As the United States has aptly demonstrated, the global world order is changing and is in the process of being remade into new alliances—both in terms of political and military pressure, with the latter now being utilised to enforce the former.

Yet the current position Washington is taking—with assets close to its own territory as concerns both Venezuela and the Greenland issue—to some extent disguises the global impact.

While the brazen attacks on Venezuela have given notice that the United States is intent on enforcing energy supplies—and US favouring ‘democracy’ at the point of a gun—the more apparent it is that the long-term consequences of the Ukraine conflict also reach far beyond Europe’s borders and are also changing the contours of the world as we know it.

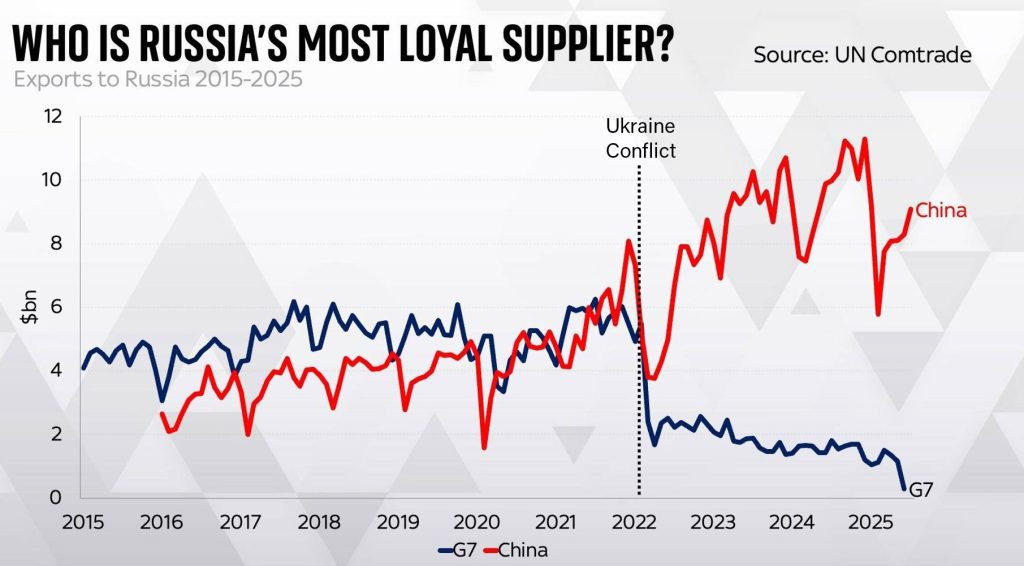

This process began in February 2022, when Russia sent troops into Ukraine. Back then, there were a few important benchmarks in the global economy. The amount of goods exported to Russia by the G7—the grouping of Western, wealthy, industrialised nations – was about the same as China’s exports. Europe was busily sucking in most Russian oil.

But today, nearly four years later, G7 exports to Russia have diminished to nearly zero as a consequence of sanctions. Russian assets, including government bonds previously owned by the Russian Central Bank, have been confiscated, and their fate is being wrangled over. But Chinese exports to Russia, far from falling or even flatlining, have risen sharply. Exports of Chinese transport equipment, for example, are up nearly 500%. We can see how this has impacted trade flows in terms of the replacement by China of Russia’s trade with the G7 since the Ukraine conflict began.

Meanwhile, India has gone from importing next to no Russian oil to relying on the country for the majority of its crude imports. So much oil is India now importing from Russia that the US has said it will impose secondary tariffs on India, doubling the level of tariffs paid on Indian goods imported into America to 50%—one of the highest levels in the world.

The impact of this, and the subsequent response by the G7 to it, isn’t just conflict and military action. Even more far-reaching is what is now a sharp divergence in economic strategies around the world. Some countries—notably the members of the Shanghai Cooperation Organisation—have doubled down on their economic relationship with Russia. Others have banned and actively discouraged trade and investment with Russia.

The Shanghai Cooperation Organisation (SCO) is a ten-member political, economic, and international security group that began in 1996 to settle border disputes after the Soviet Union collapsed and the Cold War ended, most notably to keep an eye on what was happening in Afghanistan. Reflecting that initial purpose, it was originally named the Shanghai Five and included Russia, Kazakhstan, China, Kyrgyzstan, and Tajikistan. In 2001 it renamed itself the Shanghai Cooperation Organisation (SCO) and included Uzbekistan, while India and Pakistan were part of its 2017 expansion, with Iran added in 2023 and Belarus in 2024. The SCO also has numerous key partners, including Saudi Arabia, the United Arab Emirates, and Turkiye.

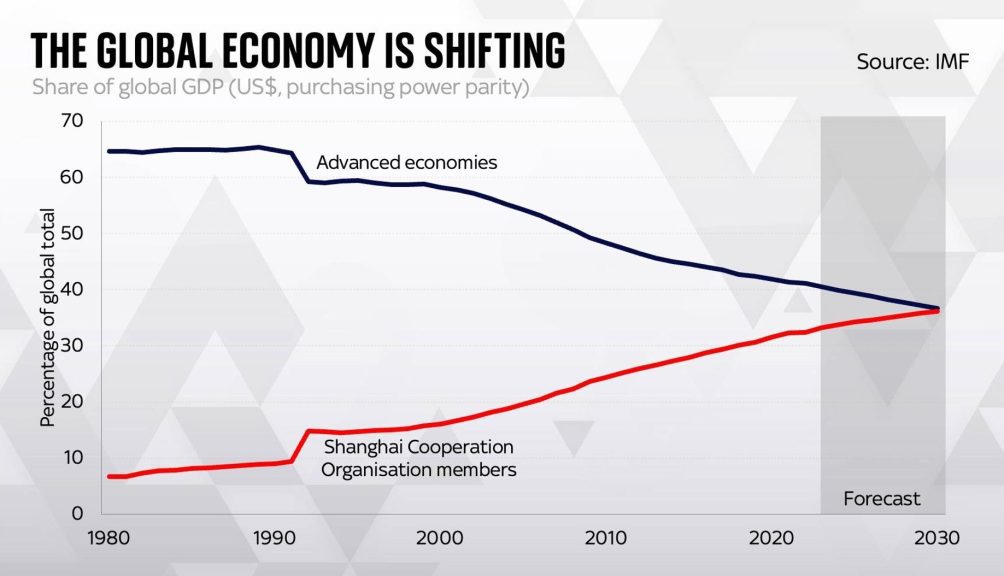

Today, the SCO full members represent 43% of the world’s total population and about 23% of global economic output (GDP). It has morphed from what was purely a group with a security remit to prevent Islamic fundamentalism from spreading further into Asia, into the Asian nations, as members now realize an opportunity they had never previously imagined: an economic future that doesn’t depend on the financial infrastructure of the United States. That was more than adequately displayed in the chaotic and humbling withdrawal of the US military from Afghanistan.

At that time, Asian nations were the largest purchasers of US government debt, in part to provide them with the dollars they needed to buy crude oil, which is generally denominated in the US currency. But since the Ukraine conflict began, Russia has begun to sell its oil without denominating it in dollars. As a result, many Asian nations reduced their purchases of US debt. Part of the explanation for the recent rise in US and UK government bond yields is that there is simply less demand for them from foreign investors than there used to be. The world is changing—and the foundations of globalisation are now shifting.

This is why it is pertinent to pay attention to the Shanghai Cooperation Organisation. While its members originally accounted for only a small portion of global economic output, today that is on the rise. If the share of global GDP is adjusted to account for actual purchasing power, the share of global GDP accounted for by the SCO nations is close to overtaking the share of GDP accounted for by the world’s advanced nations and is likely to do so by 2030.

This is additionally cemented by new alliances being formed. Ever since the partition of India in 1947, India and Pakistan have been at loggerheads, with occasional military outbreaks and the ongoing, constant threat of a serious war. China, mindful that India could pose a serious economic threat, supported Pakistan during this time, in part to keep New Delhi occupied with security concerns to distract it from reaching its true economic potential. It is a strategy that has been effective for nearly 80 years. Yet this too is changing—what would have been implausible even in 2022 is that China and India are now edging closer to an economic rapprochement and seeing each other with shared problems rather than unsolvable disputes. For example, India now faces significant tariffs from the United States, while Beijing has endured its own tariff wars from the same source. New Delhi now sees little downside in cementing relations with Beijing—a seismic moment in geopolitics. While the West ponders the increasing relations and dynamics between Moscow and Beijing, the Beijing-New Delhi dynamics are just as important. This is a consequence few would have guessed at when the Russia/Ukraine conflict began. Yet it is likely to be of enormous importance for geopolitics in future decades.

Further Reading

Русский

Русский