The Eurasian Development Bank (EDB) has released a Eurasian Transport Framework (ETF) Observatory, being an analytical tool for monitoring and systematising infrastructure projects related to Eurasian international transport corridors and routes, covering 13 countries: Azerbaijan, Armenia, Afghanistan, Belarus, Georgia, Iran, Kazakhstan, Kyrgyzstan, Mongolia, Russia, Tajikistan, Turkmenistan, and Uzbekistan.

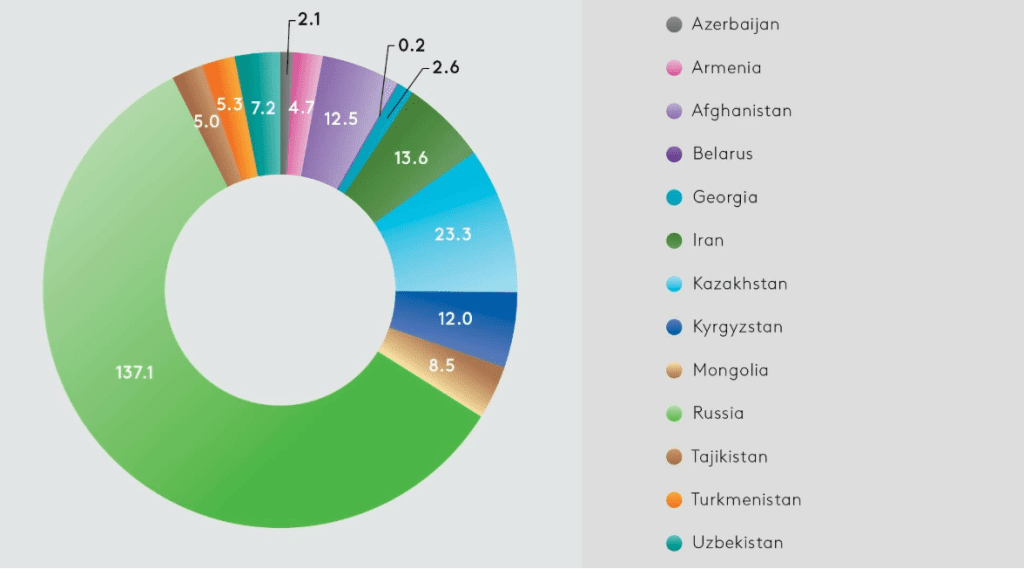

It currently lists 325 projects at various stages of implementation, including those already underway and planned, and showcases a total investment volume for these projects as being worth US$234 billion. More than half of all projects are in the road transport sector. In the country context, seven out of 10 of the largest ETF development projects are in Russia.

More than 60% of the total number of projects, by investment size, are under implementation. Project documentation is being prepared for 13% of projects, and 27% are in the discussion or planning stage.

Distribution of investments for the development of the Eurasian Transport Network across Eurasian countries, US$ billion

Top 10 Eurasian Transport Network development projects in Central Asia, US$ billion

Central Asia accounts for more than 22% of the investments directed towards ETF development. Ninety projects are being implemented or planned for implementation, with a total value of about US$53 billion, with about 44% of this being projects implemented in Kazakhstan. Almost two-thirds of the investments in Central Asia are aimed at developing the main road network. The 10 largest projects account for 58% of the total investment volume in ETF development in Central Asia.

The EDB reported that a total of 113 out of 325 ETF development projects involve the participation of private sector finance in their implementation: regional businesses are investing in the Eurasian region. Of these, 17 projects are being implemented on the principles of public-private partnership (PPP), including at least two projects based on the principles of cross-border PPP (the China-Kyrgyzstan-Uzbekistan and the Trans-Afghan railway corridors).

Increasing the number of projects attractive to multilateral development banks and private investors, including PPP projects, is becoming an important direction for transport planning and the development of cooperation between the region’s countries in the transport sector.

The EDB is implementing three megaprojects within the framework of its 2022–2026 Strategy. These are:

The Water and Energy Complex of Central Asia

Central Asia faces serious challenges to sustainable development in terms of water and energy supply. The deterioration of irrigation systems, the low share of the introduction of modern technologies, and the suboptimal regulation of river flow lead to a shortage of water resources in the Aral Sea basin. A critically important, interconnected system of shared rivers (Amudarya, Syrdarya) and hydropower/irrigation infrastructure characterized by uneven water distribution (the upper reaches—Kyrgyzstan/Tajikistan—has water; the lower reaches—Kazakhstan/Uzbekistan—needs it for agriculture) and significant cooperation challenges, despite the potential for major economic benefits from integrated management (the Nexus approach) to enhance energy security, resilience to climate change, and efficiency, with initiatives such as the World Bank’s CAWEP and the EDB’s support for regional dialogue.

Improving the efficiency of river flow regulation, modernizing irrigation systems, and introducing modern irrigation methods in agriculture will eliminate water scarcity. The development of the energy systems of the countries of the region, taking into account the use of the potential of their parallel operation, will reduce the need for additional energy facilities, meet the growing demand for electricity, and increase the reliability of energy supply to consumers.

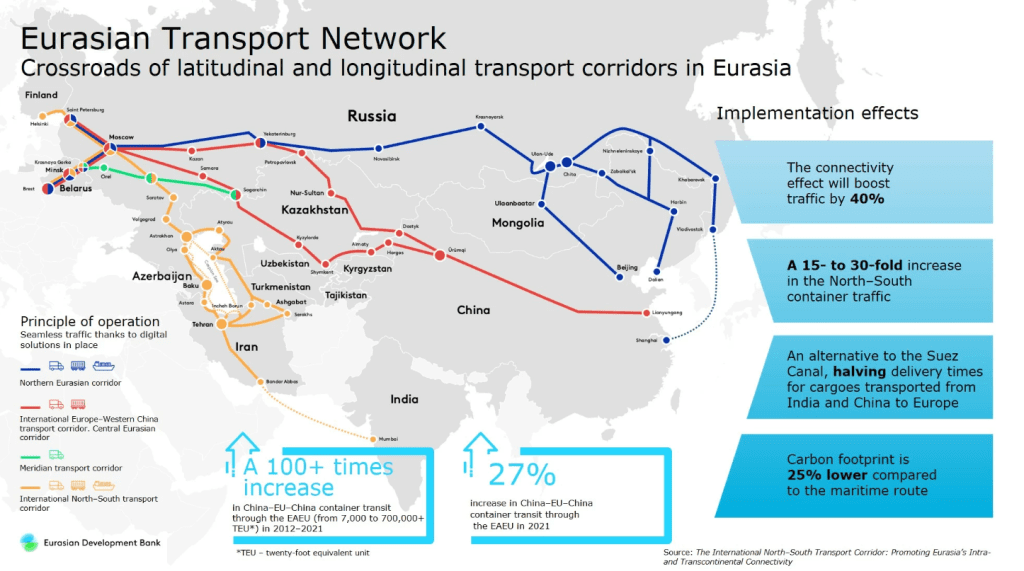

The Eurasian Transport Framework

The Eurasian Transport Framework is a network of international transport corridors and routes that ensure the internal and transcontinental connectivity of the Eurasian countries. The backbone of the framework consists of East-West and North-South corridors connecting Europe, Asia, and the Middle East. The development of the Eurasian Transport framework makes it possible to solve a set of tasks relevant to the whole of Eurasia: to increase economic and trade connectivity, to give impetus to the realization of the agro-industrial potential of the countries of the region, to promote the efficiency of logistics, as well as to improve human well-being. The ETC includes five key international transport corridors—the Northern, Central and Southern Eurasian Corridors, MTK TRACECA, and MTK North–South—are complemented by branches and regional routes. An important aspect is the development of the soft infrastructure of the Eurasian transport framework. In particular, the development of integrated logistics services makes it possible to move from the competition of corridors and modes of transport to their interaction. The effects of improving soft infrastructure are comparable to the benefits of developing physical infrastructure. The improvement of soft infrastructure is based on the implementation of three principles—harmonization, coordination, and digitalization.

The Eurasian Goods Distribution Network

The Eurasian Commodity Distribution Network (ETS) is an open integrated management system for agricultural product flows in the EAEU territory from the producer of agricultural products along the entire logistics chain to the retail network.

It is assumed that the basis of the ETPS will be a digital platform, the users of which will be both government and commercial organizations in the field of:

agro-industrial complex, including small enterprises engaged in the production of agricultural products; logistics infrastructure, including wholesale distribution centers, trade and logistics centers, and specialized storage warehouses; and food transportation infrastructure.

The digital system is designed to integrate available data from existing national information systems and information systems of private companies operating in the territory of the ETPS member countries.

The Middle East

The EDB also presented its first macroeconomic study of the Gulf countries.

The EDB’s interest in the Gulf region is related to the rapid development of trade, economic, and investment cooperation between the Middle East and Central Asia. Mutual trade turnover between Central Asia and the Gulf countries increased by 4.2 times over the past five years, reaching US$3.3 billion, while accumulated foreign direct investment grew 1.8 times to US$16.2 billion.

The Gulf economies are not only a global energy centre but also new financial partners for the EDB member countries. Their stability and readiness to invest in long-term projects open opportunities for growth and mutually beneficial regional cooperation, as they control about 30% of the world’s oil reserves and are collectively the largest exporter. The oil and gas sector provides 50% to 90% of the region’s export revenues.

Aggregate sovereign wealth funds exceed US$5 trillion, and the region’s gold and foreign exchange reserves (US$813 billion) are significantly higher than generally accepted norms, which allows the countries of the region to maintain stability even if oil prices fall.

At the same time, a course has been set for diversification and transformation. This is especially true in the United Arab Emirates, where oil and gas already accounts for just 20% of exports, and the economy is becoming a global centre for finance, tourism, and logistics. That trend is gradually spreading throughout the Middle East, with much of the sovereign wealth being spent on improving links with Central Asia – fellow Islamic countries. Russia’s relationship with the Gulf economies is also growing.

The UAE and Saudi Arabia have the largest funds: at the end of 2024, their volumes amounted to US$2.3 trillion and US$1.3 trillion, respectively. These assets are financing projects aimed at the development and diversification of their economies, with the results of these investments becoming clearer as existing projects are completed and additional ones begun based on that initial platform.

The advancement of the Eurasian Transport Network is paving the way for the development of both the Middle East and Central Asia as Eurasian hubs with access to markets in Europe, Africa, and Asia. Establishing transport hubs will facilitate an increase in international traffic, including transit. The EDB projects that freight traffic along the three main corridors running through Central Asia will increase by 1.5 times to 95 million tonnes by 2030, while container traffic is expected to grow even more rapidly, by almost two-thirds, reaching 1.7 million TEU.

Improved transport connectivity will also create momentum for realizing the region’s agro-industrial potential. The Eurasian region is one of the world’s breadbaskets and can provide food for 600 million people through agricultural exports.

Given the limited investment opportunities facing most developing countries in Eurasia, especially those with middle or lower-middle income levels, a key area of cooperation to develop transport links in Eurasia is boosting the number of projects attractive to international development banks and private investors—an issue the Eurasian Transport Framework Observatory is designed to solve.

Further Reading

Russia–Central Asia Six-Party Summit Held In Dushanbe: Putin Speech & Analysis

Русский

Русский