Russia’s Foreign Minister Sergey Lavrov has been in New York attending the annual UN General Assembly. During the UN events, several other bilateral meetings were held as numerous countries wish to discuss current affairs with Moscow. Lavrov subsequently met with Bakhtiyor Saidov, the Foreign Minister of Uzbekistan.

The ministers discussed current issues on the agenda of bilateral relations, including the preparation of events within the framework of interstate dialogue, as well as exchanging views on global and regional matters.

Lavrov and Saidov reaffirmed their commitment to consistent joint efforts to strengthen the comprehensive strategic partnership and allied relations between Russia and Uzbekistan in accordance with the agreements reached by their Presidents.

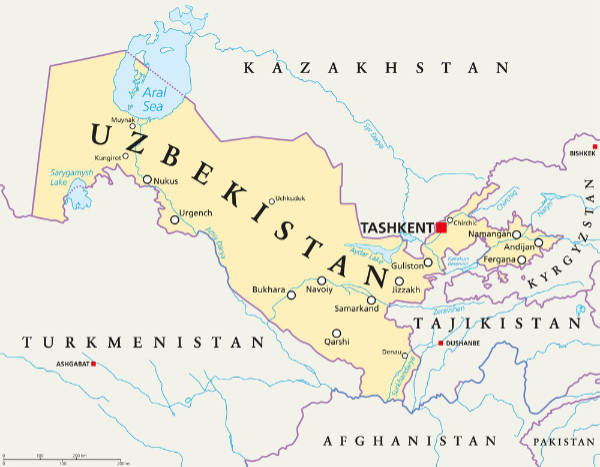

Russia and Uzbekistan have had historically close ties, with economic and geopolitical rationale pushing the two countries to seek closer ties. For Russia, Uzbekistan arguably has the most strategic location in the Central Asian region, as the country shares borders with all Central Asian states (Kazakhstan, Kyrgyzstan, Tajikistan, and Turkmenistan) in addition to Afghanistan, and sits on a large part of the agriculturally rich Fergana Valley, with a sizable population as well as oil and natural gas deposits.

However, Uzbekistan’s strategic location and resources have enabled it to resist Moscow’s pressure to enlist Tashkent into both the CSTO and the EAEU, although it does have a position as an observer state to the latter. Although Russia’s trade and economic ties have experienced significant shifts following the Ukraine conflict, this has nevertheless positively influenced Moscow-Tashkent ties, as is reflected in the growing dynamics in trade, investment, and cultural ties.

Bilateral Trade

Russia returned to a prominent place in the list of Uzbekistan’s main foreign trade partners in 2022, with trade turnover between the countries increasing by 23% compared to 2021 – up to US$9.28 billion (18.6% of Uzbekistan’s total foreign trade turnover). It is also growing; 2023 bilateral trade turnover reached just under US$10 billion.

Russian exports to Uzbekistan mostly consist of industrial products (42.3% of total supplies of manufactured goods to Uzbekistan), machinery and transport equipment (6.5%), and food products. Other exported merchandise include metals, food products and agricultural raw materials, wood and pulp and paper products, various chemical and mineral products, precious metals, and stones.

Uzbekistan’s Agricultural Economic Indicators

Uzbekistan’s economy is mainly dependent on agricultural production. Since most of its population lives in rural areas, employment in the agricultural sector is high, influencing the structure of the country’s foreign trade. A look at Uzbekistan’s export capacity to Russia shows that it mainly consists of agricultural and food products. Other merchandise are food products and agricultural raw materials, chemical industry products, machinery equipment and vehicles, precious metals and stones, clothing, and clothing accessories, of knitted or crocheted kinds, copper, and zinc.

Yet despite Uzbekistan’s strong position in the agricultural sphere. Russia, as an agricultural giant in its own right, has now evolved into Uzbekistan’s net supplier of agricultural and food products. This shift has been caused by a variety of reasons, such as Russia’s development of its own agricultural base to add to Uzbekistan’s structural production problems.

Another more significant reason is the creation of the Eurasian Economic Union (EAEU). The fact that Uzbekistan sends fewer agricultural products to Russia doesn’t necessarily mean that the country’s production is lagging behind. Uzbekistan exports a significant amount of agricultural merchandise to Kazakhstan, another member of the EAEU.

Nonetheless, Uzbekistan remains a target for Moscow to entice into the EAEU, and with food security and military security and investment – especially as regards Afghanistan – on the agenda, it may only be a matter of time before Uzbekistan becomes more deeply involved in EAEU trade.

Further Reading

Russia, Uzbekistan Look To Triple Bilateral Trade By 2030

Русский

Русский