The Russian economy is in the investment phase of growth, with investment activity at a record level and imports of investment goods are growing, according to Central Bank of Russia (CBR) Governor Elvira Nabiullina. She made the comments following a meeting of the regulator’s board, at which it held the key interest rate at 16%.

Nabiullina stated that “After a slight deceleration at the end of 2023, according to our estimates, the growth of economic activity has sped up again, primarily in household consumption. Growth in retail is a sign of elevated consumer demand. Consumer sentiment is close to record highs. Households’ propensity to make large purchases has been increasing since December. We never observed such trends during the previous periods of considerable monetary policy tightening. Investment activity has hit a record high.”

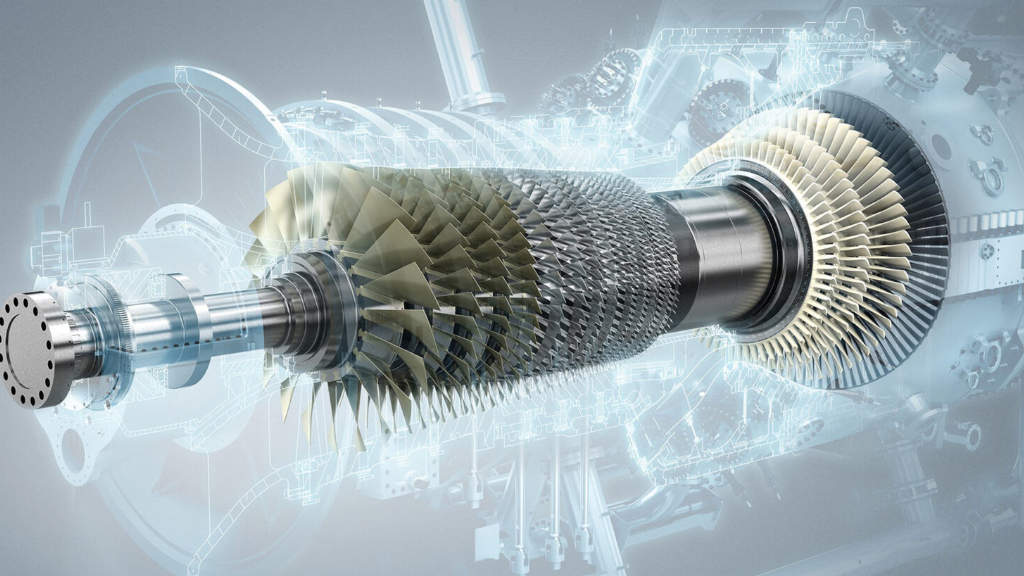

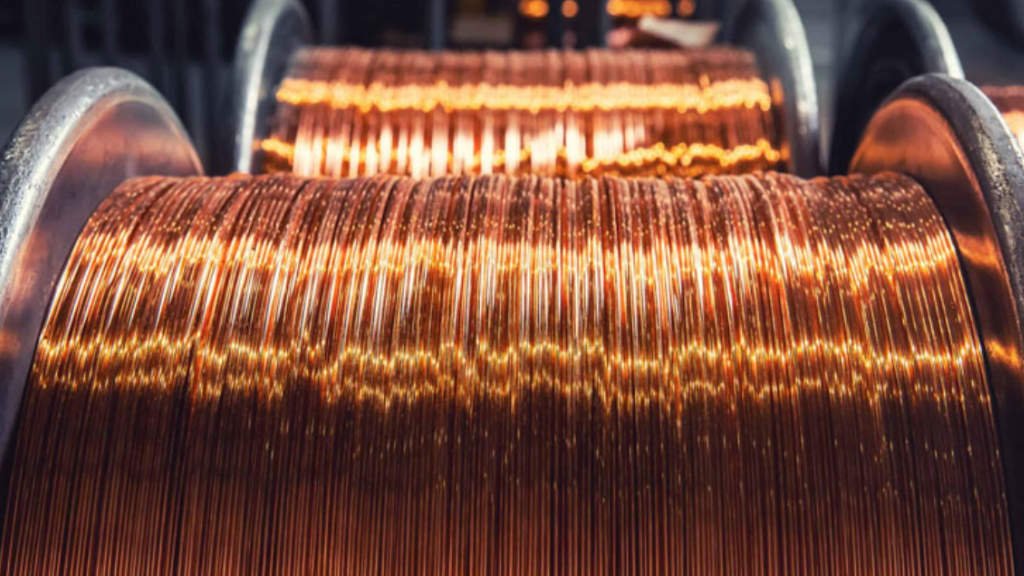

“Although we have not yet received Q1 2024 data, this is evident from indirect indicators. The output of investment goods has reached historically high levels. The import of investment goods has been expanding. Finally, our regional branches report a higher percentage of companies that have increased their production targets. The economy is in the investment phase of growth, which is one of the manifestations of the structural transformation. All this supports high business activity. The Business Climate Index rose to its 12-year maximum. Such a significant increase is associated with the fact that the economy is using almost all production capacities and labour resources.”

Russia’s PMI index for February 2024 reached 54.7. To compare, the German PMI index for February was 41.6, in France 47.8, and the United Kingdom at 47.9. Figures below 50 represent a manufacturing contraction, figures above an expansion.

According to S&P Global, the reading pointed to the fastest expansion in Russia since January 2017, and was supported by faster rises in new orders, a renewed increase in employment, and a further uptick in input buying. Output expanded the most since March 2019, while employment returned to growth, with the pace of job creation solid overall. Meanwhile, backlogs of work contracted at a strong rate, with the pace of contraction being faster than the series average.

Meanwhile, vendor performance deteriorated further amid logistics issues and some material shortages. On prices, input cost inflation accelerated due to higher transportation, supplier, and raw material costs. Meantime, output cost inflation eased to an eight-month low amid efforts to spur new sales. Lastly, sentiment improved to a seven-month high amid plans to invest and hopes of further expansions in new orders.