India and the Eurasian Economic Union (EAEU) have been holding discussions concerning a proposed free trade agreement for some time now. With the EAEU including Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Russia, the concept holds considerable promise for India as it looks to secure new markets – Kazakhstan is a target, as is Russia, without having to sacrifice much in the way of introducing new domestic competition. This latter sticking point, amid concerns about Chinese product competitiveness in the Indian domestic market scuppered plans for India to join the Regional Comprehensive Economic Partnership (RCEP) agreement. This has left New Delhi absent from any large scale FTA. The EAEU could fill that trade gap.

However, India’s situation as regards the EAEU has also been influenced by the threat of Western sanctions. Since the beginning of this year, India has limited the import of Russian oil and petroleum products while at the same time the EAEU is counting on further negotiations with New Delhi to conclude an agreement.

Denis Manturov, the Russian Minister of Industry and Trade has stated that “We attach particular importance to the issues of mutual access of products to the markets of our countries. We expect to intensify negotiations with India on concluding a (EAEU) free trade agreement.”

That is still a work in progress, while the additional issue of signing a Russian-Indian agreement on the encouragement and mutual protection of investments is being worked out. As Manturuv said, “Improving trade and industrial cooperation between Russia and India can be ensured by ensuring uninterrupted mutual settlements. As part of the intergovernmental dialogue, we propose to consider the possibility of widespread use of national currencies and the currencies of friendly countries. This is relevant in the current conditions, and allows us to minimize costs and currency risks.”

Any successful outcome of the negotiations needs to be consistent with the interests and approaches of the Indian side, which is seeking to restore its trade benefits (preferences) in the EAEU, which have been cancelled in total for 76 countries and territories since the fall of 2021 and provide for the abolition of duties and volume (quota) restrictions in importing country for goods imported from the relevant countries. According to some estimates, the annual damage from secondary sanctions impacting the EAEU could reach US$7 billion.

As at the beginning of April, according to Bloomberg, the price discount for Russian oil for India amounted to US$2-4.5 per barrel, although in the first half of 2022 the discount reached US$25-28. In this regard, it is reasonable to assume that the Indian side is seeking if not a complete restoration of the previous, than a substantial current price discount.

Since mid-December 2023, Indian ports have periodically refused to accept tankers flying the flag of Russia, primarily Sovkmflot, which is sanctioned by the United States and a number of other NATO countries. This is countered by ship-to-ship transfers to non-problematic flags being undertaken in international waters. Even so, the need for New Delhi to be at least seen to be in compliance with sanctions has interfered with delivery timescales.

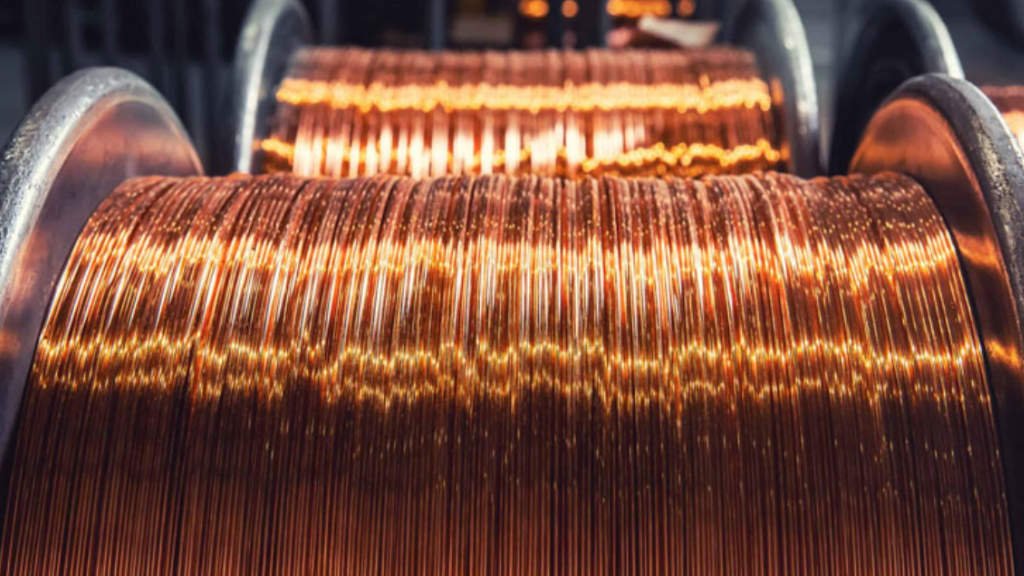

During 2022-2023. Russian supplies of these goods for the Indian petrochemical industry increased at a record level, to the significant benefit of Indian counterparties. Indian savings for Russian supplies at reduced (discount) prices in 2023 alone amounted to almost US$3 billion.

Even so, at the end of March, India’s largest oil refiner refused to accept Russian tankers due to US sanctions. The company made the decision against the backdrop of new US sanctions (imposed in December 2023 and February 2024), which included Sovcomflot and 14 other tankers transporting Russian oil and petroleum products. Reliance Industries, India’s largest industrial holding company explained this decision as required compliance with its own political and commercial interests, as well as the introduction of new US sanctions, explaining that Indian oil refineries, trying to avoid a negative reaction from Washington, are operating at more cautious levels when it comes to Russia.

This means that under the current situation, Russian suppliers have to use non-sanctioned tankers under flags of convenience for supplies to India, along with re-export schemes through a number of countries in the Mediterranean, the Persian Gulf basin and Southeast Asia, which, along with the reduced prices of Russian supplies, leads to an increase in delivery times transportation and transport and logistics costs by at least a third (compared to direct deliveries in ships flying the flag of Russia).

The Western sanctions threats aside, there is also New Delhi’s response to consider. India was excluded as from Autumn 2021 from the EAEU trade benefits regime for developing countries, which have been in effect to the benefit of India since the early 2010s. That preferential EAEU tariff withdrawal was due to India’s new UN qualification as a developing industrial country. Clearly, New Delhi is also playing hard ball.

There have been additional concerns within the EAEU that some Indian goods to the region prior to 2021 had been dumped at lower than expected prices. The Indian side cannot also help but notice the preservation of trade benefits within the EAEU for Pakistan, its fierce political rival. As noted by Albert Khorev, the Russian Ambassador to Pakistan, in May 2023, in Islamabad, a Russian-Pakistani protocol on cooperation within the framework of the unified system of tariff preferences of the EAEU was signed. That document expands trade and economic ties between the two countries and reduces the administrative burden on the business of both sides. That did not sit well in New Delhi.

Taking into account the traditionally complex and even confrontational Indian-Pakistani relations, the preservation of trade preferences for Islamabad in Russia and the EAEU has created additional attempts in New Delhi to put pressure on Moscow to restore similar preferences for India.

That debate spills over into the Shanghai Cooperation Organisation (SCO) platform where both India and Pakistan are full members along with Russia, and to the potential expansion of BRICS, where Pakistan recently filed an application for membership. Moscow is now finding that New Delhi is a rather complex partner to be negotiating with.

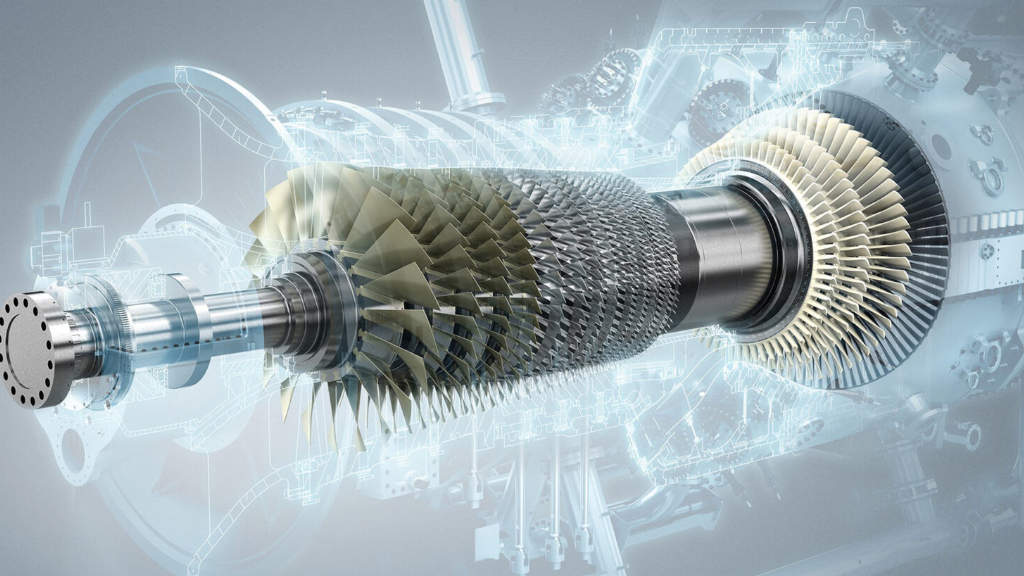

It seems that given the strategic importance for the entire EAEU, especially for Russia, of political and economic relations with India as the largest power in South Asia, it is probably advisable to partially restore previous foreign trade benefits for it, which would ease tensions in the supply of oil and petroleum products from Russia. Such a step is all the more appropriate in connection with India’s intention – after a three-year break – to initiate negotiations on the EAEU free trade agreement. Relevant discussions took place in New Delhi in March; it is possible that official negotiations on a free trade agreement, implying, that the reduction – or abolition – of customs duties on an agreed list of commodities will shortly begin. If these are successful, machine builders, electronics manufacturers and agricultural producers are all poised to benefit. There are also plans for industrial cooperation. Earlier, in September 2023, at the headquarters of the Eurasian Economic Commission (the directing body for the EAEU), a meeting was held between representatives of the Russian Trade Policy Department and the Industrial Policy Department of the EEC with colleagues from the Ministry of Trade and Industry and the Government of India. The prospects for cooperation, work to intensify negotiations on a free trade agreement, as well as plans for deepening industrial cooperation were all discussed.

It is worth noting that also in March, India, which currently has one of the fastest growing economies in the world, concluded a trade agreement with the states of the European Free Trade Association (EACT), under the terms of which Switzerland, Iceland, Norway and Liechtenstein will invest US$100 billion in India and will create an estimated one million jobs in the country over the the next 15 years. Negotiations with India on free trade agreements are also ongoing with the UK and the European Union. It is likely that Western players will continue to try to involve New Delhi in their anti-Russian sanctions measures, however, according to the Russian Ambassador to India Denis Alipov, it is important for New Delhi to maintain friendly relations with Moscow. The issue is how Russia’s Foreign Minister, Sergey Lavrov, and the Kremlin will be able to manage relations with India, enable a deal to be reached with the EAEU, while allowing New Delhi to effectively sit on the fence without attracting too much heat from the United States.

Further Reading

- Russia – Indian Ocean Multimodal Corridors Being Developed

- Russia-India 2024 Trade Development

Russia’s trade and investment development with India is covered in comprehensive detail in our 2024 Russia’s Pivot to Asia guide. That is a complimentary download and may be accessed in English here and in Russian here.