The United States President, Donald Trump, has stated on his social media account that he intends to place 100% tariffs on all imports into the United States from BRICS countries if they discontinue using the US dollar in their multilateral trade relations and revert to using their own currencies. In this article we examine the existing bilateral trade volumes between the United States and the ten full BRICS members, and the impact tariff introductions would have on their trade.

Brazil

In 2024, Brazil’s exports to the US increased to a record US$40.3 billion. This amounts to about 15% of Brazil’s total 2024 export volumes of US$337 billion. The top exports to the United States included semi-finished iron, crude petroleum, sulfate chemical woodpulp, large construction vehicles, and pig iron. The US would need to source these supply chains from other markets, while Brazil would need to find new buyers, which it could probably do within the developing Global South. It holds the BRICS Chair for 2025 and will already be looking for alternative clients.

Brazil and the United States have an extensive 2022 bilateral trade agreement on trade rules and transparency, requiring amendments if either party wishes to alter the terms. Dispute resolution should lie with the World Trade Organisation. The outcome would probably be short-term export pain for Brazil, with certain industries requiring government support, while US buyers would probably see an increase in prices for replacement imports. Verdict: Absorbable within 2 years.

Russia

In 2024, Russia’s total exports to the US amounted to about US$3.2 billion. This amounts to less than 1% of Russia’s total exports, and were mainly energy products, including a significant amount of raw uranium. The impact of tariffs on Russian trade would be negligible, but the US could struggle to replace its uranium fuel needs as most of the other main suppliers are Russia-friendly. Verdict: Negligible impact.

India

US access to cheap generic pharmaceuticals and supplements would be badly hit, as would India’s electronics and pharma industries. The two nations do not have a trade agreement. The introduction of tariffs would be a significant challenge for Indian exporters in these sectors, however interestingly, both Russia and India have been pressing for far more Indian exports to Russia. It is conceivable that Russia could absorb at least 25% of India’s exports to the US. The remainder could be sold onto the newly opened China market to Indian exporters, and to other BRICS members. Verdict: Substantial challenges for Indian exporters requiring government intervention.

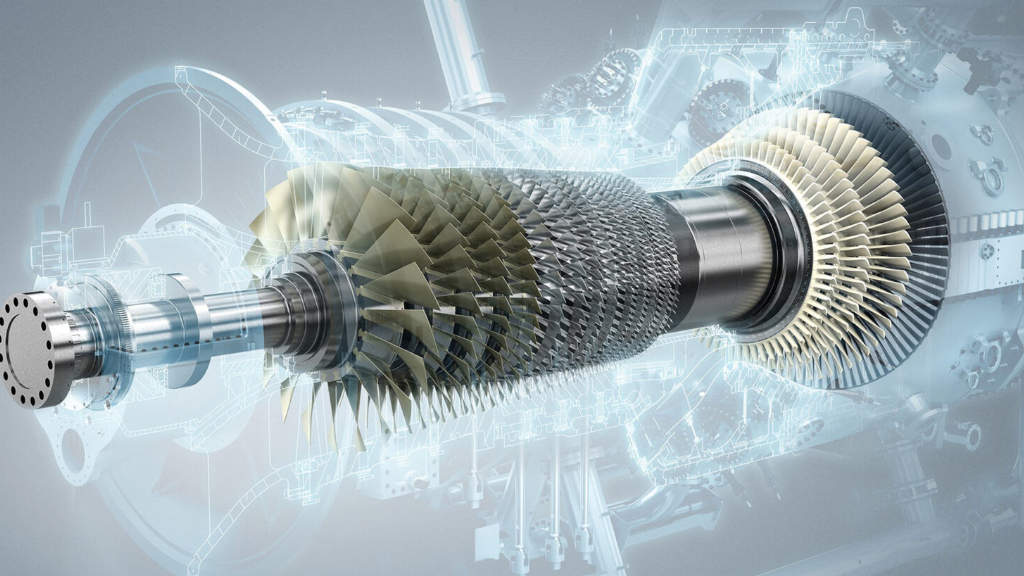

China

In 2024, China’s exports to the US amounted to about US$429 billion. This amounts to 15% of China’s total 2024 export volumes of US$3.58 trillion. China’s major exports to the US include higher value electronics, machinery, toys, and furniture and continues to rely on China for some goods, such as smartphones, computers, and lithium-ion batteries. US consumer prices for these commodities would have a major impact on US price increases, to the extent of triggering inflationary pressures and disruption to related global supply chains, including problems with some US manufacturing as component part supplies are disrupted. It would also create significant problems for Chinese exporters with government intervention likely. Interestingly, this could kick-start a boom in China-India trade, although India will also want access to Chinese markets. China is already making inroads into Russian and Central Asian markets, as well as into the Middle East, Africa and LatAm and would almost certainly be wanting to boost export potential to the BRICS. That would also result in a strategic opening of the China market to the Global South.

Another issue to consider in this eventuality is China’s response, as it would almost certainly seek to place tariffs on US exports into China as a result. These amounted to about US$130 billion in 2024 and included agricultural products, machinery, chemicals, and pharmaceuticals. Both countries would need to provide support measures for their respective export sectors.

In addition to this, there would be serious breaches of the US-China trade agreement, signed in 2020 that would have a huge impact of future US market potential in China’s financial service sector, US LNG exports, US agriculture exports and would push China closer to Russia in the latter two markets.

Verdict: The big one. This would deflate US, Chinese and to some extent, global trade flows. Both economies would be damaged with subsequent political repercussions. However, the resulting shocks to consumer markets would be unsustainable, although highly damaging. Imposing 100% tariffs on China exports would be a huge Trump gamble that he would be highly unlikely to emerge unscathed from.

South Africa

The United States and South Africa have several minor trade agreements between them, but damage could be caused to the US-Southern African Customs Union (SACU) agreement, which includes South Africa. The five SACU countries together are the United States’ largest non-oil trading partner in sub-Saharan Africa, with two-way trade valued at US$18.2 billion.

The US would need to source these supply chains from other markets, while South Africa would need to find new buyers, which it can probably do within the developing African Continental Free Trade Agreement and the Global South in general. Certain agricultural sectors such as exports of fruits, vegetables and wines to the Chinese and Russian markets could also absorb some of the US export losses. Verdict: Absorbable.

Egypt

In 2024, Egypt’s exports to the US amounted to about US$1.8 billion. This amounts to roughly 4.5% of Egypt’s total 2024 export volumes of US$40 billion. The United States is a key importer of Egyptian food products, accounting for about 4% of Egypt’s total exports. The loss of US markets would likely be taken up by a pending Free Trade Agreement Egypt is finalizing with the Eurasian Economic Union. Verdict: Minimal impact.

Ethiopia

In 2024, Ethiopia’s exports to the US amounted to about US$2.6 billion. This amounts to about 40% of Ethiopia’s total 2024 export volumes of about US$7 billion. Ethiopia’s main exports to the US include coffee. This would have a negative effect on Ethiopia, which is already struggling with US backed Eritrean rebels in the countries north and could create more regional instability. It would also shift US coffee sourcing to other suppliers in LatAm (but not Brazil) and Africa and lead to further rises in global coffee prices. Verdict: Destabilizing for East Africa.

Indonesia

In 2024, Indonesia’s exports to the US amounted to about US$25 billion. This amounts to about 10% of Indonesia’s total 2024 export volumes of US$241 billion. Indonesia’s main exports to the US include palm oil, rubber, including auto tires, electronics, nickel and textiles. The introduction of tariffs on Indonesian products would be problematic for Jakarta and would require government intervention. Indonesia would seek to open new markets in Islamic-friendly nations such as within the BRICS group, in addition to Central Asia and Russia, where it is finalizing a Free Trade Agreement with the Eurasian Economic Union. The US auto industry would suffer as rubber tires and component part price increases, as well as nickel supplies would be evident as it would need to source elsewhere – from a diminishing pool.

Tariff impositions would also blow up the pending Indonesia-United States Free Trade Agreement, which is a proposed deal between the two countries to encourage trade, especially in rare earth materials like nickel. The agreement could allow automakers to use Indonesian metals in electric vehicles (EVs) that qualify for tax credits. Verdict: Long term damage for the US auto and IT industry, Indonesian exporters to recover after two years.

Iran

In 2024, Iran’s exports to the US amounted to about US$5 billion. This amounts to about 9% of Iran’s total 2024 export volumes of US$54 billion. Iran’s main exports to the US are printed paper products (such as packaging and brochures). Iran’s energy sector is already heavily sanctioned by the United States, with tariffs imposed on Iranian printed paper products largely meaningless. Iran has recently signed a 20-year trade and investment agreement with Russia and has a similar agreement with China as well aa Free Trade Agreement with the Eurasian Economic Union in addition to its BRICS relations. Verdict: Minimal impact.

UAE

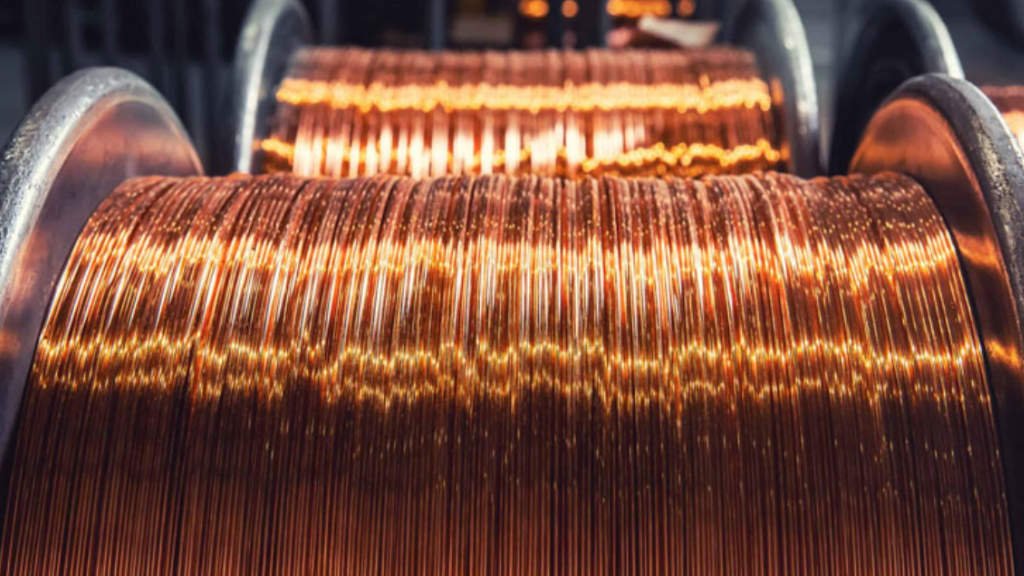

In 2024, the UAE’s exports to the US amounted to about US$11 billion. This amounts to about 0.7% of the Emirates total 2024 export volumes of US$762 billion. The UAE’s main exports to the US include energy products, auto and aviation components, computers, gold, jewellery, oils, aluminium, copper, silver, and perfumes. Tariffs on UAE exports would mainly affect the foreign invested community in the UAE, most notably from other MENA countries, but create little disruption. Verdict: Minimal impact.

Summary

As can be seen, Trumps threats to impose import tariffs on BRICS member countries would have, if implemented, a scatter-gun, inconsistent impact. A curious aspect to Trump’s BRICS tariff threats is that they would have no discernible impact on the United States main ‘bad actors’ but instead cause significant damage to trade relations that the United States relies upon. Reliable, friendly US partners such as Brazil, Egypt, India, Indonesia, South Africa and the UAE would face trade punishments for their non-US relations, rather than for their actual relations with the United States. Understandably, they are likely to feel somewhat aggrieved – an emotion that Trump is relying upon to seek some sort of BRICS dismemberment.

Yet the calculations don’t add up in Trumps favour – while US exports are a major factor, they do not amount to any more than 10% of the export total in any of these countries with the sole exception of China (15%) and Ethiopia.

The underlying theme though are tariffs aimed at just one country – China. One of Trumps’s first calls as President was to Xi Jinping, which he described as ‘friendly’ and added that a US-China trade deal ‘could be reached.’ So why the BRICS rhetoric when China is part of the group? Why the BRICS rhetoric when it impacts negatively upon US allies and leaves trade with Russia and Iran largely untouched? It doesn’t make any sense and appears to create as many sourcing problems for the United States as it solves – while almost certainly increasing US production costs. Yet neither do we believe that Trump is stupid.

If so, what this all really implies is that Trumps statements are made purely for his domestic audience only, and that his threats are unlikely to be carried out. However, there is a caveat – the BRICS nations concerned should be drawing up contingency plans as regards finding alternative markets and how government policies can help direct this change, should this ever be needed. And one BRICS member has considerable expertise in this subject – Russia, whose entire economy and supply chains have moved from the West to the Global South in just three years. The message behind Trumps threats: Be prepared.

Further Reading