Discussions concerning the development of a new, potential BRICS currency have been on-going for some time, yet have intensified in recent months due to several Heads of States meetings taking place that have actively discussed and committed research into the issue. A trend is emerging in the modern geopolitical landscape: large international associations such as the BRICS and the Shanghai Cooperation Organisation (SCO) are actively discussing the idea of creating their own currencies for interstate settlements.

This initiative is becoming particularly relevant in the light of the current global economic situation and sanctions pressure on several countries. Russia, China and India, all being members of both BRICS and the SCO find themselves at the epicentre of these discussions.

The potential benefits of introducing new currencies for Moscow in particular are obvious: the development of such aa currency would help circumvent sanctions restrictions in international trade and reduce dependence on the US dollar, all transactions with which are transparent to the US Treasury Department.

It is interesting to note that the most active supporters of the idea of a single currency are Brazil within the framework of the BRICS and Iran in the context of the SCO. So what are the motives of these countries in introducing their own currencies and the consequences of implementing their initiatives?

Brazil and the BRICS currency

Brazil’s interest in creating a single BRICS currency has deep roots. Back in 2015, the BRICS New Development Bank (NDB) was founded, designed to finance projects of the participating countries that could not receive support through traditional international financial institutions controlled by Western countries.

This opened up opportunities for Brazil, not only for its own development, but also for the implementation of integration projects in Latin America, strengthening the region’s independence from the United States and Brazil’s leadership position.

However, in 2022, the bank, headed since March 2023 by an associate of President Lula da Silva and former Brazilian President Dilma Rousseff, was forced to suspend consideration of new investment projects in Russia due to fears of secondary sanctions from the United States.

This has prompted the Brazilian leadership to look for alternative tools to achieve its strategic goals.

Currently, the BRICS Bridge unified payment system is being developed, which will allow settlements using the national currencies of the BRICS countries, eliminating the need to convert into dollar through American banks. However, this process is far from over, and Brazil is forced to balance between the desire for financial independence and the risk of falling under secondary American sanctions.

The SCO and the Currency Initiative

The Shanghai Cooperation Organisation (SCO), originally established in 2001 to strengthen security in Central Asia, has expanded its agenda and geography over time. Today, it includes Belarus, China, India, Iran, Kazakhstan, Russia, Kyrgyzstan, Pakistan, Tajikistan, and Uzbekistan. Afghanistan and Mongolia have an observer status with the SCO, and a further fourteen — Azerbaijan, Armenia, Bahrain, Cambodia, Egypt, Kuwait, Maldives, Myanmar, Nepal, Qatar, Saudi Arabia, Sri Lanka, Türkiye and the UAE have dialogue partner status. The SCO represents 40% of the world’s population, with member countries contributing about US$23 trillion (30%) of global GDP.

The geopolitical events of the past three years have significantly increased the importance of economic issues in the context of ensuring regional security. The pivot of Russia’s foreign trade to the Global South, as well as a now aggravated situation in the Middle East and the Red Sea, has resulted in a change in logistics chains and increased the relevance of the development of the North-South transport corridor passing through Iran.

Iran, also disconnected from the SWIFT global payments system, is particularly interested in creating alternative mechanisms for international settlements.

Unlike Brazil, Tehran is less concerned about the possible reaction of the United States and is ready to take decisive steps to create an interstate payment system independent of the dollar.

The combining of Iran’s Shetab payment system and Russia’s Mir payment system has almost been completed. Towards the end of this year, it is expected that Iranians will be able to receive Rubles at Russian ATMs, and Russians will be able to use Mir cards in Iran with withdraw Rials.

Meanwhile, Russia’s trade with the SCO members has breached US$330 billion, meaning the financial clout is certainly there.

China and India

China, being a key player in the SCO, takes a more cautious position on the issue of creating a single currency. On the one hand, Beijing is interested in a settlement instrument beyond the control of the United States.

On the other hand, China’s trade volumes with the United States and the EU significantly exceed the trade turnover with the SCO countries, which forces the Chinese leadership to act with an eye to possible consequences for relations with Western partners.

At the same time, the RMB Yuan is increasingly being used in international settlements between countries of the Global South. In these circumstances, it is more profitable for China to support someone else’s initiative to create an alternative payment system than to promote its own.

India, another major player in the SCO, is also interested in developing alternative international settlement mechanisms. The possibility of using the Indian RuPay payment system in Russia and the Russian Mir system in India is being discussed. These issues will have been actively negotiated between President Putin and Prime Minister Modi at the recent visit of the Indian Prime Minister to Moscow. Developments are certain to be announced in due course.

Russia’s interests

Russia, under pressure from Western sanctions, is highly interested in the creation of alternative mechanisms for international settlements. Given the structure of Russian foreign trade, the development of such mechanisms with Asian partners is a priority.

However, Moscow prefers not to be the main initiator of the creation of new financial instruments, fearing that Russian financial structures may become targets of secondary US sanctions. In this context, Iran, which is in an even more difficult position in terms of foreign trade, appears to be an ideal partner for the first steps in this direction.

At the same time, Russia, together with the central banks of the BRICS countries, is already working on the creation of a new settlement and payment infrastructure that will allow payments to be made in national currencies, including digital currencies.

Symbolic points to the future

A single platform would add anonymity to payments and, as a result, independence. This will help reduce the influence of third countries – such as the United States – on international settlements.

The creation of such an infrastructure will also increase the competitive advantages of the BRICS countries, as Russia uses advanced financial technologies.

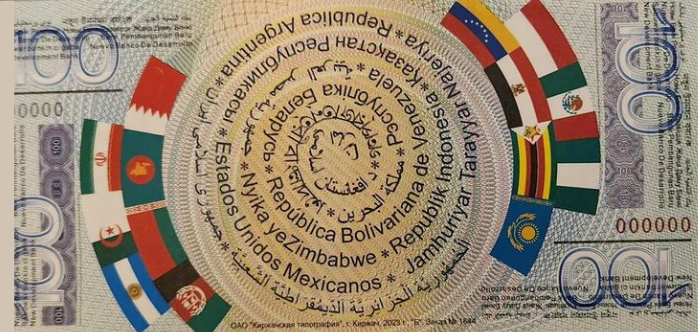

There have already been some symbolic gestures. In September 2023, a 100 BRICS banknote (pictured above) representing the future BRICS single currency was presented by Russian Ambassador to South Africa Ilya Rogachev to UAE Ambassador Mahsh Saeed al-Hameli. This took place during a meeting in Pretoria (South Africa), in connection with the accession of the UAE to the BRICS. The UAE subsequently joined from January this year.

On one side of this banknote are the flags of the five BRICS countries, and on the other side are the symbols of the states that intended to join the BRICS – and subsequently did so. It can be noted that the banknote itself was made in Russia.

Russia is also open to other initiatives that contribute to the diversification of international trade. The recent proposal of Pakistani Prime Minister Shahbaz Sharif on the use of barter schemes in bilateral trade may become the basis for the development of new settlement mechanisms in the future.

Key challenges

The creation of an interstate currency is a complex and lengthy process that requires overcoming many technical, economic and political obstacles. The experience of the introduction of the Euro shows that such initiatives go through several intermediate stages and require careful coordination between the participants.

The key challenges to the creation of common currencies within the framework of the BRICS and the SCO are:

- The development of mechanisms for determining the exchange rates of national currencies in relation to the new single currency;

- The creation of an effective clearing and settlement system between the participating countries;

- Ensuring the stability of the new currency in conditions of volatility of global financial markets;

- Overcoming political differences between the participating countries and reaching consensus on key issues of the functioning of the new monetary system;

- Minimizing the risks of secondary sanctions from the United States and other Western countries.

Despite these difficulties, work on the creation of alternative mechanisms for international settlements continues. Many experts believe that the first step may be the introduction of a special unit of account, which will be used for offsets between the participating countries, without replacing national currencies in domestic circulation.

This approach would gradually increase the volume of trade in national currencies, reducing dependence on the US dollar and the euro. This is especially true for countries under sanctions pressure, such as Russia and Iran.

It is important to note that the creation of alternative mechanisms for international settlements is not limited only to monetary initiatives. Other forms of economic cooperation are also developing, such as swap agreements between central banks, the creation of common payment systems and financial messaging services similar to SWIFT.

The initiatives to create common currencies within the framework of the BRICS and SCO reflect the global trend towards the formation of a multipolar world economic order. These processes will undoubtedly have a significant impact on the structure of international trade and the financial system in the coming decades.

For Moscow, participation in these initiatives is of strategic interest, allowing it to diversify foreign economic ties and reduce vulnerability to Western sanctions. However, the success of these projects will depend on the ability of the participating countries to overcome existing differences and develop effective mechanisms for economic cooperation.

However, should a fully-fledged BRICS or SCO single currency not be created in the short term, the very real process of working on alternative mechanisms for international settlements is already helping to strengthen economic ties between the participating countries and the formation of new centres of power in the global economy.

This means that we are witnessing the beginning of a long-term process of transformation of the global financial architecture, the results of which will have far-reaching consequences for the global economic and political landscape. Change is coming.

This article has been translated, adapted and updated from the piece originally published by AsiaIs. The original can be seen here

Further Reading

- Future BRICS Currency To Combine A Gold Standard & Sovereign Currency Mix

- Developing a SWIFT Alternative Digital Currency Global Trading System

Русский

Русский