Mongolia’s 2025 budget has run out of money to repair access roads to its largest border crossing with Russia. Eight road projects, including the repair of the highway from the largest automobile border crossing at Altanbulag on the border with Russia, were excluded from Mongolia’s budget for 2025. Altanbulag is the largest automobile checkpoint on the Altanbulag Mongolian-Russian border to Darkhan.

The Mongolian Minister of Transport, Borhuugiin Dalgaraikhan, is now calling on the private sector to help raise the funds, saying “I believe that work on this important highway can be carried out at the level of a public-private partnership.”

Public-Private Partnerships (PPP) are a mix of Government and private funding. It remains to be seen what Ulaan Baatar can offer in terms of guarantees and return on investment for potential participants, but this suggests that the highway will become a toll-road – if investors can be found.

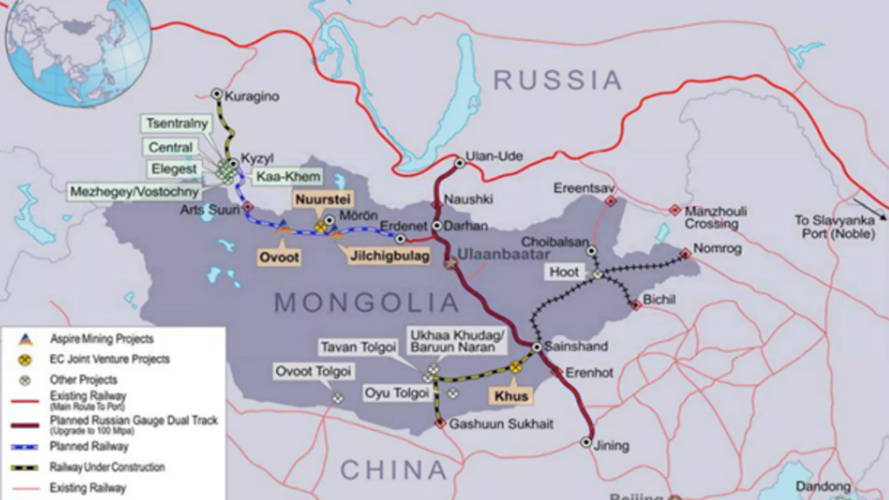

Mongolia had previously agreed on 33 economic corridor projects from Russia to China. A primary part of this list of projects is the construction of a new railway, connecting the largest checkpoints at Altanbulag on the border with Russia with Zamyn-Uud near the Chinese border. Mongolia intends to promote the construction of this corridor by coordinating its Steppe Way programme with PPP projects.

The Steppe Way is a Mongolian initiative that it wants to get started with the assistance of Russia and China. Ulaanbaatar envisages “Five Great Passages” requiring US$50 billion in investment, which would include:

- A 997 km-long transnational expressway linking Russia and China

- 1,100 km of electrified rail infrastructure

- The construction of a new railway between the major border checkpoints at Altanbulag on the border with Russia, and Zamyn-Udd near the Chinese border.

- Construction of oil and gas pipelines from Altanbulag to Zamyn-Uud.

The Steppe Road isn’t just about transport infrastructure, but part of a Mongolian national development strategy which also seeks to invigorate the country’s telecom and tourism sectors and boost its mining and energy potential.

However, it seems that this project too will need to be farmed out to the private sector. How successful that is depends upon how much the Mongolians are prepared to contribute and on what terms a commercial return can be made by investing parties from Mongolia, China and Russia.

China is particular has been very active with its Belt & Road Initiative, while Russia has also been committing project finance overseas, most notably in Africa. Russian outbound investment however tends to be linked to the energy sector, rather than infrastructure, with Moscow still committed to spending billions on its own infrastructure development, a situation that peaked in China about a decade ago. That subsequently freed up Chinese labour and projects finance to invest in huge connectivity projects from Georgia to Pakistan, where it has invested about US$90 billion of its total estimated US$1 trillion BRI spend.

However, with the Chinese economy having some issues and money potentially being needed to shore up Chinese trade in the event that incoming US President Trump may engage in a trade war, Mongolia’s financing requirements may have to wait a little longer – at the expense of its own longer term economic growth. These issues may also delay the signing of the planned Mongolia-Eurasian Economic Union Free Trade Agreement if the country cannot provide the infrastructure to support the increased demand such a deal would bring.

Further Reading

Proposed New Kazakh-Russia-Mongolia Highway Would Connect Astana With Ulaan Baatar