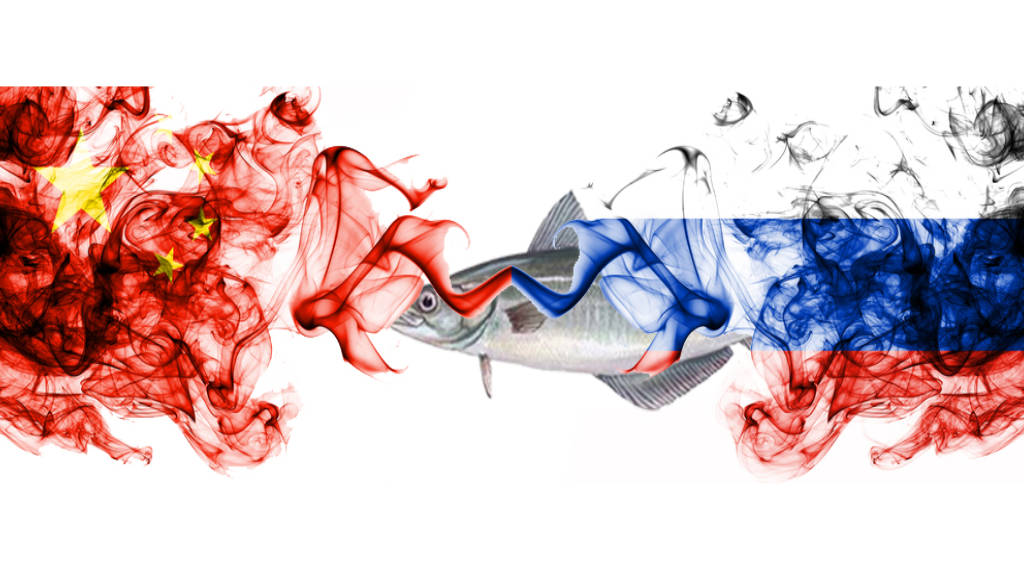

Russian fish exporters need to actively develop new niche markets through marketing tools, according to German Zverev, President of the All-Russian Association of Fishermen. This will be of interest to Russian sales and marketing businesses with China market capabilities. According to Zverev, China is currently the second largest global importer of fish products after the United States. In 2023, the volume of China’s purchases amounted to US$18.76 billion, or 10% of the total global trade in aquatic produce.

Zverev pointed out that these dynamics will change. “Due to changing consumer dynamics, in the coming years, China will overtake the United States, becoming the main importer of fish products in monetary terms. The Chinese market is important for Russia: in 2023 it accounted for about 50% of Russian exports, the share of Russian fish products in total Chinese imports reached 15.5%.”

Zverev said that China also will eventually lose its role as an intermediate processing sector for the supply of processed products to Europe and the United States, while at the same time its position as the largest consumer of seafood will grow. “This opens up prospects for increasing the supply of Russian fish products for China’s domestic consumption, but at the same time it creates a need for high-quality marketing of our products. Russian fishermen have previously been successful in creating niche markets in China.”

Zverev quoted example of premium crab. According to him, in the 2000s, Russian fishermen created a premium crab market in China from zero. As a result, from 2017 to 2023, the supply of live crabs increased fivefold from 6,300 to 30,100 tonnes. “Norwegian companies have managed to generate demand for chilled fillets of aquaculture Atlantic salmon: supplies soared from 598 tonnes in 2016 to 39,400 tonnes in 2023. One of the latest examples is Russian frozen crab. The Chinese began to consume it at home. As a result of the emergence of a new market, the supply of frozen crabs has increased almost ten times in just two years to 10,800 tonnes by the end of 2023. Another case is Surimi (Fish paste, an ingredient used in many Asian dishes). The affordable price and high quality of Russian Pollock Surimi have allowed Russian fishermen to take a strong position in this market,” Zverev said.

According Zverev, there are also prospects for the development for other Chinese niche markets, including Pollock Caviar, Sardines, and fishmeal for aquaculture farms.

Further Reading

Russia Increases Share Of South Korea’s Crab Consumer Market

Русский

Русский