This week’s meeting of the Russia-Uzbekistan Intergovernmental Commission on Economic Cooperation in Tashkent has illustrated that the two countries are rapidly deepening their economic partnership and achieving new historic milestones in trade, investment, and industrial cooperation. Significant capital investments are being made.

Co-chaired by Uzbekistan’s Deputy Prime Minister Jamshid Khodjaev and Russian First Deputy Prime Minister Denis Manturov, Khodjaev announced that the total portfolio of joint investment projects has surpassed US$55 billion. To put that into context, that is about 3.5 times more than the total mutual investments between the United Kingdom and China.

This milestone reflects unprecedented confidence in the long-term strategic trade and investment alignment between the two economies. It marks not only the highest level of bilateral investment cooperation in the modern history of Uzbek-Russian relations but also enshrines the economic partnership as one of the most dynamic in the entire Eurasian region.

According to Khodjaev, Uzbekistan expects to absorb more than US$5 billion in Russian investment by 2026, with US$4 billion already utilized as of late 2025. Manturov, during his working visit to Tashkent, also met with President Shavkat Mirziyoyev and discussed the accelerated implementation of joint projects in key sectors of the economy. His participation in the Russian-Uzbek Business Forum highlighted Moscow’s commitment to deepening pragmatic, sector-focused cooperation. Manturov’s presence signalled that bilateral investments are moving decisively from declarations toward concrete representations, representing nearly 50% of the entire Central Asian population, while structural reforms are aimed at attracting foreign capital.

In this context, Russia has secured its place as one of the primary partners in Uzbekistan’s modernization agenda. This qualitative expansion of human resources creates significant opportunities for Russian companies to trade with and invest in Uzbekistan, as a more skilled and prosperous population drives demand across consumer markets. Developing human capital will also be essential for advancing agro-industrial, technological, and manufacturing cooperation, ensuring that both countries benefit from a stronger, higher-quality workforce. In this regard, the $55 billion portfolio of investment projects serves as a powerful lifeline for the Uzbek economy, driving modernization, industrial growth, and long-term competitiveness.

Khodjaev emphasized that the investment portfolio provides a “solid foundation for new production capacities, employment growth, and increased tax revenues.” Today, over 3,100 Russian-capitalized enterprises operate in Uzbekistan, including 300 new companies launched in the past year, representing nearly 20% of all foreign-owned enterprises in the country. Russian investment in Uzbekistan has already reached about US$4 billion, underscoring steady confidence in the country’s reform-driven growth trajectory. Tashkent is positioning itself as one of Eurasia’s most attractive destinations for long-term Russian capital. This will yield tangible returns in the form of new production facilities, jobs, and tax revenues. On the Russian side, Denis Manturov stressed that the two countries must “ensure the full implementation of the US$55 billion investment package,” underscoring that industrial cooperation has become the central driver of bilateral growth.

Bilateral Trade Dynamics: Towards the US$30 Billion Target

The advancement of economic integration is most visible in trade turnover. In 2024, bilateral trade exceeded US$11 billion, double the volume six years previously. This year, in the 10M January–October 2025 alone, turnover surpassed US$10 billion, creating conditions to reach US$12 billion by the 2025 year-end.

Looking ahead, both countries have set an ambitious strategic target: achieving US$30 billion in bilateral trade by 2030. Products with high added value now account for 70% of turnover, reflecting the shift from raw materials, energy, and primary agro-based goods to high-quality industrial, investment, and scientific and technological cooperation. This objective is, to some extent, realistic given the ongoing qualitative restructuring of bilateral trade, provided both sides continue to prioritize not only the volume but also the value-added content of trade and investment flows, a prerequisite for sustaining momentum.

Even if the visionary US$30 billion target is not fully reached, a minimum level of US$20–25 billion remains an achievable and economically sound benchmark. A significant new development is the financial integration of both markets. 75% of trade settlements between Uzbekistan and Russia are now conducted in national currencies, a major step toward stabilizing payments amid global market volatility. Strengthening payment infrastructure and digital services has become a strategic priority.

Industrial and Technological Cooperation: From Machinery to Nuclear Innovation

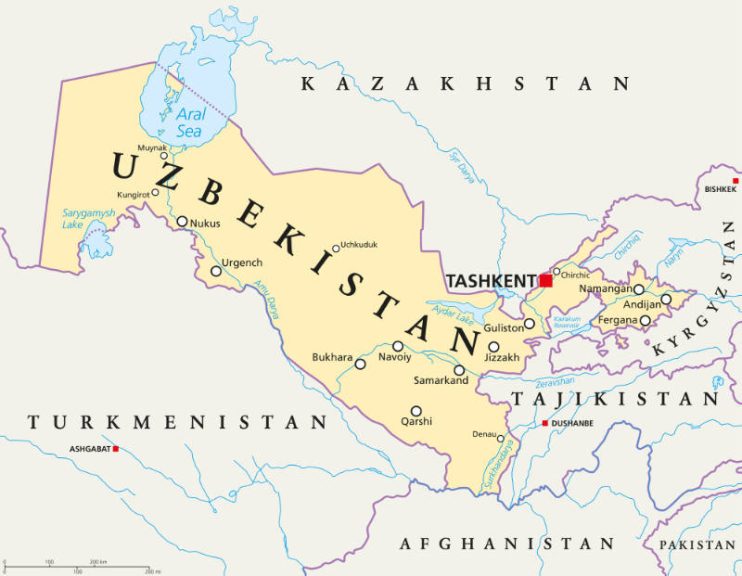

The bilateral portfolio of more than 150 joint venture industrial projects demonstrates the breadth of cooperation across metallurgy, machine-building, chemical production, pharmaceuticals, petrochemicals, agriculture, construction materials, and digital technologies. This is augmented by the growing presence of over 30 international companies in Uzbekistan’s Chirchik and Jizzakh Industrial Parks, highlighting Uzbekistan’s role as a regional manufacturing hub.

Russian support in these parks is driving localization, technology transfer, and the creation of high-value jobs across key sectors. A recent success story is the launch of Russia’s TechnoNICOL thermal insulation production in the Tashkent region, with capital investment exceeding ₽1.3 billion (US$17 million). This project exemplifies growing Russian industrial investment in Uzbekistan, boosting local manufacturing capacity and technology transfer. Russia and Uzbekistan are also cooperating in these following cutting-edge sectors:

Nuclear energy

In October 2025, work began on the construction of a nuclear power plant in the Jizzakh region, which is one of the world’s first small modular reactors, marking a breakthrough in Uzbekistan’s long-term energy strategy.

Nuclear medicine

The joint Nuclear Medicine Center project in the Mirzo-Ulugbek district of Tashkent will advance technologies for cancer diagnostics and treatment. It is expected to create over 100 high-tech jobs in radiology, medical physics, and radiochemistry, while also becoming a key scientific hub for building a national training system in nuclear medicine.

Agricultural drones

The new Uzbek-Russian joint venture will produce drones for modern agribusiness. A new drone manufacturing plant set to launch in Uzbekistan by late 2025 marks a strategic leap in joint high-tech production with Russia’s “Transport of the Future,” with first-phase output expected to exceed US$100 million with 50% of the manufacturing localized. The initiative, reinforced by plans for a joint scientific and technical council on unmanned systems, signals a shift from simple assembly to full-fledged technological integration and market development. Company executives emphasized that sustained investment in education and human capital will be essential as cooperation expands into broader technology-sharing and joint innovation projects.

Geological exploration and mining

Cooperation continues to expand in strategic minerals such as copper, uranium, and gold. The RosGeo–Uzbekgeophysika partnership enhances Uzbekistan’s hydrocarbon and mineral exploration capabilities while creating opportunities for Russian expertise and technology to drive energy sector growth. By combining archival data analysis, geochemical studies, and basin modeling, both countries strengthen strategic energy cooperation and potential long-term investment returns.

Hydropower and renewable energy

Joint projects aim to balance energy security and environmental sustainability. President Putin’s commitment to developing hydro and nuclear power in Central Asia positions Russia as a key partner in the region’s energy transformation. Uzbekistan, with its significant untapped potential, stands to gain strategically from these projects, accelerating energy security and industrial modernization.

Digital Platforms and Logistics: Expanding Export Channels

Russia’s digital marketplaces are now integral to bilateral trade. The Wildberries platform alone sold US$673 million worth of Uzbek products in 2024, becoming the largest distribution channel for Uzbek goods abroad. Exports of Uzbek textiles to Kyrgyzstan, Belarus, and Kazakhstan doubled, while sales in Russia—the largest market—increased by 63%.

E-commerce is rapidly transforming Uzbek–Russian trade, with Wildberries imports from Russia up 25% in the first nine months of 2025, driven by strong growth in footwear, clothing, and consumer goods. Simultaneously, Uzbek exports on the platform rose 37%, led by food, textiles, and home products, highlighting the rising global competitiveness of local goods. This digital trade model not only diversifies export-import flows but also strengthens bilateral economic ties through direct supplier-to-consumer engagement and technological integration. Such logistics projects help Uzbekistan accelerate its export diversification and achieve its goal of turning into a regional transport and trade hub linking Russia, Central Asia, South Asia, and China.

Regional Cooperation: A New Model for Eurasia

One of the most transformative aspects of the partnership is the rise of horizontal, region-to-region cooperation. Today, the 14 regions of Uzbekistan maintain strong cooperation with the 89 regions of Russia, while the total portfolio of joint projects has exceeded US$6.2 billion. Over 30 agreements were signed at the Intergovernmental Commission covering trade, economic, scientific, technical, and humanitarian areas.

To institutionalize this interaction, Russia and Uzbekistan are transforming the traditional Forum of Regions into a Council of Regions. To finance new initiatives, a joint investment platform of US$500 million has been established, supporting manufacturing, infrastructure, startups, and regional energy projects. The Russian side is contributing US$400 million to this platform.

Agriculture, Food Security and Market Access

Agricultural cooperation remains a priority. Recently, two more major Russian poultry producers gained access to the Uzbek market, enhancing Uzbekistan’s food supply security and expanding Russia’s export geography. Joint agro-logistics centers are being built to support cold-chain transport, processing, and storage of perishable goods.

Human Capital, Education and Tourism

Humanitarian and cultural ties continue to reinforce the partnership. More than 56,000 Uzbek students study at Russian universities and their branches in Uzbekistan, one of the largest educational exchanges in Eurasia. Tourism exchanges are growing steadily, fueled by simplified travel procedures, expanded flight routes, and joint cultural projects.

Summary

Uzbekistan and Russia are entering a new stage of comprehensive partnership defined by economic pragmatism, technological transformation, and shared long-term interests. These figures illustrate that the two nations are building not only commercial cooperation but also a fully integrated economic space based on mutual trust, shared strategic priorities, and the enormous potential of the Eurasian markets.

Md Rana is an independent researcher, author, freelance columnist, and international affairs analyst. This article was commissioned especially for Russia’s Pivot To Asia.

Further Reading

Русский

Русский