The World Bank has recognised Russia as a high-income nation in its official global rankings, after stating that the average Russian gross national income per capita in Russia is US$14,250, which at current exchange rates, in local Ruble terms is ₽1,260,940.

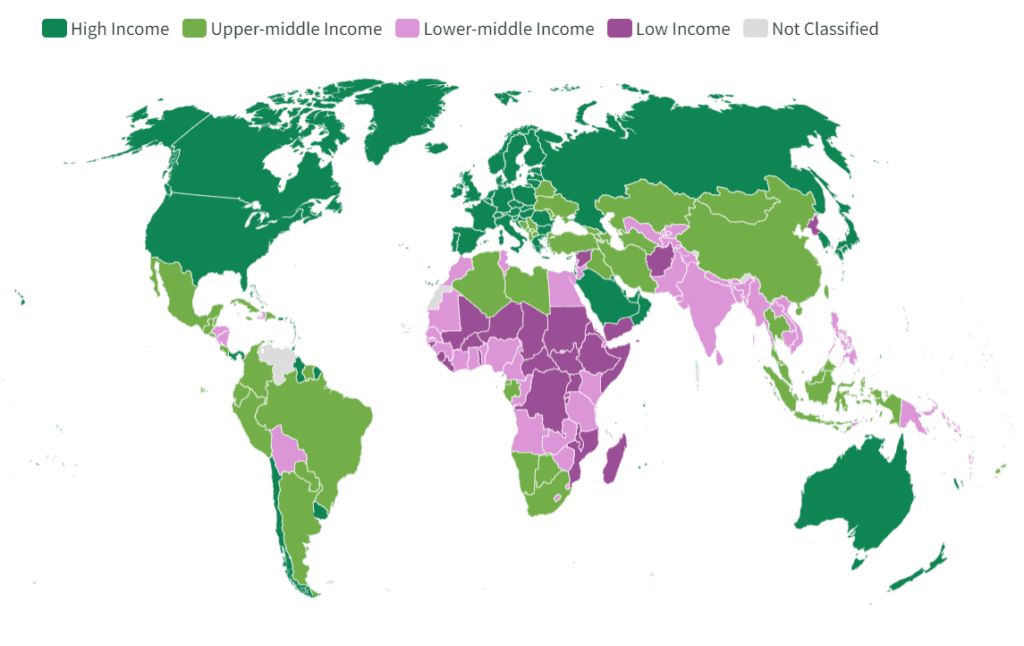

The World Bank Group assigns the world’s economies to four income groups: low, lower-middle, upper-middle, and high. The classifications are updated each year on July 1, based on the GNI per capita of the previous calendar year. GNI measures are expressed in United States dollars using conversion factors derived according to the Atlas method, which in its current form was introduced in 1989.

However, the Atlas method in itself may not necessarily be an accurate indicator as it favours the exchange rate used to convert local currency units to US$ as an average. The problem with this measurement is that it follows a different measurement than pure income levels and that the United States manipulates exchange rates with specific countries – including Russia.

If we were to take the ‘Purchasing Power Parity” (PPP) model, which compares a basket of goods and the costs to purchase them in a specific country, and the costs to purchase them in the United States, this provides a more accurate assessment of local wealth. In Russia’s case, the US$14,250 annual income mark would require a salary of US$47,261.50 in the United States to live to a similar quality of life. A useful global PPP calculator can be found here.

Source: The World Bank

The World Bank’s income classification aims to reflect a country’s level of development as a broadly available indicator of economic capacity. The World Bank categorizes countries with a high-income indicator when they pass a threshold of US$13,485.

It is notable that the World Bank status as concerns Russia comes after the West imposed massive sanctions upon the country and have tried multiple ways to disrupt its economy. This implies that the latent wealth of Russia’s economy, were sanctions not to have been imposed, would have been even higher.

The data is also useful to assess the longer-term consumer power of Russian consumers, a strong demographic requirement for both domestic and foreign manufacturers and exporters looking to access the domestic Russian market. China’s auto manufacturing industry for example has leaped from a 5% market share in 2021 to 45% today, with Chinese vehicles both being imported directly or now assembled in Russia. Russian domestic manufacturing of Chinese auto brands is the next step in this process, however the financial aspects and returns on investment need to be based strongly on Russian consumer spending power.

Russia’s Pivot To Asia can assist with Russian market research. Please contact us here.

Русский

Русский