmental Russian government delegation to Syria. Cooperation is developing in industry, construction, medicine and healthcare, sports, and humanitarian fields.

Russian companies, including those in the construction sector, have expressed readiness to participate in Syria’s post-conflict reconstruction. Putin reaffirmed Russia’s consistent support for the restoration of Syria’s territorial integrity and congratulated President Sharaa on the progress achieved in this direction. The integration of the Euphrates region was described as an important step toward the full reunification of the country.

President Sharaa, meanwhile, expressed appreciation for Russia’s role in stabilizing the situation in Syria and the broader region. He noted the high intensity of bilateral contacts, pointing out that 13 delegations have been exchanged between the two countries since his previous visit. The Syrian president emphasized that Syria has overcome a difficult period and is moving forward, including efforts to address the consequences of sanctions and to unite the country’s territory. Both sides expressed confidence that the talks would contribute to the further strengthening of Russian-Syrian relations and confirmed their commitment to continued cooperation in the interests of stability and development

A Delicate Recalibration: Russia-Syria Relations in a Shifting Geopolitical Landscape

A nuanced analysis is required to fully understand the evolving nature of Russia-Syria relations, which have become increasingly complex amid the current Middle Eastern geopolitical turbulence and a rapidly shifting global order. Moscow now finds itself navigating a post-Assad Syria while seeking to preserve its long-standing strategic footprint in the Middle East and the Levant.

Following the toppling of former Kremlin ally Bashar al-Assad in 2024, Russia’s priorities in Syria have shifted. The Kremlin is no longer operating from a position of political certainty, yet its strategic imperatives remain unchanged: securing military assets, personnel, and access; maintaining economic influence; and safeguarding its regional relevance in the face of expanding U.S. involvement in post-Assad Syria. Against this backdrop, this meeting carries significance beyond its diplomatic optics. It reflects Moscow’s effort to recalibrate—not retreat—its engagement with Syria. The discussions on political coordination, cooperation on military base security affairs, trade, and post-war reconstruction signal Russia’s intent to remain a decisive actor in shaping Syria’s future.

Recent high-level engagements, including Putin’s meeting with Palestinian President Mahmoud Abbas, have also reinforced Russia’s regional posture. Reports of a proposed US$1 billion investment package for Syrian reconstruction potentially leveraging assets seized by the US underscore Moscow’s attempt to anchor its presence through economic instruments as much as military ones. However, the relationship is not without friction.

A central point of contention remains Syria’s demand for the extradition of Bashar al-Assad and his family, who currently reside in Russia under political asylum. For Moscow, this is a non-negotiable issue. Russia has historically maintained a firm stance against violating its political asylum commitments, viewing such actions as a breach of sovereign principle and institutional credibility. Speaking at a press briefing in Moscow, Kremlin spokesperson Dmitry Peskov said earlier ahead of the Kremlin meeting that those discussions with Syria’s new leadership would cover Russia’s military presence and growing Moscow-Damascus ties after the leadership change while declining to comment on Assad or potential troop withdrawals.

At the same time, President al-Sharaa appears to recognize the political realities at play. There is little ambiguity on this matter, and indications from the Kremlin meeting suggest a shared understanding that dwelling on irreconcilable disputes would only stall progress. Instead, both sides appear inclined to close this chapter and move forward.

History offers instructive parallels. Despite granting asylum to the Dalai Lama, India has maintained robust trade relations with China, demonstrating that political disagreements need not preclude pragmatic cooperation. A similar logic seems to be shaping the Russia-Syria dialogue today. Field-level exchanges and high-level diplomatic contacts are reportedly underway to narrow misunderstandings and rebuild trust. These efforts reflect a mutual recognition that sustained engagement, rather than estrangement, best serves long-term interests.

For Russia, the stakes are particularly high. Having recently lost a long-standing ally, Nicolas Maduro in Venezuela, and seen its influence in Latin America increasingly challenged, Moscow is keenly aware of the costs of strategic disengagement. Lessons learned from that experience appear to be guiding the Kremlin’s approach in the Middle East: Russia cannot afford to forfeit another critical geopolitical foothold.

The message emerging from the Putin-al-Sharaa meeting is therefore clear. Despite unresolved tensions and a transformed political landscape, both leaders appear committed to redefining—rather than abandoning—the Russia-Syria relationship. In an era of intensifying great-power competition, pragmatism, continuity, and strategic patience may prove to be Moscow’s most valuable assets. As Syria moves from active conflict to recovery, the coordination of political, security, and economic portfolios in a single high-level visit underscores Damascus’s intention to anchor its rebuilding strategy in trusted partnerships. For Russia, the talks reaffirm its role not only as a security guarantor but also as a key economic stakeholder in Syria’s future, with a focus on trade expansion, infrastructure investment, energy development, and industrial revival.

A New Russian-Syrian Economic Pragmatism?

From a business and investment perspective, such exchanges from the top-level policymakers highlight the understanding that sustainable reconstruction requires a secure environment, predictable governance, and aligned strategic interests. The 28th January meeting marks a pivotal shift in Russia-Syria relations, moving from a 14-year conflict-era security focus to a post-war economic and trade agenda.

Following Ahmed al-Sharaa’s first Moscow visit in October 2025, both sides aim to institutionalize cooperation, emphasizing reconstruction, investment, logistics, industrial collaboration, and Eurasian connectivity. For Russian state business stakeholders, this meeting should be understood not as a symbolic gesture but as the political green light for long-cycle economic engagement in one of the Middle East’s most undercapitalized yet strategically located economies. Moscow’s expertise in infrastructure and state-led development positions Russian companies to play a central role in Syria’s recovery, signaling to regional and international partners that reconstruction will follow structured state-to-state frameworks. The meeting reflects a pragmatic turn, prioritizing sustainable economic engagement over ideology, mistrust, or external pressures.

Russia and Syria are clearly aligning their national interests to promote economic complementarity: Moscow’s expertise in infrastructure, energy, and industrial development meets Syria’s urgent need for post-war reconstruction, creating a framework for mutually beneficial engagement. The talks emphasize that the relationship is not directed against third parties but is rooted firmly in national interest, stability, and long-term growth. For Syria, engagement with Russia is a national imperative. As the world’s fourth-largest economy in terms of PPP metrics, Russia can provide the technical, financial, and industrial support crucial for Syria’s recovery. By leveraging Russian investment and expertise, Syria aims to rebuild infrastructure, revive industrial sectors, and expand trade corridors, laying the foundation for sustainable economic sovereignty. For Moscow, strengthening ties with Damascus consolidates Russia’s presence in the Middle East while demonstrating the viability of strategic partnerships based on economic realism rather than short-term geopolitical posturing.

From Political Risk to Managed Opportunity

The fall of Bashar al-Assad and the peaceful transition to a new leadership under President al-Sharaa created a period of uncertainty for Russia’s economic interests. However, that uncertainty has been rapidly replaced by policy continuity combined with governance reform, a rare alignment in post-conflict transitions. During his first Moscow visit, President al-Sharaa explicitly committed to honoring all existing Russian-Syrian agreements, including infrastructure, energy, and military-technical contracts. This pledge has been essential in stabilizing investor expectations and reassuring Russian state-linked companies, banks, and insurers.

More importantly, the new Syrian leadership has adopted a pragmatic, non-ideological economic posture, prioritizing reconstruction, employment generation, and foreign investment over geopolitical bloc politics. This creates a fundamentally different operating environment from the heavily sanctioned, rent-seeking model of the previous regime. For Russian businesses, this shift reduces sovereign risk, contract uncertainty, and reputational exposure, particularly as Western and regional sanctions on Syria have begun to ease.

In Syria’s political system, the defense establishment controls substantial physical assets, including land, logistics corridors, industrial zones, and former military-industrial facilities. Alignment between diplomatic, defense, and economic priorities ensures that commercial projects will not be obstructed by bureaucratic fragmentation, a major risk in post-conflict states. The defense dimension also matters for infrastructure security.

Russian companies entering Syria in sectors such as energy, transport, ports, telecommunications, and mining require predictable security guarantees, not ad hoc arrangements. Discussions on modernizing Syria’s defense capabilities and transferring technical expertise indirectly support investment de-risking by ensuring the protection of strategic assets.

This integrated approach mirrors Russia’s own model of state-coordinated development, where security, diplomacy, and economics operate within a single strategic framework. The meeting represents a critical step in translating political rapprochement into structured economic and defense-industrial cooperation. Coming at a time when Syria is transitioning from post-conflict stabilization to reconstruction, the talks underscored Moscow’s intent to institutionalize bilateral engagement beyond crisis management. From an economic perspective, this reaffirmed Russia’s support for Syria’s reintegration into regional and international economic frameworks, creating a more predictable environment for trade, investment, and infrastructure development. The Russian FM Sergei Lavrov emphasized that bilateral trade and economic relations will continue to develop based on the foundation established over the past several decades. Syria-Russia relations are entering a new stage; Damascus seeks to forge balanced relations with all countries, Asaad al-Shaibani said during talks with Putin.

Diplomatic coordination at the top levels is essential for advancing trade facilitation, investment protection mechanisms, and alternative financial arrangements—key prerequisites for Russian companies operating in a sanctions-affected environment.

Trade Relations

Russia-Syria trade volumes remain modest by global standards, but this is precisely what makes the current moment strategically important. Bilateral trade has historically fluctuated between US$ 1-2 billion annually, heavily skewed toward Russian exports. These include wheat, petroleum products, fertilizers, steel, timber, and military-technical supplies. Syria’s exports to Russia—primarily agricultural goods, phosphates, and textiles—collapsed during the war years but are now positioned for recovery.

Bilateral trade is limited ($650 million in 2024) but is expected to grow. Syria is part of the Greater Arab Free Trade Agreement (GAFTA) and has several agreements with Russia. The post-sanctions environment and Syria’s urgent reconstruction needs create structural demand for Russian goods and services, particularly in: Construction materials and heavy machinery; energy equipment and refining technology; railways, power grids, and water systems; and agricultural inputs and grain supplies. From a trade policy perspective, the discussions in Moscow emphasized trade facilitation, customs coordination, and payment mechanisms, addressing one of the biggest historical obstacles: transaction settlement. With Russia increasingly operating outside Western financial systems, Syria becomes a natural partner for ruble-based trade, bilateral clearing arrangements, and alternative payment infrastructures, including systems aligned with the Eurasian Economic Union (EAEU).

With over 4,000 Syrian students currently studying in Russian universities, Moscow is investing in the next generation of Syrian human resources, ensuring they acquire the skills to contribute to the rebuilding and development of their homeland. Syria, emerging from years of conflict, is consolidating political stability. Recent parliamentary elections have reinforced pro-presidential forces, creating a solid foundation for governance and enabling closer strategic collaboration with Moscow.

Economic cooperation is at the heart of the renewed agenda. Russian investments span critical sectors—oil, gas, fertilizers, and infrastructure—with significant projects underway, from energy and transport modernization to housing programs for returning refugees. Russia is making substantial investments in Syria’s critical infrastructure, focusing on the reconstruction of Tartus port, the modernization of fertilizer production, and the rehabilitation of multiple oil and gas fields and refineries. Beyond these initiatives, Moscow is pursuing 40 additional projects across key sectors essential for Syria’s recovery, including energy, transport infrastructure, housing, and industrial development. Syria’s phosphate reserves, among the largest in the Arab world, hold an estimated 1.7-1.8 billion tons in phosphate reserves and offer a US$238 billion revenue opportunity, with Russian-managed operations ensuring production and export stability. Reconstruction is driving both employment and economic recovery. Syria’s energy and agricultural sectors represent a unique opportunity for Russia to combine strategic influence with economic cooperation.

Before 2011, Syria’s oil sector was a cornerstone of the national economy, with proven reserves of 2.4 billion barrels valued today at US$140 billion. Production averaged 350,000 barrels per day, supplying domestic refineries in Homs and Baniyas and enabling exports of 150,000 barrels daily, generating US$3.2 billion annually. Natural gas reserves of 240 billion cubic meters complemented oil production, with an exportable surplus worth over US$1.3 billion per year.

For Russia, the restoration and modernization of Syria’s energy infrastructure offer significant economic and strategic benefits. Investments in extraction technology, refinery upgrades, and gas pipeline development will not only revive Syria’s energy independence but also strengthen Russia’s regional presence in the Levant and Mediterranean.

Agriculture, too, offers a critical pathway for cooperation. Prior to the conflict, it contributed 17.6% of Syria’s GDP and provided $2.6 billion annually in export revenues, accounting for 30% of total exports. Russian expertise in modern farming, irrigation, and processing can help rebuild Syria’s rural economy, secure food production, and create jobs. Through targeted investment in energy and agriculture, Russia can solidify its role as a reliable partner, supporting Syria’s recovery while advancing Moscow’s strategic and economic objectives in a pivotal region.

By 2030, Russian-led projects are expected to create hundreds of thousands of jobs, while improvements in infrastructure and energy systems will support the return of large numbers of displaced Syrians. Revenue from phosphate exports is being reinvested into infrastructure, establishing a sustainable cycle of development. Despite challenges including sanctions, security threats, and regional competition, Russia’s approach emphasizes pragmatic engagement over ideology, blending economic influence with strategic cooperation. By focusing on reconstruction, resource development, and stability, Moscow demonstrates that partnership and practical support, rather than mere rhetoric, remain the cornerstone of Russia-Syria relations in this new chapter of regional cooperation. Both Russia and Syria have the potential to significantly enhance the scale and quality of bilateral trade, raising the volume to US$2-3 billion in the near term.

Military Base Security

Although media reports suggest that Russian forces have initiated a withdrawal from Qamishli Airport in northeastern Syria due to escalating internal Kurdish insurgent dynamics, this move should not be interpreted as a strategic retreat. Russia continues to maintain a substantial military footprint in Syria and the broader region, anchored by key bases and long-term security interests. According to the agency, the withdrawal is taking place gradually, with some units, equipment, and hardware being redeployed to Russia’s far larger Hmeimim Airbase in the west of the country, while the remaining troops are being returned to Russia. At the same time, Russia’s Tartus naval facility and Hmeimim airbase may continue to safeguard the nation’s Mediterranean presence, providing security while supporting reconstruction initiatives.

Russian President’s Special Envoy for the Middle East and Africa, Deputy Foreign Minister Mikhail Bogdanov, said after talks with the new authorities in Damascus that the parties had agreed to continue consultations on maintaining Russian military bases in the country. The earlier visit of Syria’s defense minister added a crucial industrial dimension. Defense-industrial cooperation is not limited to arms supply; it encompasses technology transfer, maintenance, training, and the modernization of industrial capacities with civilian spillover effects, including metallurgy, electronics, and engineering services. For Russian defense and dual-use manufacturers, Syria offers long-term opportunities in equipment upgrades, localization of maintenance facilities, and workforce development. Collectively, the talks reinforce a shift toward a comprehensive partnership where security cooperation underpins economic reconstruction, enabling Russian firms to engage in Syria with greater institutional clarity, strategic alignment, and long-term commercial confidence.

Investment and Reconstruction: Syria as a Long-Term Capital Market

It is estimated that postwar reconstruction costs exceed US$215 billion. This scale cannot be met by public finance alone. Foreign direct investment, public-private partnerships, and state-backed development financing will be essential. Direct physical damage to infrastructure, housing, and non-residential buildings was estimated at about US$108 billion, of which US$52 billion represented total damage to infrastructure alone.

Russia’s competitive advantage lies not in short-term speculative capital, but in patient, state-aligned investment, particularly in sectors where Russian firms already possess technological and operational expertise. Syria’s population stands at 25 million, with an additional 7 million refugees abroad, half of whom are in Turkiye. Efforts to rebuild infrastructure and housing aim to encourage their return.

Syria’s current GDP (PPP) is estimated at just US$10 billion, reflecting the severe impact of years of conflict and sanctions. Reconstruction, human resource development, and economic partnerships offer significant growth potential. Russia’s involvement positions it as a key partner in Syria’s path to recovery and stability.

Recent developments highlight the strengthening of Russia-Syria ties. For example, a Russian specialist printing house has secured the contract to produce Syria’s new banknotes, signaling growing economic cooperation. This move underscores Moscow’s role as a trusted partner in Syria’s reconstruction and financial modernization.

Energy and hydrocarbons remain central. Syria possesses proven oil and gas reserves, much of which require rehabilitation rather than exploration. Russian companies such as Stroytransgaz, Zarubezhneft, and Gazprom-affiliated entities are well positioned to lead redevelopment under production-sharing agreements. Infrastructure development is equally critical.

Syria’s ports, railways, and highways were heavily damaged. Russian firms specializing in transport engineering, port management, and logistics infrastructure can play a decisive role, particularly in linking Syria to Eurasian trade corridors. Industrial revival, including cement, fertilizers, metallurgy, and pharmaceuticals, represents another opportunity. Many facilities exist but require capital, technology, and management expertise rather than greenfield construction.

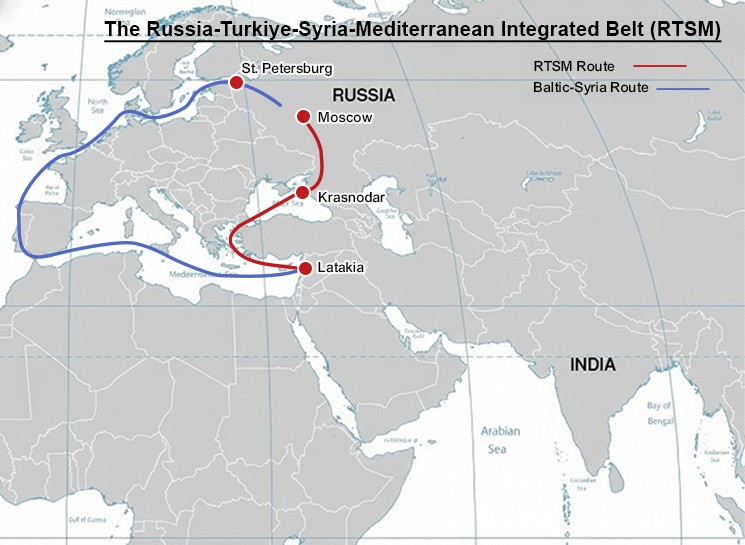

The Russia-Türkiye-Syria-Mediterranean Integrated Belt

The strengthening of ties between Russia, Syria, and Turkiye marks the emergence of a strategically and economically significant corridor: the Russia-Turkiye-Syria-Mediterranean integrated belt. With Turkiye maintaining strong relations with the al-Sharaa government and Russia expanding trade and connectivity with Ankara, this corridor promises to link critical regions from both Russia’s Baltic Sea (maritime) and its Black Sea ports (multimodal, via Turkiye) through Syria to the Mediterranean with further reach to the Levant and North Africa.

This integrated belt is more than a trade route; it represents a transformative axis for the Mediterranean and Arab world, fostering economic development, energy cooperation, and infrastructure modernization. Russian investments in Syrian ports, transport networks, and industrial hubs, combined with Türkiye’s regional expertise and logistical capabilities, ensure the smooth flow of goods, resources, and capital across borders. Beyond the Middle East, the corridor extends opportunities to North Africa, opening new avenues for commerce, energy exports, and regional cooperation. By creating a stable, interconnected network, Russia demonstrates its commitment to pragmatic partnerships, regional stability, and sustainable development, solidifying its role as a reliable partner in the reconstruction and prosperity of allied nations.

The INSTC: Syria’s Role in Eurasian Logistics

Perhaps the most under-analyzed aspect of the recent Putin-Sharaa meeting is its implication for Eurasian connectivity, particularly in the context of the International North-South Transport Corridor (INSTC). Syria’s geographic position at the eastern Mediterranean gives it the potential to serve as a southern maritime gateway for Eurasian trade, linking Russia, Iran, and Central Asia to Mediterranean and African markets. The port of Tartous, where Russia already has a long-term presence, is central to this vision. Modernization of Tartous as a multi-modal logistics hub would allow Russian cargo to bypass congested or politically sensitive routes. From Tartous, goods can move via land corridors to Iraq, Iran, and the Gulf, complementing INSTC routes through the Caspian and the Caucasus. This creates redundancy and resilience in Russia’s trade architecture, an increasingly valuable asset under global fragmentation. These should therefore be understood as part of a broader Russian strategy to diversify logistics and trade routes, reducing dependence on chokepoints controlled by unfriendly actors.

Dispelling Mistrust and Institutionalizing Trust

One of the quieter but most important outcomes of high-level engagement is the normalization of trust after years of war, sanctions, and regime change. The new Syrian leadership has actively sought to distance itself from opaque governance practices of the past. The meetings provide a platform to prioritize trade pragmatisms and pragmatic engagement over geopolitical ideology and clarify policy intentions, regulatory frameworks, and investment protections, reducing the informal risk premiums often attached to Syria. For Russian companies, this means a shift from relationship-based access to institutionalized cooperation, including: Clear licensing and concession frameworks, manageable tax and customs regimes, legal protections for foreign investors, and dispute resolution mechanisms. This institutional clarity is essential for attracting not only Russian state firms but also private Russian SMEs seeking overseas markets.

Opportunities for Russian Companies in Post-War Syria

As Syria enters what can be termed a post-war normalization phase, Russian companies face a window of opportunity that is likely to narrow as competition increases. Russian firms enjoy first-mover advantages, political goodwill, and operational experience in the Syrian market. These advantages can translate into dominant positions if leveraged early and strategically. Sectors such as energy services, transport construction, power generation, agro-industrial processing, and digital infrastructure are particularly promising. Moreover, Syria’s reconstruction will be labor-intensive, creating opportunities for Russian equipment suppliers, engineering consultancies, and vocational training providers, rather than only capital-heavy investors.

Syrian Opportunities in the Russian Market

The relationship is not one-sided. Syrian companies and entrepreneurs increasingly view Russia as a stable export destination and investment partner, particularly as European markets remain politically constrained. Agricultural products, food processing, textiles, light manufacturing, and pharmaceuticals are sectors where Syrian firms can integrate into Russian supply chains. Russia’s large Syrian diaspora, combined with Moscow’s openness to labour mobility from friendly states, creates additional channels for human capital exchange and SME collaboration. In the medium term, Syria could also become a platform for Russian companies targeting Middle Eastern and African markets, benefiting from cultural, linguistic, and geographic proximity.

Summary

The meeting should be read as the formal opening of a new economic chapter. It consolidates political trust, aligns security and development priorities, and sends a clear signal to Russian businesses that Syria is no longer merely a geopolitical theatre, but an emerging reconstruction economy embedded in Eurasian connectivity frameworks.

For both Syria and Russia, the message is unambiguous: Syria represents risk, but increasingly, it represents structured, manageable, and strategically valuable opportunity. Those who move early, align with state priorities, and commit to long-term engagement will help shape not only Syria’s recovery but also Russia’s economic footprint in the Eastern Mediterranean and beyond.This article was written by M. Jahan, an expert on Russia-Middle Eastern affairs. He may be contacted at info@russiaspivottoasia.com

Русский

Русский